The RBA Credit Aggregates to August 2018, out today tells an interesting story.

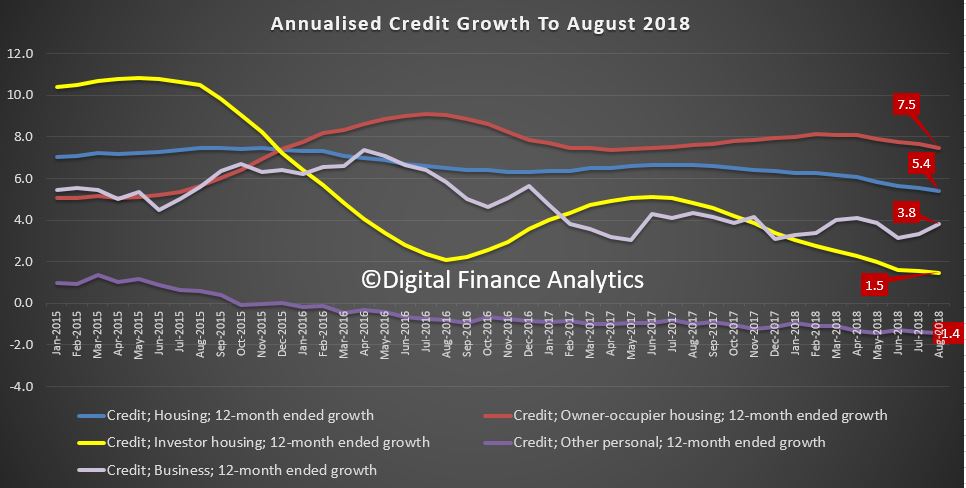

The 12 month growth by category shows that owner occupied lending is still growing at 7.5% annualised, while investment home loans have fallen to 1.5% on an annual basis. Overall housing lending is growing at 5.4% (compared with APRA growth of 4.5% over the same period, so the non-banks are clearly taking up some of the slack). Still above wages and inflation. Household debt continues to rise.

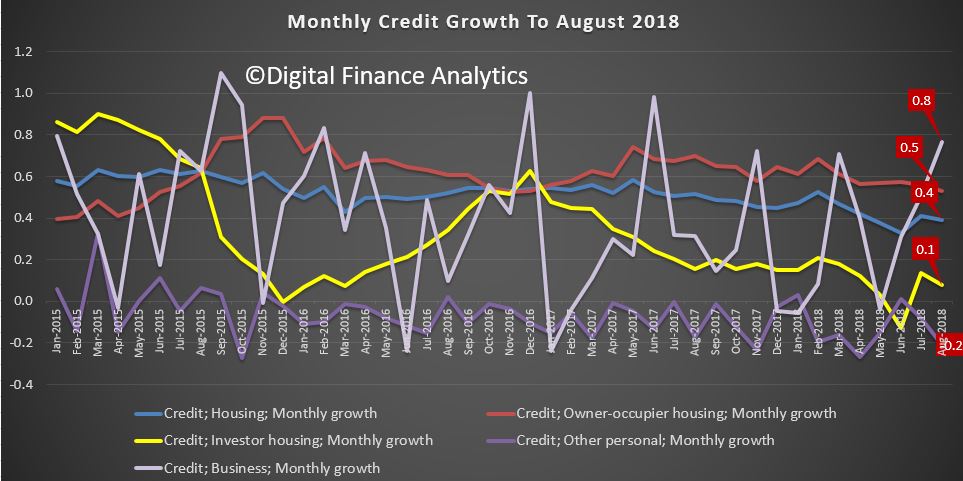

The more noisy monthly data shows investor loans slowing, while business lending is up. Personal credit continues to slide.

The more noisy monthly data shows investor loans slowing, while business lending is up. Personal credit continues to slide.

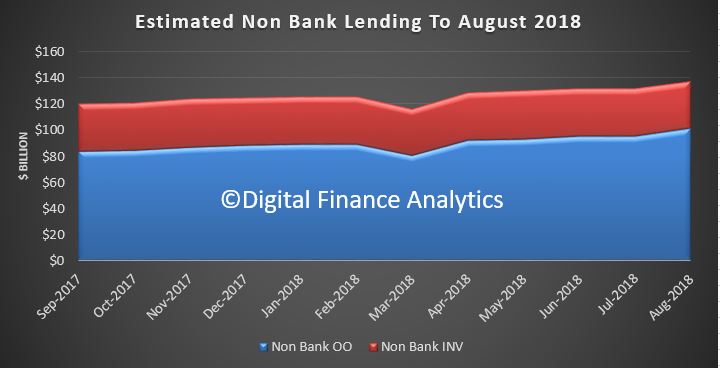

The non-bank sector (derived from subtracting the ADI credit from the RBA data) shows a significant rise up 5% last month in terms of owner occupied loans. This is indicative, as there are timing and other issues when making this comparison, but its the best available. This is consistent with our survey data which slows that non-banks are indeed seeking to grow their books under the lighter non-ADI regulation.

The non-bank sector (derived from subtracting the ADI credit from the RBA data) shows a significant rise up 5% last month in terms of owner occupied loans. This is indicative, as there are timing and other issues when making this comparison, but its the best available. This is consistent with our survey data which slows that non-banks are indeed seeking to grow their books under the lighter non-ADI regulation.

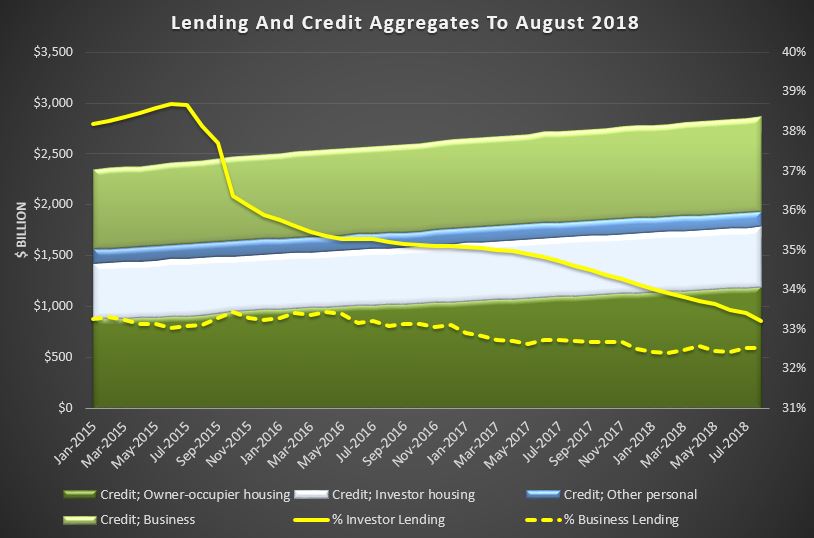

Finally, total lending lose to 1.78 trillion, with owner occupied loans at $1.2 trillion and investment loans at $593 billion. The mix of loans fell to 33.2% of housing loans for investment lending. Business lending was $934 billion, comprising 32.5% of all credit.

In summary, housing debt is still rising too fast . Period. APRA needs to look at the non-banks. And quickly.

In summary, housing debt is still rising too fast . Period. APRA needs to look at the non-banks. And quickly.