The ABS released the retail trade turnover figures today for July 2018. The noisy seasonally adjusted numbers returned no growth on last month (which had exceed expectations in June). This is what will be reported, I suspect and equates to 2.7% annually.

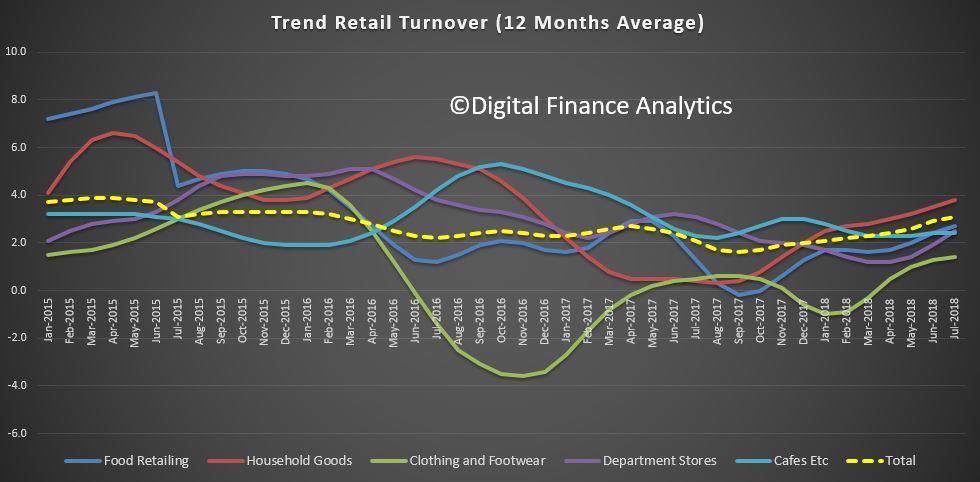

However, as usual we look beyond the seasonally adjusted series to the trend data, which provides a better longer term indication of what is happening. In fact on an annual basis retail is sitting at 3.1% for the past 12 months, still above both wages growth and inflation, at circa 2%. So we can conclude that households are still spending, but financial pressures are crimping their style. Savings are being raided, and credit extended. But 3.1% is reasonably healthy, given the state of things.

The data is reported firstly by major category, with Household Goods sitting at 3.8% annually, Food Retailing at 2.7%, Departmental Stores at 2.5%, and Clothing & Footwear at 1.4%.

The state annual data, on the same basis highlights significant contrasts across the country, with Victoria leading the charge at a massive 5.4%, followed by Tasmania at 4.7%, the ACT at 4.2%, NSW 3.7%, South Australia 2.8%, Queensland 1.4% and Western Australia down 0.5%.

The state annual data, on the same basis highlights significant contrasts across the country, with Victoria leading the charge at a massive 5.4%, followed by Tasmania at 4.7%, the ACT at 4.2%, NSW 3.7%, South Australia 2.8%, Queensland 1.4% and Western Australia down 0.5%.

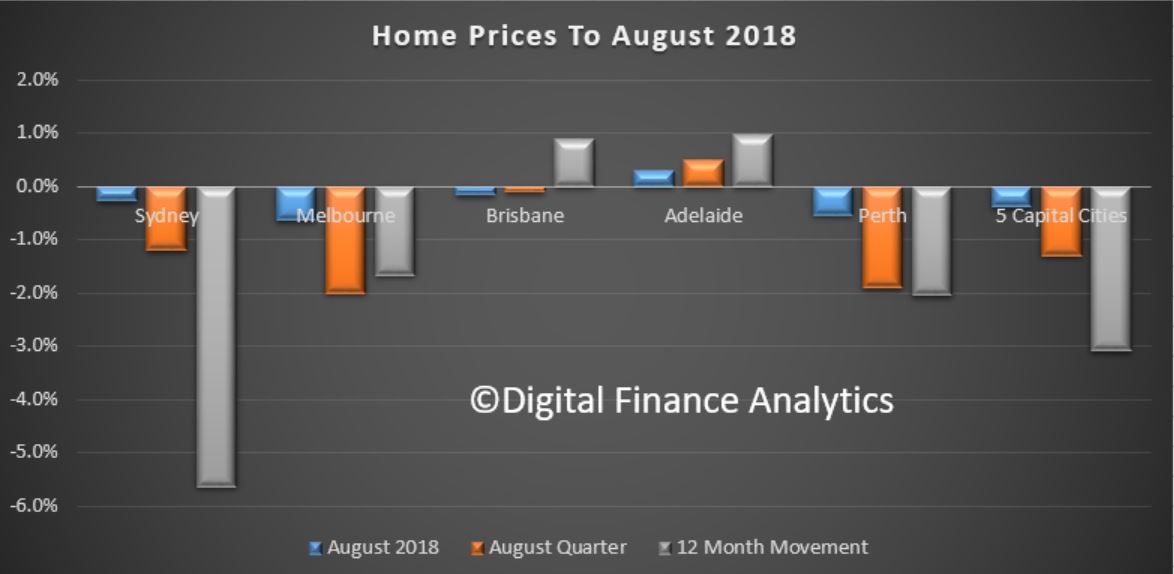

We often see a correlation between home price growth and retail, and as a result, we suspect Victoria will slide lower now, given the fact that in the past quarter values fell in VIC.

The mix of low income, and rising costs coupled with the latest home price falls suggests that retail will be struggling ahead, as shops continue to discount heavily to turn trade over. Indeed, the retail turnover data actually tells us very little in terms of margin and profit, and the data from our own SME surveys suggests that it is really tough for many across discretionary categories, while food costs are rising.

The mix of low income, and rising costs coupled with the latest home price falls suggests that retail will be struggling ahead, as shops continue to discount heavily to turn trade over. Indeed, the retail turnover data actually tells us very little in terms of margin and profit, and the data from our own SME surveys suggests that it is really tough for many across discretionary categories, while food costs are rising.

Later we will get a read on GDP, but it looks like household consumption will not be providing a significant leg-up to the next set of indicators.

Finally, Online retail turnover contributed 5.5 per cent to total retail turnover in original terms in July 2018, a fall from 5.7 per cent in June 2018. In July 2017 online retail turnover contributed 4.3 per cent to total retail.