The ABS reports that the Consumer Price Index (CPI) rose 0.5 per cent in the December quarter 2018, which follows a rise of 0.4 per cent in the September quarter.

This means that inflation, on the official measures remains BELOW the RBA’s target range of 2-3%, at 1.8% and may suggest more of a bias towards cutting the cash rate (as we have been suggesting for some time).

Of course the “official” figures bear little resemblance to the real lived experience of many households – and the rental proxy for housing in the figures is understating the real expense of many with mortgages. In fact, one reason why the RBA policy levers look pretty sick is the fact that TRUE inflation in real households is closer to 3.5%, on average and for some even higher. They dropped the cash rate too far and now cannot recover.

The upshot is real net disposable income, after expenditure on necessities is all but shot for many, given the anemic wages growth. This explains why household financial confidence is falling away, as we reported before.

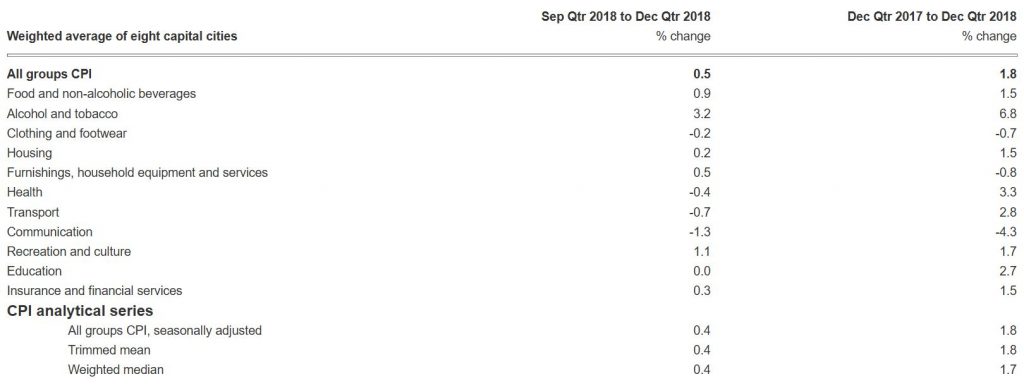

This is how the ABS broke the figures down.

The most significant rises in the December quarter are tobacco (+9.4 per cent), domestic holiday travel and accommodation (+6.2 per cent), fruit (+5.0 per cent), new dwellings purchased by owner-occupiers (+0.4 per cent) and furniture (+1.8 per cent). The rise is partially offset by falls in automotive fuel (-2.5 per cent), audio visual and computing equipment (-3.3 per cent), wine (-1.9 per cent) and telecommunications equipment and services (-1.5 per cent).

While automotive fuel rose 3.3 per cent in October, falls in November and December of 10.8 per cent and 5.0 per cent respectively resulted in a decrease across the quarter of 2.5 per cent.

The CPI rose 1.8 per cent through the year to the December quarter 2018, after increasing 1.9 per cent through the year to the September quarter.

ABS Chief Economist, Bruce Hockman said: “Annual growth in the CPI remains below 2 per cent in the December quarter 2018, with annual growth in tradables inflation of just 0.6 per cent, while non-tradables inflation rose 2.4 per cent. Over the past four years, annual growth in the CPI has only risen above 2 per cent in two of the past 16 quarters.”