The ABS released their February 2018 housing finance data today. Where possible we track the trend data series, as it irons out some of the bumps along the way.

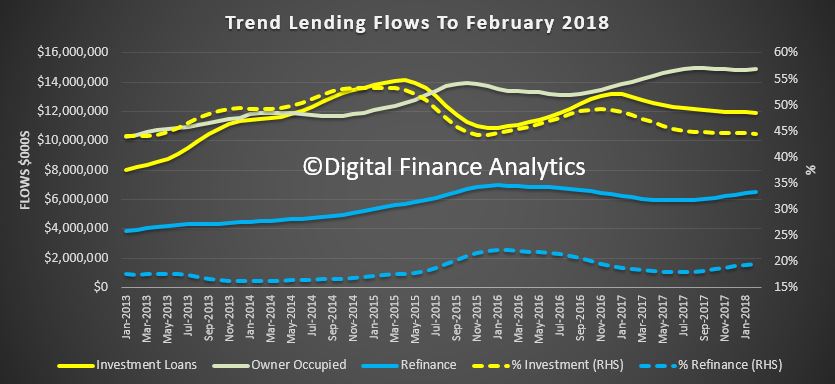

The flow of investment loans was worth $11.9 billion and down 0.2% from last month. Owner occupied loans rose 0.1% to $17.1 billion, while refinancing of existing loans rose 1.1% to $6.4 billion. So investment loans comprise 44.5% of loans, excluding refinanced, while refinanced loans were 19.5% of owner occupied loans.

Looking at the individual moving parts, we see owner occupied construction loans flows rose 0.2% by $4.6 million to 2.0 billion, and owner occupied purchase of new dwellings was down 0.1% to $1.2 billion. The purchase of other owner occupied dwellings was up 0.1% by $13.3 million to $11.6 billion. On the investment side of the ledger, investment construction fell 0.9%, down $11 million to $1.2 billion, while purchases by individuals for investment purposes down 0.6% or $60 million to $9.5 billion and purchases by other entities, for example super funds, rose 4% of $47 million to $1.2 billion.

Looking at the individual moving parts, we see owner occupied construction loans flows rose 0.2% by $4.6 million to 2.0 billion, and owner occupied purchase of new dwellings was down 0.1% to $1.2 billion. The purchase of other owner occupied dwellings was up 0.1% by $13.3 million to $11.6 billion. On the investment side of the ledger, investment construction fell 0.9%, down $11 million to $1.2 billion, while purchases by individuals for investment purposes down 0.6% or $60 million to $9.5 billion and purchases by other entities, for example super funds, rose 4% of $47 million to $1.2 billion.

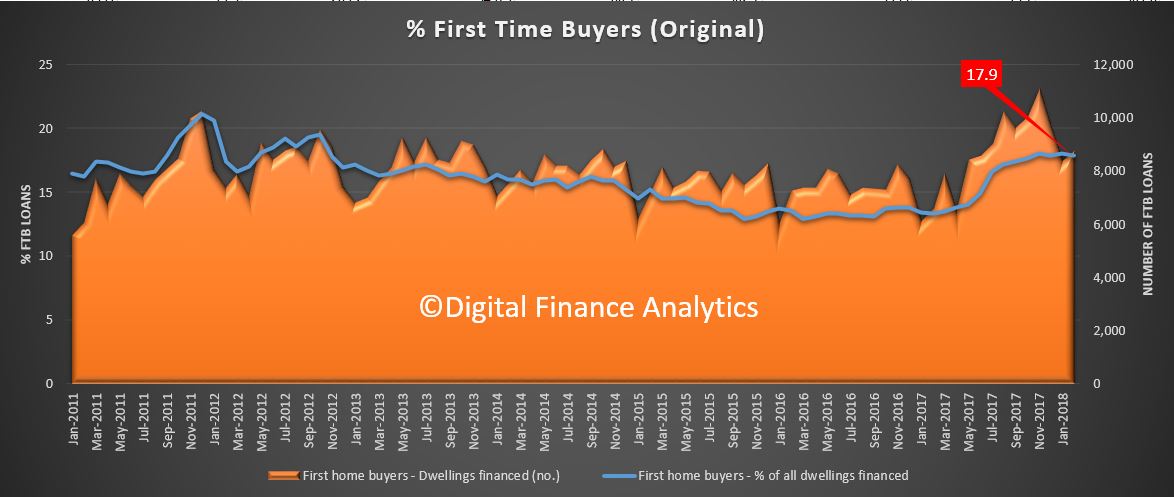

Looking at the original first time buyer data, there was a small fall this past month, to 17.9% of all loans as the volume of non first time buyers rose faster. However the upward move was a small one, and it appears the benefit of the new first time buyer incentives have abated. Tighter lending standards probably play in here also.

Looking at the original first time buyer data, there was a small fall this past month, to 17.9% of all loans as the volume of non first time buyers rose faster. However the upward move was a small one, and it appears the benefit of the new first time buyer incentives have abated. Tighter lending standards probably play in here also.

Here are the individual moving parts. There was a rise of 403 buyers, to 8,892, up 4.8%, compared to a 5.9% rise in non-first time buyer loans. The average loan size fell by 2.1%.

Here are the individual moving parts. There was a rise of 403 buyers, to 8,892, up 4.8%, compared to a 5.9% rise in non-first time buyer loans. The average loan size fell by 2.1%.

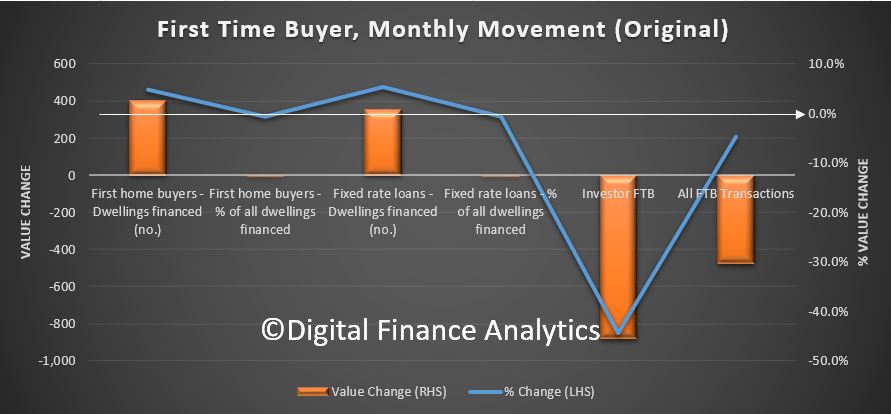

Using our survey data we also track first time buyers going to the investment market directly. We saw a further fall in momentum here as interest in investor loans wains.

Using our survey data we also track first time buyers going to the investment market directly. We saw a further fall in momentum here as interest in investor loans wains.

![]() Finally, the original loan stock data for banks (ADIs) shows that the share of investor loans fell to 34.1%, and was up by $590 million or 1.11% to $562 billion. Owner Occupied stock rose 0.63%, up $6.8 billion to $1.08 trillion.

Finally, the original loan stock data for banks (ADIs) shows that the share of investor loans fell to 34.1%, and was up by $590 million or 1.11% to $562 billion. Owner Occupied stock rose 0.63%, up $6.8 billion to $1.08 trillion.

So the bottom line is investor as still active but at a slower rate. Some are suggesting there is evidence of stabilisation, but we do not see that in our surveys.

So the bottom line is investor as still active but at a slower rate. Some are suggesting there is evidence of stabilisation, but we do not see that in our surveys.

Owner occupied loans, especially refinancing is growing quite fast – as lenders seek out lower risk refinance customers with attractive rates. First time buyers remain active, but comprise a small proportion of new loans as the effect of first owner grants pass, and lending standards tighten.