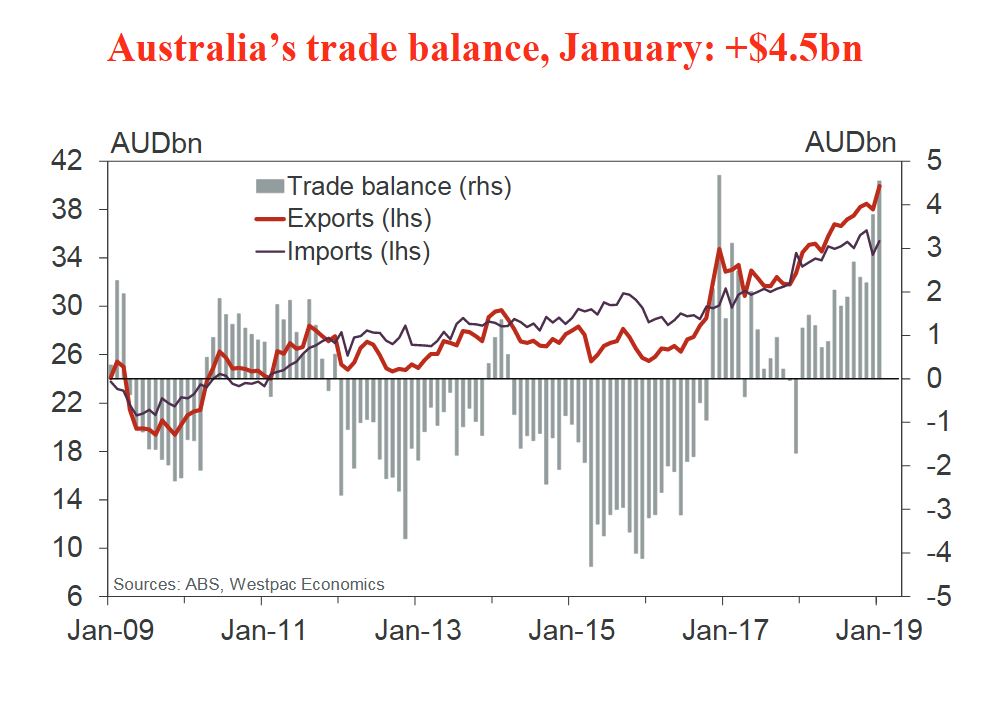

The ABS released the latest trade data to end January 2019. The surplus jumped to $4.5bn which is the second highest on record. The largest was

$4.7bn surplus in December 2016.

Westpac highlighted that the January outcome was a $0.8bn improvement on December and exceeded expectations (market median $2.75bn and Westpac $3.1bn).

Imports did rebound in the month, +3.3%, following a 5.5% fall last month (vs a forecast +4%).

Exports were much stronger than anticipated, increasing by 5.0%, up $1.9bn (vs a forecast +2.2%).

Export strength was largely centred on a sharp rebound in gold off a low base, up 174% (Westpac expected a 75% rebound).

In dollar terms, gold accounted for $1.4bn of the $1.9bn increase in total exports in the month.

Coal exports rose 6%, following a couple of softer months, and metal ores increased by 3.4%, boosted by the higher iron ore price. But rural exports have been more resilient over the past couple of months – however the drought in NSW and surrounds remains a considerable headwind.

Metal ores and coal both advanced in January, up a combined $0.6bn.

The trade surplus widened in 2018 and in to 2019 on higher export earnings, boosted by rising commodity prices.

Notably, commodity prices have surprised to the high side in part due to supply disruptions having an amplified impact in a market where supply and demand are in relatively tight balance.

The $4.5bn surplus for January compares with a Q4 monthly average of $2.8bn.

The surplus for Q1 as a whole is expected to be a material improvement on that in Q4, with export volumes forecast to rise (following a disappointing second half of 2018) and on a likely further increase in the terms of trade.