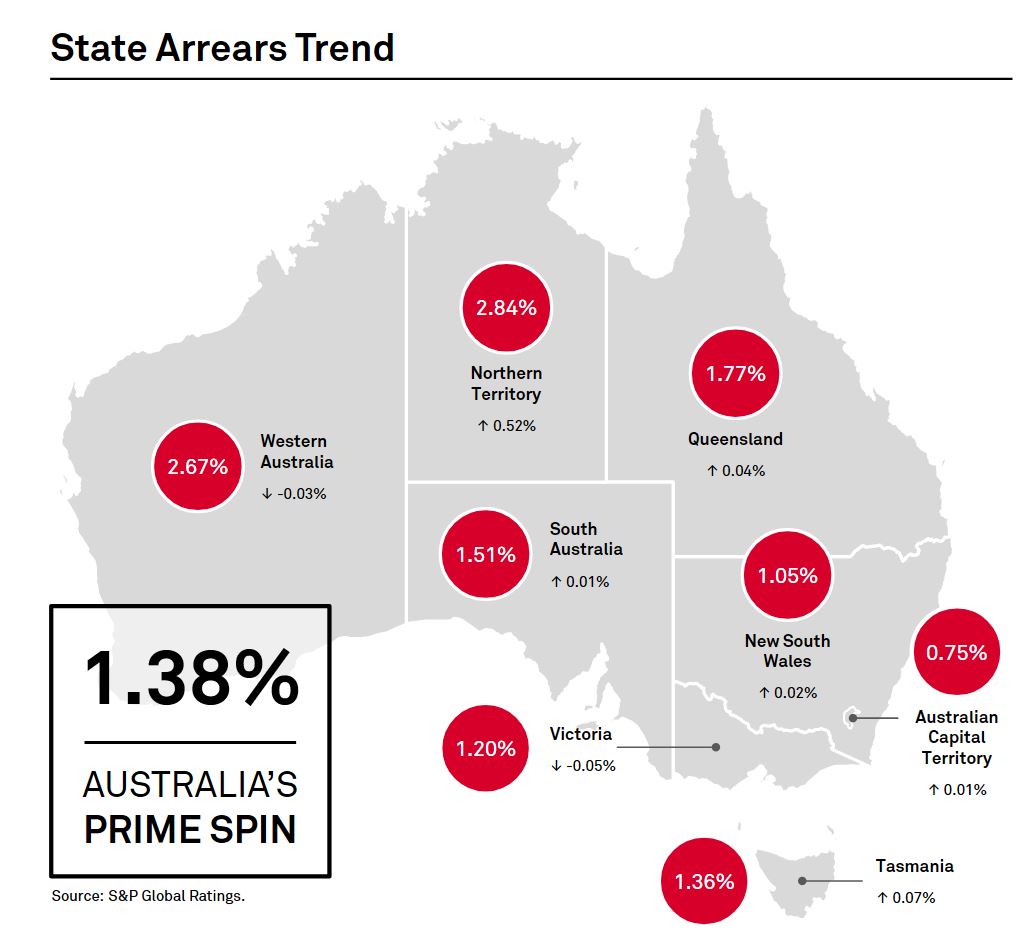

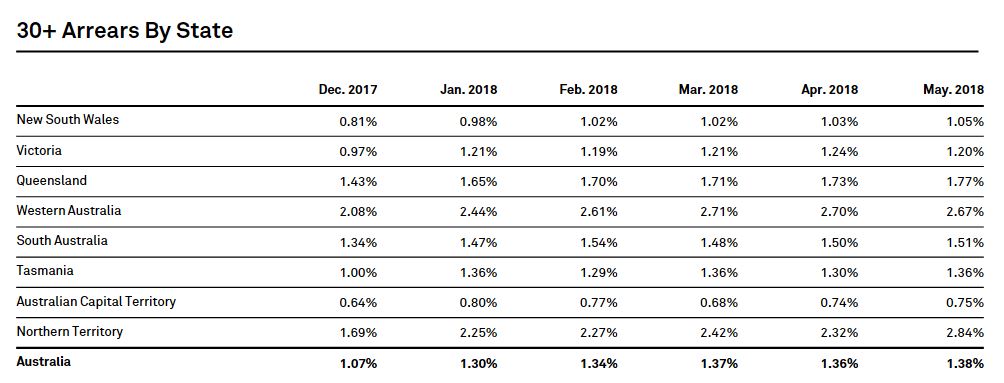

The latest S&P Ratings SPIN index to May 2018, based on their portfolio of mortgage backed securities showed a further move up in defaults compared with last month, from 1.36% to 1.38%.

In fact, Western Australia’s default rates improved a little, as did Victoria, but there were rises in New South Wales of 0.02%, Queensland of 0.04% and Northern Territory up 0.52%. ACT has the lowest default rate at 0.75%, followed by New South Wales at 1.05% while the Northern territory and Western Australia have the highest rates of 30 default at 2.84% and 2.67% respectively.

In fact, Western Australia’s default rates improved a little, as did Victoria, but there were rises in New South Wales of 0.02%, Queensland of 0.04% and Northern Territory up 0.52%. ACT has the lowest default rate at 0.75%, followed by New South Wales at 1.05% while the Northern territory and Western Australia have the highest rates of 30 default at 2.84% and 2.67% respectively.

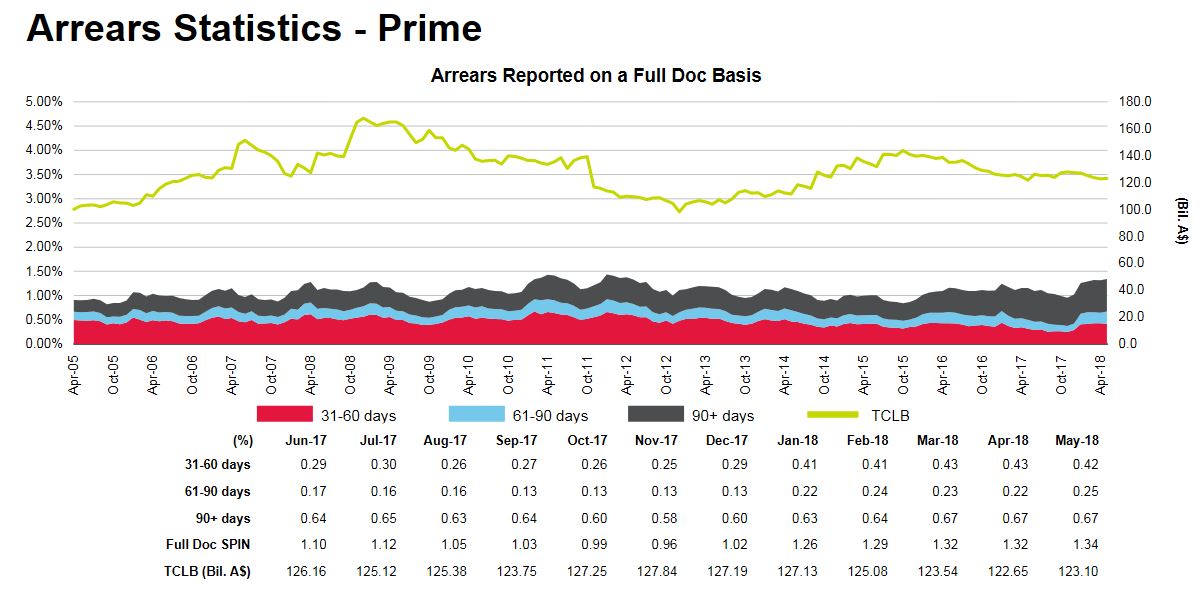

Looking across the period in default, the most significant rise across prime loans was in the 61-90 days bracket, up from 0.22% in April to 0.25% in May. 90 day plus arrears remained the same at 0.67%.

Looking across the period in default, the most significant rise across prime loans was in the 61-90 days bracket, up from 0.22% in April to 0.25% in May. 90 day plus arrears remained the same at 0.67%.

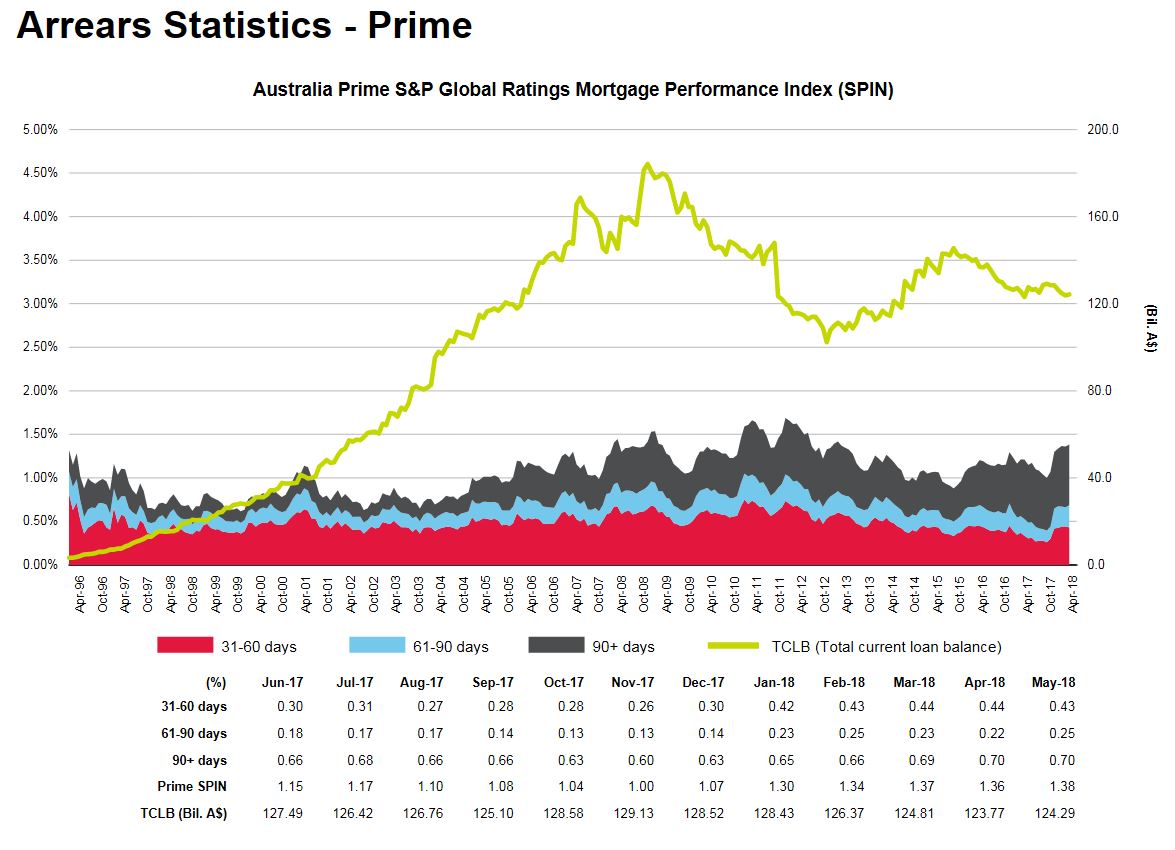

Significantly, the larger hikes were see in the major bank portfolios, with the prime spin rising from 1.36% last month to 1.38% in May. There was a rise in 61-90 day past due loans, from 0.22% last time to 0.25%.

Significantly, the larger hikes were see in the major bank portfolios, with the prime spin rising from 1.36% last month to 1.38% in May. There was a rise in 61-90 day past due loans, from 0.22% last time to 0.25%.

Whilst these moves are small, arrears are now as high as they were back in 2011, and interest rates are much lower today, so this highlights the risks in the system. This does not appear to be a seasonal issue, it is more structural.

Whilst these moves are small, arrears are now as high as they were back in 2011, and interest rates are much lower today, so this highlights the risks in the system. This does not appear to be a seasonal issue, it is more structural.

Sydney or as we in Central Queensland call it “Moranbah South” should see a major untick in defaults due to the end of the residential construction boom as workers move elsewhere to find work. This will leave vacant rental properties and service businesses having to adjust their capacity to deal with lower volumes.