The SMH published an article today “‘It’s our version of the GFC’: warning on looming interest-only crisis” which dissects the Interest Only Loan repayment issue, and includes a number of quotes from DFA.

Martin North, the principal at consultancy Digital Finance Analytics, said interest-only loans account for about $700 billion of the $1.7 trillion in Australian mortgage lending and it was “our version of the GFC”.

“My view is we’re in somewhat similar territory to where the US was in 2006 before the GFC,” Mr North said.

“This is absolutely not ‘sub-prime’ in the US definition but there were people [in Australia] who were being encouraged to get very big loans on the fact that principal & interest was impossible to service but they could service interest-only,” Mr North said.

“We also know that some interest-only loans were not investors but they are actually first-home buyers encouraged to go in at the top of the market.”

Those who follow our posts will know this has been an area of concern for several years as the volume of IO loans accelerated to a peak of more than 40%, before the regulator finally acted.

Now lending standards have been tightened, but there is a large overhang of loans which now will fail to be refinanced again.

So many households will need to step-up to an interest and principal repayment loan, which could be 40% or more higher to service, or be forced to sell.

In addition, some borrowers appear to not understand that they hold an IO loan, so this could all come as a nasty shock, at a time when property values are sliding, incomes are flat and costs of living are rising.

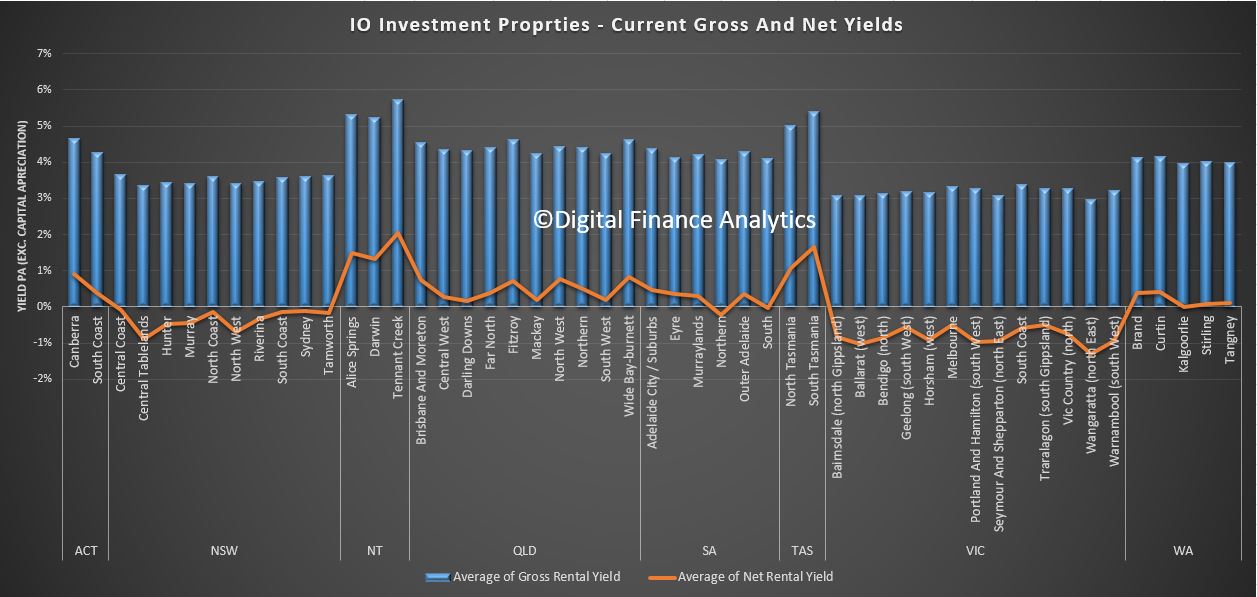

In addition, we know that many investment properties are already underwater from a net cash flow (before tax) position.

Despite the RBA’s recent assurances that many will cope just fine (and some households will) this has the potential indeed to be our version of the GFC.

Here is analysis by state and region looking the the gross and net yield on investment properties (excluding capital appreciation). Many of the loans coming up for reset will require cash from sources other than the rentals. Most pressures appear to be in NSW and VIC, where on average loans are larger, and households more leveraged.