Last Friday, the China Banking Regulatory Commission published for public comment a draft regulation of commercial banks’ large exposure management in accordance with the Basel Committee on Banking Supervision’s framework. The draft regulation is credit positive for banks because it will quantifiably curtail the shadow-banking practice of investing in structured products without risk-managing the underlying exposures and will limit the concentration risk in traditional non-structured loan portfolios.

For the first time, regulators are introducing binding and quantifiable metrics to implement the look-through approach when measuring credit exposures of investments in structured products, as emphasized in a series of recent steps to tighten shadow banking activities. A bank must aggregate unidentified counterparty risk in a structured investment’s underlying assets as if the credit exposures relate to a single counterparty (i.e., the unknown client) and reduce that aggregate exposure to below 15% of the bank’s Tier 1 capital by the end of 2018. Any investment in structured products above the capped amount must identify counterparty risks associated with underlying assets so that investing banks can manage the risks accordingly.

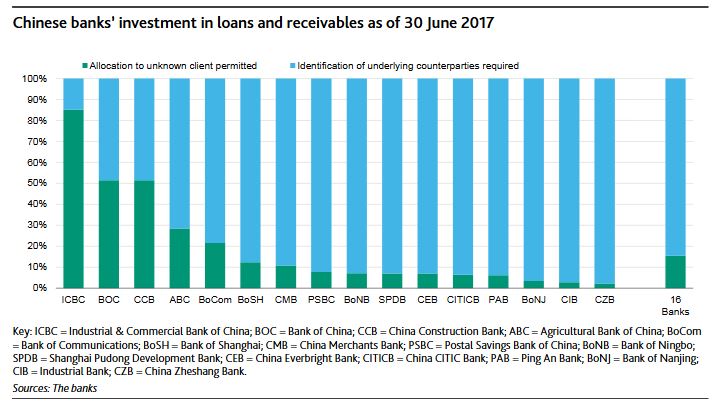

The draft regulation’s measure of the unknown client limit will discipline banks’ implementation of the look-through approach to their investment portfolio to address opaque bank investment categories such as “investment in loans and receivables” that have been originated by other financial institutions. For the 16 listed banks that we rate, which account for more than 70% of the country’s commercial banking-sector assets, total investment in loans and receivables was slightly more than 100% of Tier 1 capital as of 30 June 2017. This implies a forced look-through approach will be applied to more than 85% of this segment of banks’ investment portfolios (see exhibit).

For the concentration risk in traditional non-structured loan portfolios, the draft regulation reiterates the current rule limiting a bank’s loans to a single customer to 10% of the bank’s Tier 1 capital, and extends the limit to include non-loan credit exposure to a single customer at 15% of Tier 1 capital. For a group of connected customers, either through corporate governance or through economic dependence, the draft regulation caps a bank’s total credit exposure at 20% of Tier 1 capital.

For a group of connected financial-institution counterparties, the draft regulation caps a bank’s total credit exposure at 100% of Tier 1 capital by 30 June 2019 and steadily lowers the cap to 25% by the end of 2021. In the case of credit exposures between global systemically important banks (G-SIBs), the cap is 15% of Tier 1 capital within a year of the bank’s designation as a G-SIB.