APRA has released their latest quarterly data to December 2016 on Authorised Deposit-taking Institution Performance. Profitability and return on equity are down, despite significantly lower provisioning.

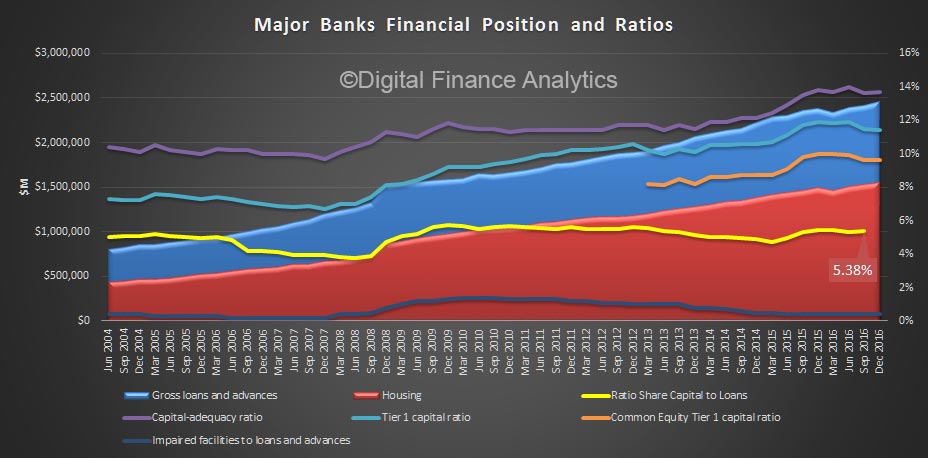

A quick look at the 4 majors shows further growth in home lending assets, small falls in capital, after an earlier rise, and the continued high leverage ratio between share capital and total assets – it sits at 5.38%, which highlights the continued massive leverage in the system.

Financial performance

Financial performance

- The net profit after tax for all ADIs was $28.4 billion for the year ending 31 December 2016. This is a decrease of $8.4 billion (22.7 per cent) on the year ending 31 December 2015.

- The cost-to-income ratio for all ADIs was 47.9 per cent for the year ending 31 December 2016, compared to 49.4 per cent for the year ending 31 December 2015.

- The return on equity for all ADIs was 10.0 per cent for the year ending 31 December 2016, compared to 13.8 per cent for the year ending 31 December 2015.

Capital adequacy

- The total capital ratio for all ADIs was 13.8 per cent at 31 December 2016, a decrease from 13.9 per cent on 31 December 2015.

- The common equity tier 1 ratio for all ADIs was 9.9 per cent at 31 December 2016, a decrease from 10.2 per cent on 31 December 2015.

- The risk-weighted assets (RWA) for all ADIs was $1.98 trillion at 31 December 2016, an increase of $109.2 billion (5.8 per cent) on 31 December 2015.

Asset quality

For all ADIs:

- Impaired facilities were $15.3 billion as at 31 December 2016. This is an increase of $1.5 billion (11.2 per cent) on 31 December 2015. Past due items were $12.9 billion as at 31 December 2016. This is an increase of $1.2 billion (10.1 per cent) on 31 December 2015;

- Impaired facilities and past due items as a proportion of gross loans and advances was 0.92 per cent at 31 December 2016, an increase from 0.86 per cent at 31 December 2015;

- Specific provisions were $7.3 billion at 31 December 2016. This is an increase of $0.8 billion (12.9 per cent) on 31 December 2015; and

- Specific provisions as a proportion of gross loans and advances was 0.24 per cent at 31 December 2016, an increase from 0.22 per cent at 31 December 2015.

On a consolidated group basis, there were 152 ADIs operating in Australia as at 31 December 2016, compared to 153 at 30 September 2016 and 157 at 31 December 2015.

- Central Coast Credit Union Ltd changed its name from Wyong Shire Credit Union Ltd, with effect from 15 November 2016.

- Fire Brigades Employees’ Credit Union Limited had its authority to carry on banking business in Australia revoked, with effect from 1 December 2016.

- Bank Australia Limited changed its name from MECU Limited, with effect from 15 December 2016.