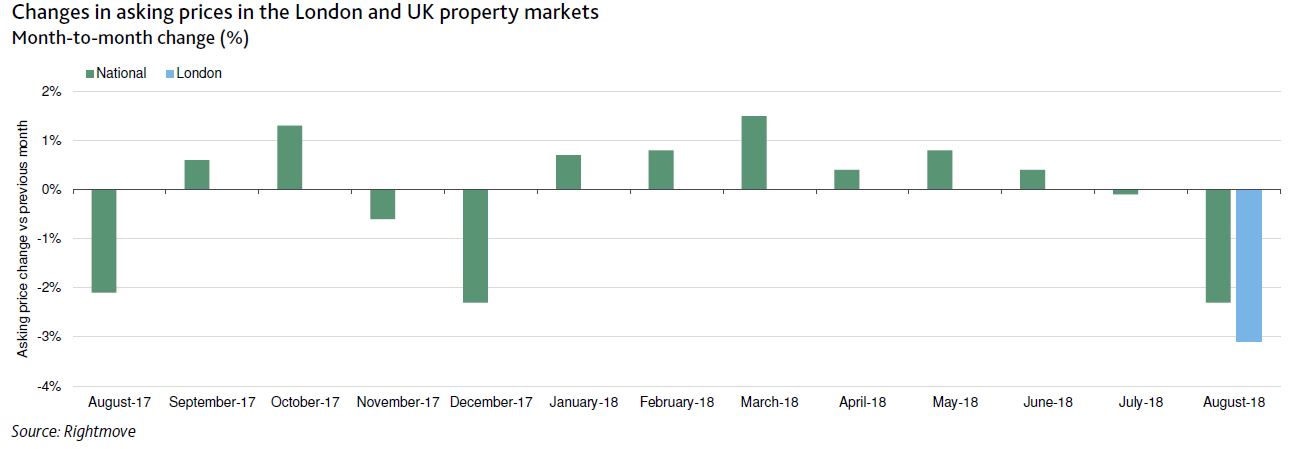

On Monday, Rightmove, a UK online real estate portal, reported that asking prices for UK homes for sale fell 2.3% in August from July, the largest decline since Rightmove began publishing such data, according to Moody’s.

The slowdown, which comes amid heightened uncertainty over Brexit, is credit negative for UK mortgage securitisations because it indicates a possible increase in loan severity as well as further delays in sales, as sellers seek to maximise prices and buyers wait for prices to fall further. The prospect of further house price declines, combined with recent tax increases and tightening underwriting criteria, will impel some buy-to-let landlords and borrowers under stress to sell their properties, resulting in further house price decreases.

In addition, a weaker housing market risks lessening borrowers’ willingness to repay their loans given that declining house prices reduce the equity in their properties. This could particularly affect regions with high average loan-to-value (LTV) ratios, such as London and the southeast, as well as the non-conforming mortgage market in general, since the average LTVs for non-conforming mortgages are typically higher than for prime or buy-to-let mortgages. However, the potential effect of decreasing house prices on borrowers is mitigated in the UK by lenders having full recourse to the borrower in case of default.

Uncertainty surrounding Brexit has increased the average time it takes to sell a property and increased the stock of properties being offered for sale throughout the UK, but particularly in London. The average time to sell a property in London increased by 13% in August from the same month last year, while in the UK as a whole it rose by 3.6%. Additionally, the number of UK properties under offer increased by 6% in August from the year-earlier period, signalling a slowdown in the sales process.

Following the changes in demand and supply, asking prices in London decreased by 1.2% between August 2017 and August 2018. This decline accelerated over the past month, with asking prices dropping by 3.1% compared with July 2018. The situation was less severe for the UK as whole, with prices dropping 2.3% during August, but increasing 1.1% from the same month last year.

The last significant house price drop in the UK was during the financial crisis (2007-08). However, the level of borrower indebtedness and the house price increases before the financial crisis were greater than in the run-up to the current house price decrease. Also, new origination has been more prudent from banks and building societies post crisis. Therefore, we would expect that any upcoming house price decrease would be smaller that during the previous financial crisis.