Now Westpac has broken the dam, others are following, as expected. More will follow, especially late on a Friday afternoon…

Both regional banks, Suncorp and Adelaide Banks said that “challenging” market conditions have forced them to hike rates on variable rate mortgages across both owner-occupied and investor mortgage products by as much as 40 basis points.

Both regional banks, Suncorp and Adelaide Banks said that “challenging” market conditions have forced them to hike rates on variable rate mortgages across both owner-occupied and investor mortgage products by as much as 40 basis points.

Suncorp says rates on all variable rate home and small business loans will rise by 17 basis points and 10 basis points respectively, from September 14.

Adelaide Bank says rates for eight products across its range of principal and interest and interest-only owner-occupied and investor products will apply from September 7. Specifically, principal and interest-owner occupied and investment variable loans will be increasing by 12 basis points, interest-only owner occupied and residential investment loans will rise by 35 basis points and 40 basis and interest-only investment loans settled before January 1 will be increased by 12 basis points.

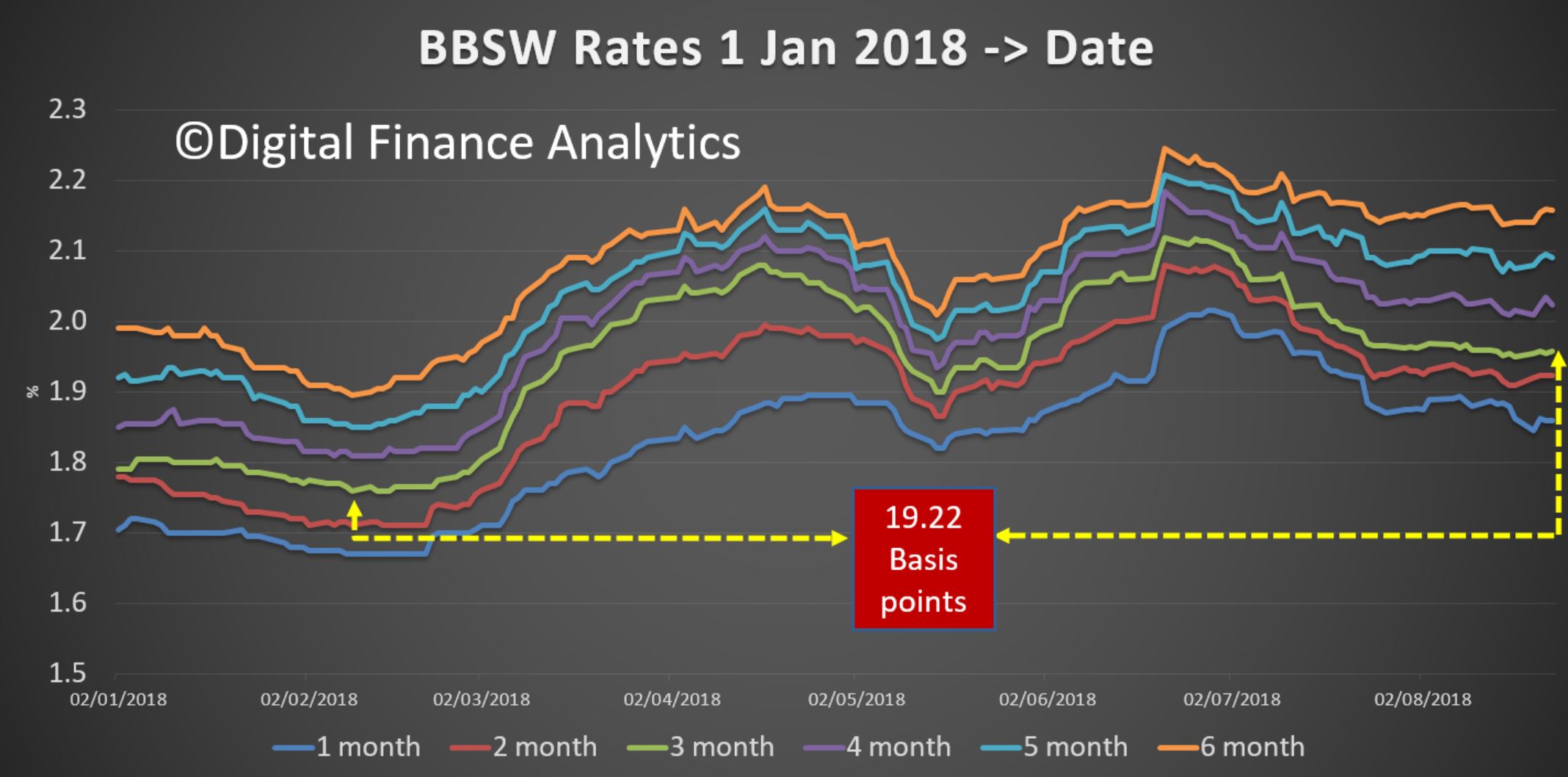

Lets be clear about what is happening here. Funding costs are indeed rising, as we show from the latest BBSW.

In addition some of the smaller lenders are lifting some deposit rates to try and source funding.

In addition some of the smaller lenders are lifting some deposit rates to try and source funding.

But the real story is the they are also running deep discounted rates to attract new borrowers, (especially low risk, low LVR loans) and are funding these by repricing the back book. This is partly a story of mortgage prisoners, and partly a desperate quest for any mortgage book growth they are capture. Without it, bank profits are cactus.

Once again customer loyalty is being penalised, not rewarded. Those who can shop around may save, but those who cannot (thanks to tighter lending standards, or time, or both) will be forced to pay more.