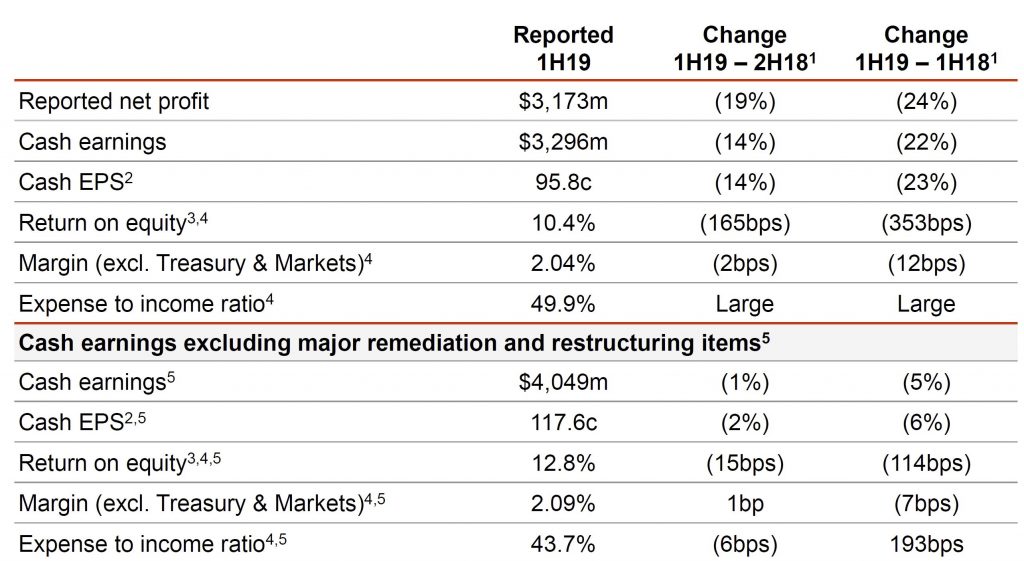

Westpac released their 1H19 results today and declared a statutory net profit of $3,173 million, down 24%. It would have been worse, but for lower than expected provisioning at $0.33 billion. Revenue was weaker than expected as they were hit by slower mortgage lending and weaker treasury. Margin is under pressure, but customer remediation costs continue to rise.

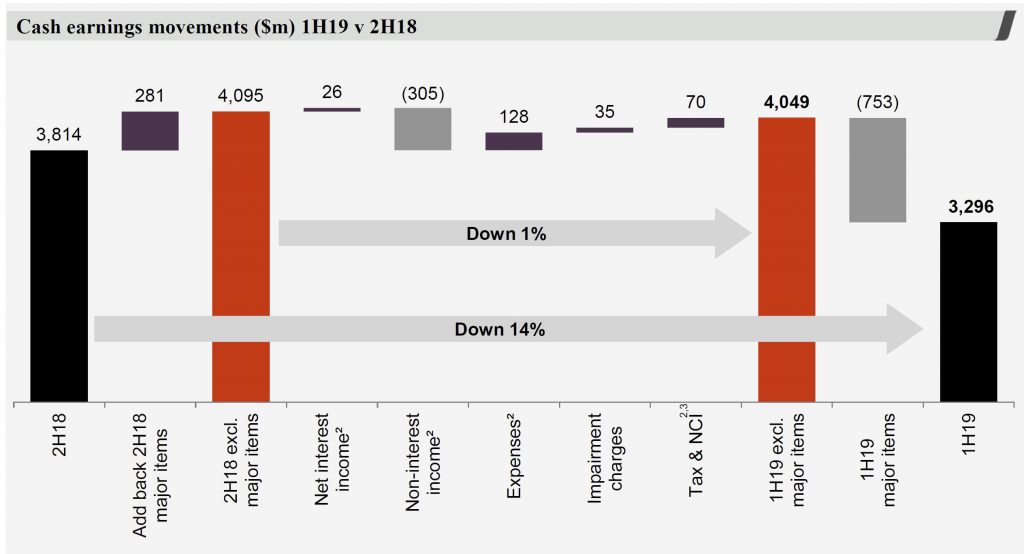

Cash earnings were $3,296 million, down 22% and cash earnings per share at 95.8 cents was down 23%.

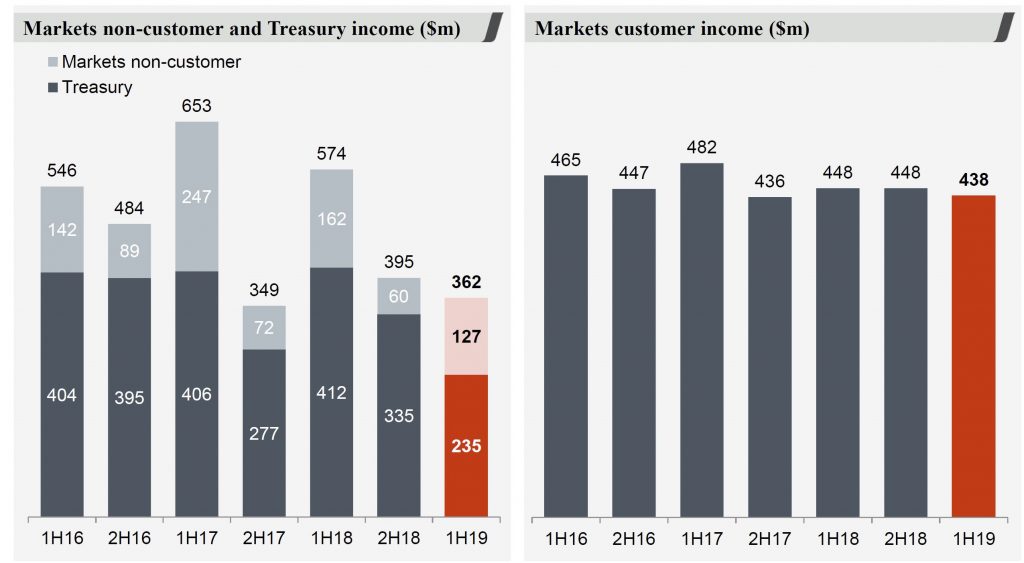

Market and Treasury Income was down 5% this half excluding derivative valuation adjustments.

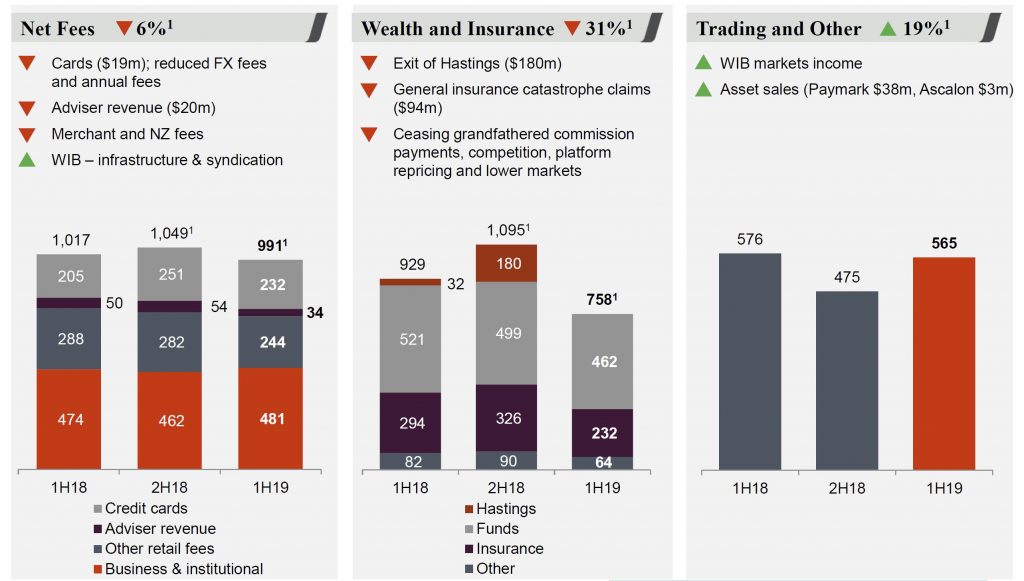

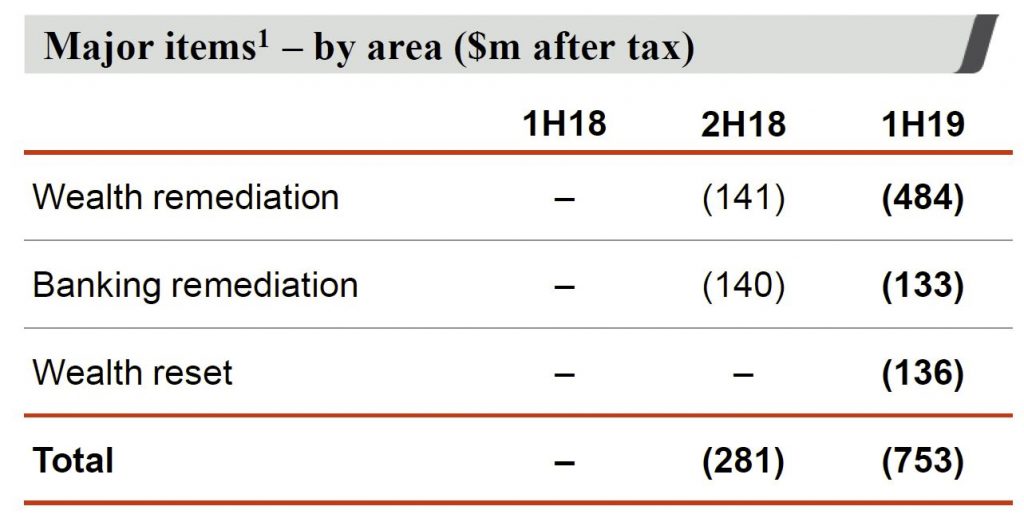

Non-interest income was down 30%, or 12% excluding major items (including provisions for estimated customer refunds, payments and associated costs, along with restructuring costs associated with resetting the Group’s wealth strategy).

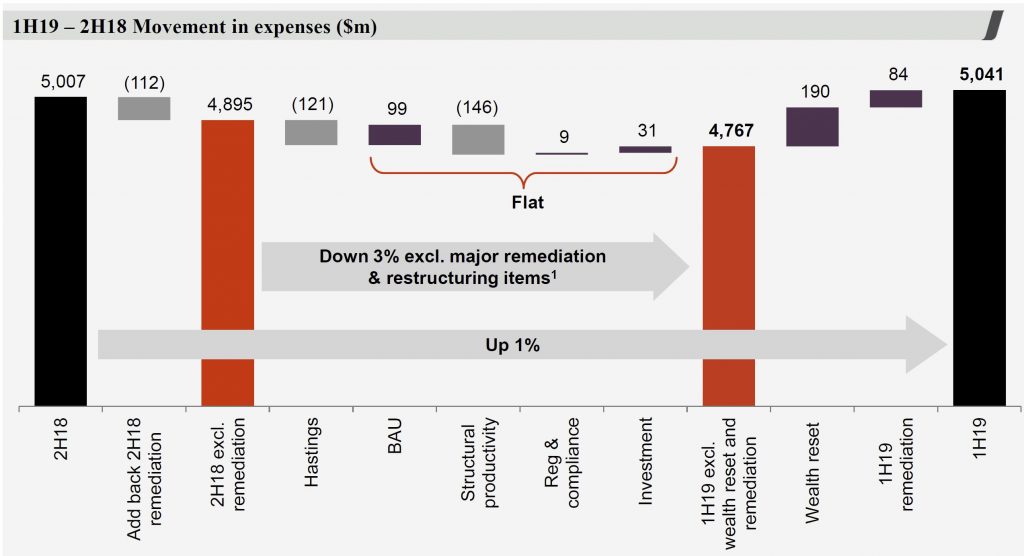

They claim there was a focus on expense management, though overall expenses were 1% higher.

Cash earnings, excluding major remediation and restructuring items of $753 million (after tax), was down 5%.

Westpac has provisioned $1,445 million pre-tax in total over the past three years to work on its customer remediation programs, including $1,249 million for customer refunds. $896 million pre-tax in provisions were made this half ($617 million post-tax). They have more than 400 employees working directly on remediation projects and over the past 18 months, they have repaid around $200 million to customers.

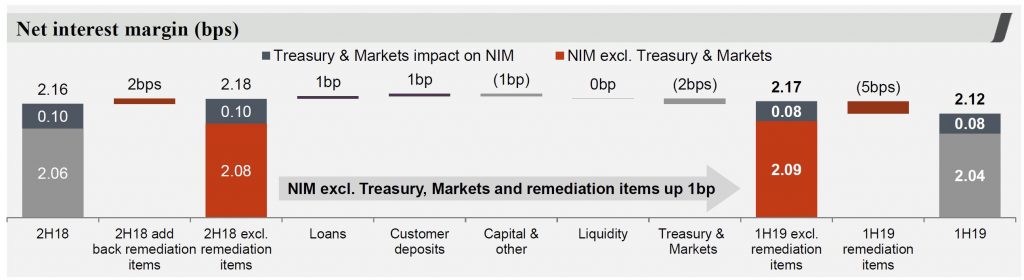

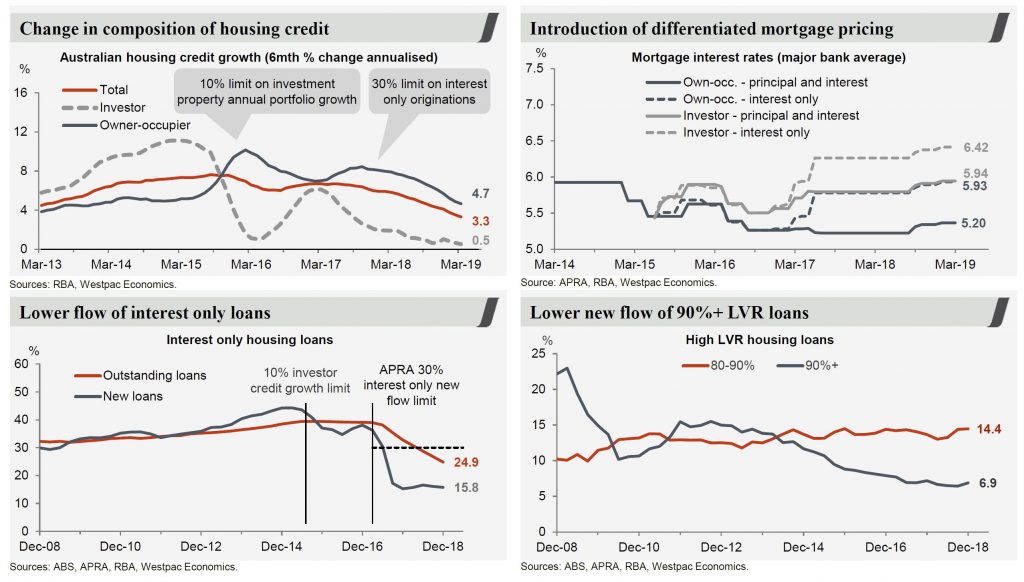

The bank’s net interest margin (excluding Treasury & Markets) was down 12 basis points from 1H18 due to provisions for customer refunds and higher short-term funding costs. There was also a 4bps decrease in Treasury & Markets primarily from Treasury interest rate risk management.

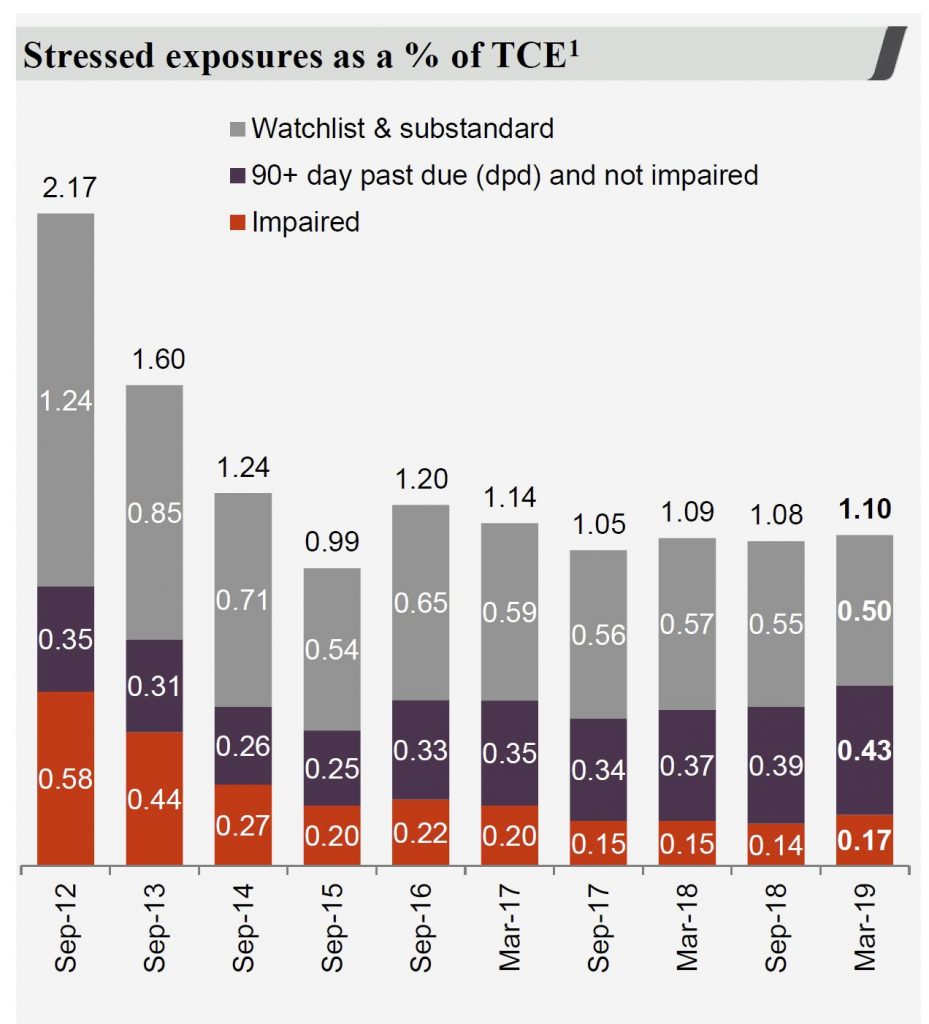

There was a rise in 90 day plus past due and impaired, with stressed exposures rising from 1.08% to 1.10% from the previous half.

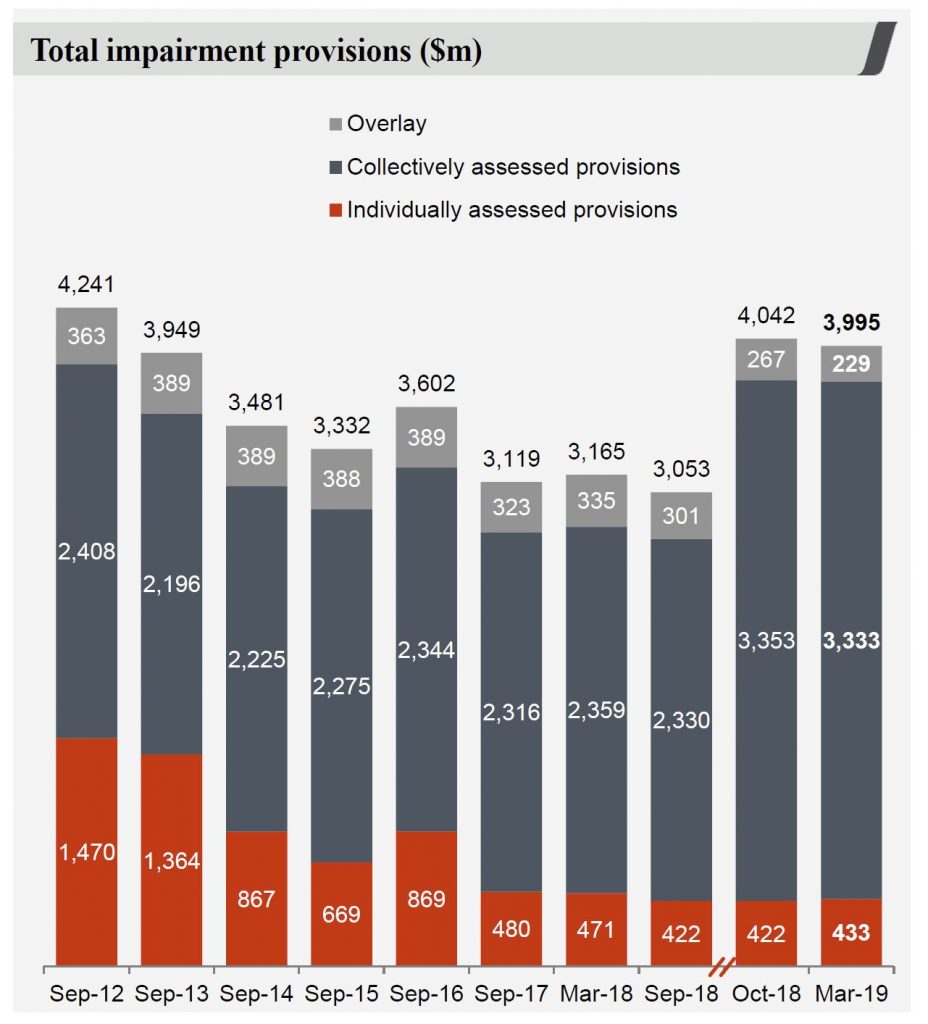

Total impairment provisions fell slightly from Oct 18, despite individually assesses provisions slightly higher. The economic overlay was weirdly reduced (despite the weaker economy!).

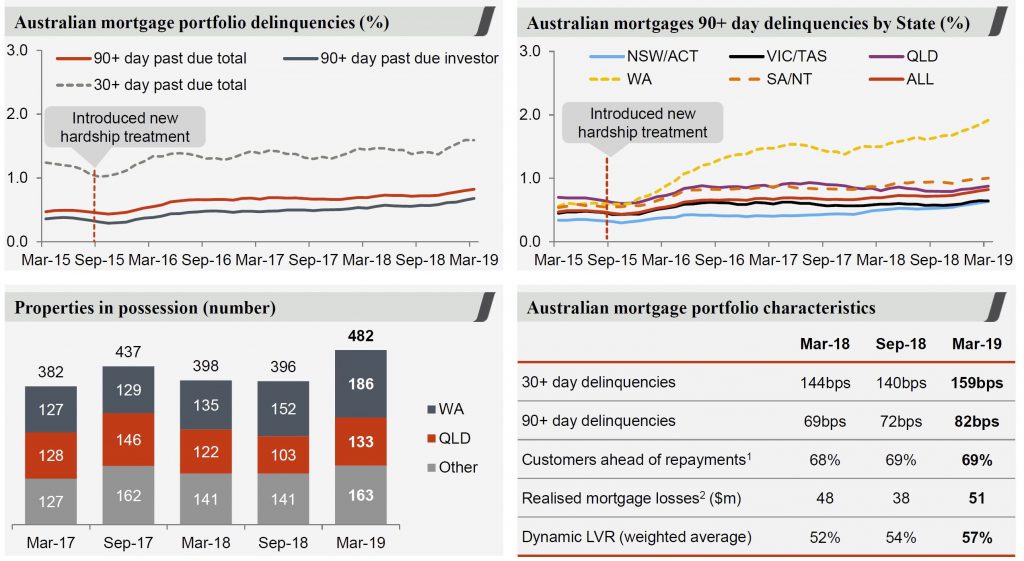

Mortgage delinquency in Australia continued to rise (as expected), with 482 properties in possession, compared with 396 last time (most were in WA or QLD). Past Due 90 days rose in most states, but WA lifted the most, and continues to reflect the weaker conditions in the west. They also called out rising delinquencies in NSW, a rise in P&I loans and longer cure times, together with the RAMs portfolio which has a higher delinquency profile. Total losses are at 2 basis points, which is low.

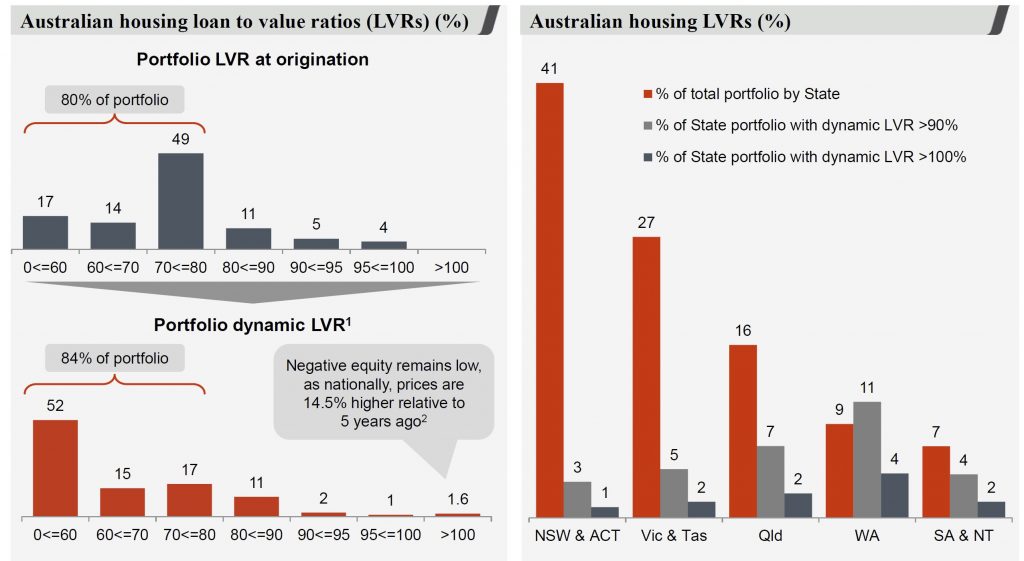

There was a rise in 100%+ LVR’s but is a small proportion of total book, based on data from Australian Property Monitor (but date not disclosed).

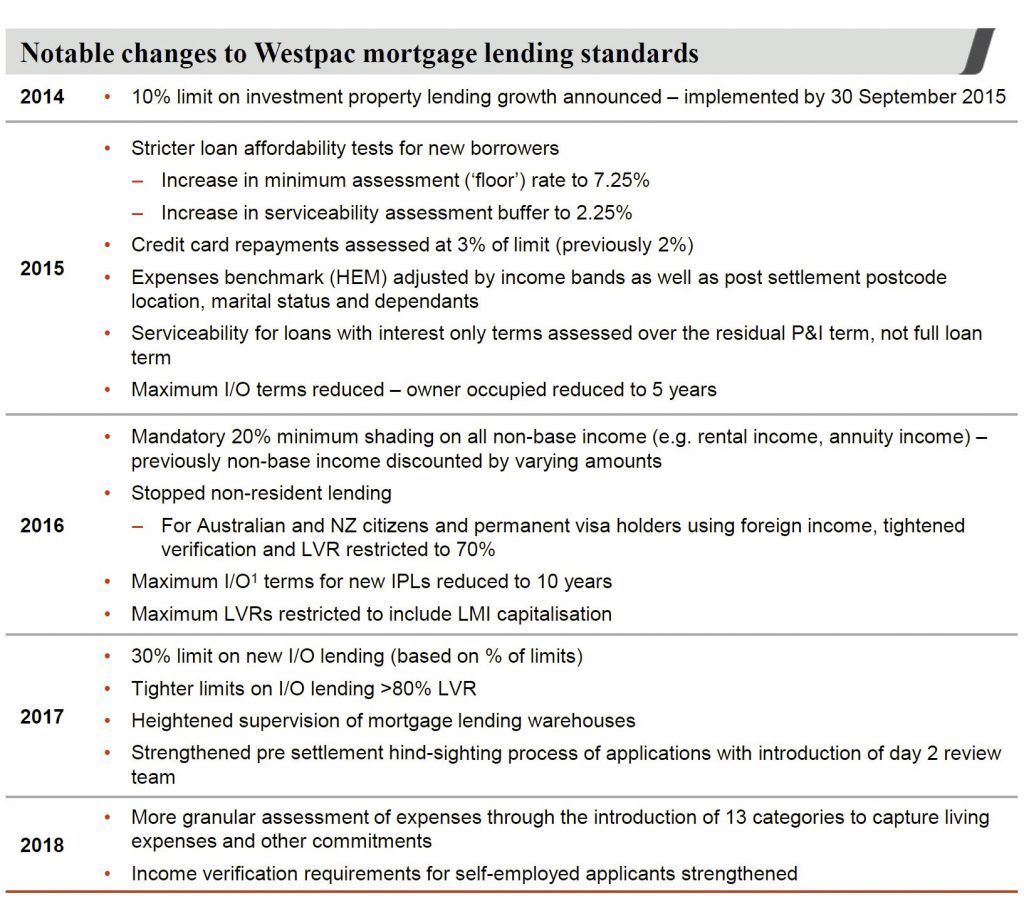

They have tightened lending standards significantly, and 62% of the portfolio were originated after the tightening. However, 19% of loans date from 2012-2014 and there are higher risks here.

90+ day delinquencies were 75 basis points for interest only loans, compared to Principal and interest rates were 83 basis points.

They made much of the better quality of new mortgage lending, but this begs the question about the back book in our view.

The banks return on equity (ROE) was 10.4%, and down 3.5 percentage points or excluding major remediation and restructuring items was, 12.8%.

They declared an interim fully franked dividend of 94 cents per share, which is unchanged

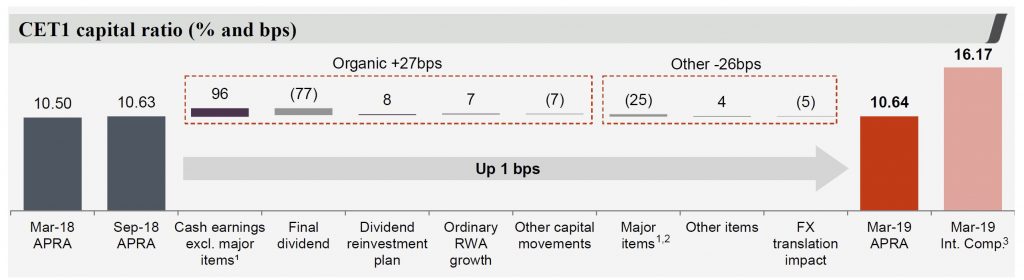

Their common equity Tier 1 capital ratio (CET1) of 10.64% is above APRA’s unquestionably strong benchmark

They foresee ongoing weakness in the Australian economy with subdued GDP growth this year expected to hold at around 2.2%. Consumers were being more cautious in the face of flat wages growth and a continuing soft housing market. They expect system credit growth to moderate, with pressure on margins to continue. But they expect credit quality to remain in good shape.