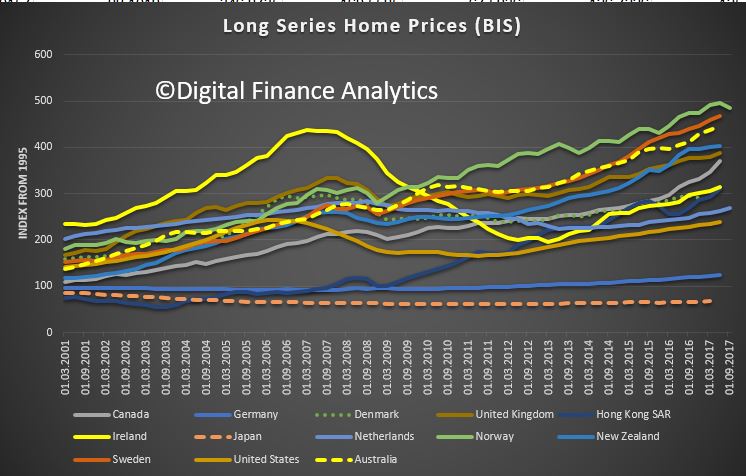

The latest BIS data series on home prices trends has been published to Q2 2017. Here is a selected range, which shows Australia is near the top in terms of trend growth, relative to other western countries, including UK, USA, Canada and New Zealand.

Norway and Sweden are slightly higher. The fastest rate of growth is in South Africa, which has reached a heady 700!

Norway and Sweden are slightly higher. The fastest rate of growth is in South Africa, which has reached a heady 700!

There is an important lesson in this data. If prices do crash it can take significant time to recover. Look at home prices in Ireland (the yellow solid line), which peaked in 2007, and 10 years later is still well below the peak – a salutatory warning. USA prices have now just passed their pre-GFC peak and the UK achieved this in 2014!

The fallout from home price falls cast a long shadow. Importantly, the fall in prices took on average 5 years from their peak to the subsequent trough. A warning that if Australian prices start to slide, they could do so for many years.

For many years, the BIS has promoted analysis of the long-term movements in residential property prices that are particularly important for financial stability research and policy. A data set of long historical time series of nominal residential property prices in 13 advanced economies was presented for the first time in 1994. Interest in this data set has steadily increased among researchers as well as policymakers and private sector practitioners.

The research data set on long series on residential property prices presented here currently includes quarterly time series for 18 advanced economies going back as far as 1970 or 1971 or even earlier, and quarterly time series for five emerging market economies with starting dates between 1966 and 1991. This work has been undertaken by the BIS in close coordination with national authorities with the aim of providing the most accurate data whenever possible. However, these long series are imperfect. They have been constructed from a variety of sources, including central banks, national statistical offices, research institutes, private companies and academic studies. The methodologies they employ, and the types of geographical areas and dwellings they cover, are likewise varied. Although significant efforts have been made recently to harmonise and improve the comparability of house price indices across countries, the discrepancies in the compilation methods are quite large and may hamper the usability of the data set.