We updated our household surveys with the September data. Today we focus in on SMSF property transactions, which is a small, but rising factor in the market. We start by looking at the reason why trustees for SMSF’s are considering retail property. The strongest incentives are the tax efficient nature of the investment, and appreciating property values. Low rates also have part to play. I have excluded commercial property from the analysis.

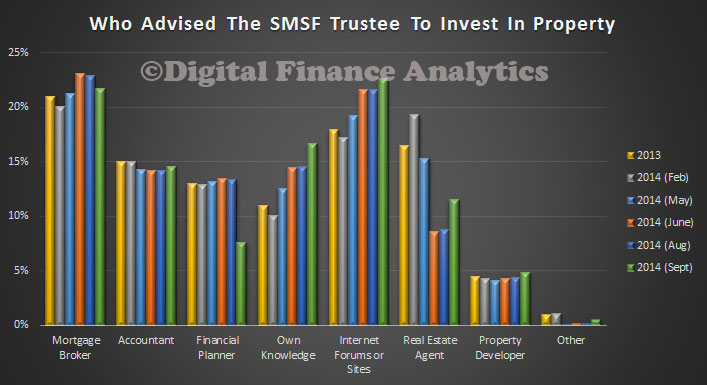

We also asked where the trustees were getting advice from regarding retail property investment. Most interesting is a fall in advice from financial planners (maybe a reaction to FOFA, CBA etc?), and a rise in advice from real estate agents. Mortgage brokers also figure in the mix, alongside internet sources and own knowledge. We wonder how well qualified these sources are to provide the right advice, bearing in mind the long term nature of super.

We also asked where the trustees were getting advice from regarding retail property investment. Most interesting is a fall in advice from financial planners (maybe a reaction to FOFA, CBA etc?), and a rise in advice from real estate agents. Mortgage brokers also figure in the mix, alongside internet sources and own knowledge. We wonder how well qualified these sources are to provide the right advice, bearing in mind the long term nature of super.

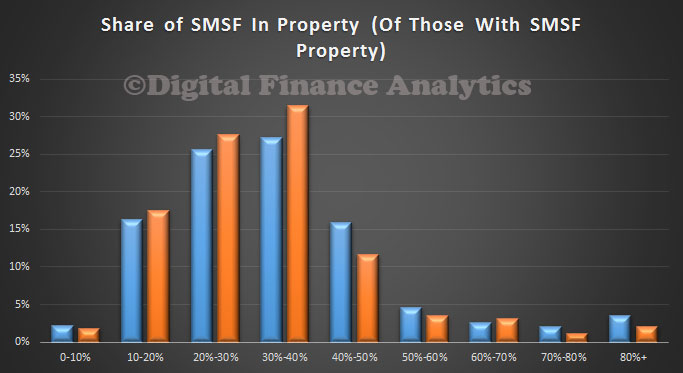

Finally, we looked at changes in relative distribution of property in super funds, and of those who were investing in property (about 3% of all funds are investing in retail property, and another 3% are considering it). We see retail property making up quite a significant share of superannuation savings for some. The blue bar is last year, the orange bar is to September 2014.

Finally, we looked at changes in relative distribution of property in super funds, and of those who were investing in property (about 3% of all funds are investing in retail property, and another 3% are considering it). We see retail property making up quite a significant share of superannuation savings for some. The blue bar is last year, the orange bar is to September 2014. Others can decide if this a good or bad thing, but it does highlight the linkages between property and super, and demonstrates that if house prices fall, then some super funds will be impacted, just at the time house valves are also falling. The impact of the double whammy is potentially significant and concerning.

Others can decide if this a good or bad thing, but it does highlight the linkages between property and super, and demonstrates that if house prices fall, then some super funds will be impacted, just at the time house valves are also falling. The impact of the double whammy is potentially significant and concerning.

One thought on “SMSF Property Investment Continues – DFA Survey”