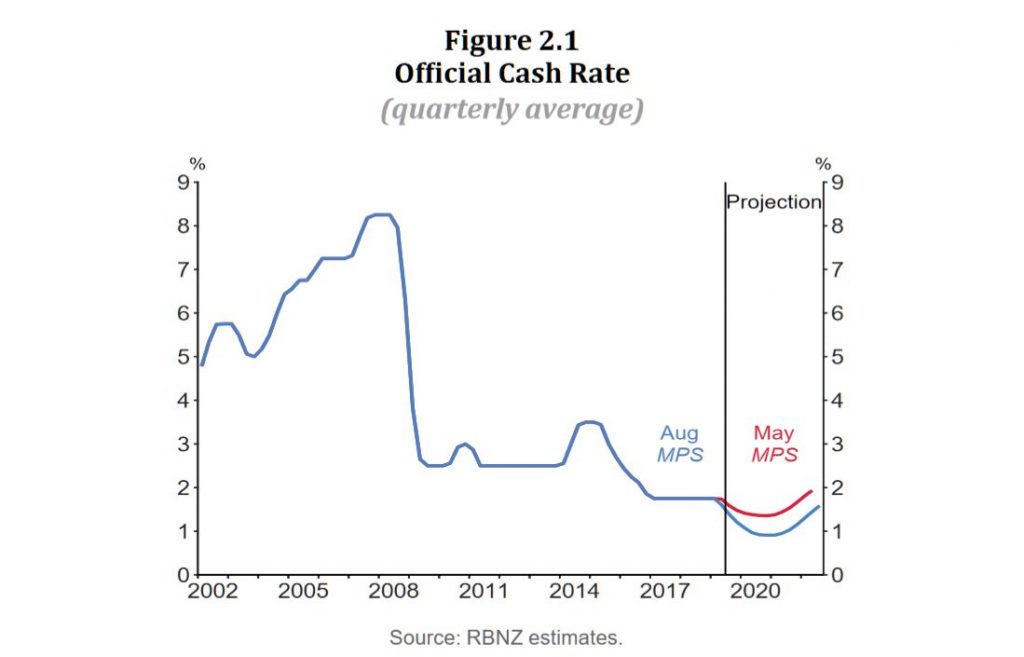

The New Zealand Reserve Banks says the Official Cash Rate (OCR) is reduced to 1.0 percent. The Monetary Policy Committee agreed that a lower OCR is necessary to continue to meet its employment and inflation objectives.

Employment is around its maximum sustainable level, while inflation remains within our target range but below the 2 percent mid-point. Recent data recording improved employment and wage growth is welcome.

GDP growth has slowed over the past year and growth headwinds are rising. In the absence of additional monetary stimulus, employment and inflation would likely ease relative to our targets.

Global economic activity continues to weaken, easing demand for New Zealand’s goods and services. Heightened uncertainty and declining international trade have contributed to lower trading-partner growth. Central banks are easing monetary policy to support their economies. Global long-term interest rates have declined to historically low levels, consistent with low expected inflation and growth rates into the future.

In New Zealand, low interest rates and increased government spending will support a pick-up in demand over the coming year. Business investment is expected to rise given low interest rates and some ongoing capacity constraints. Increased construction activity also contributes to the pick-up in demand.

Our actions today demonstrate our ongoing commitment to ensure inflation increases to the mid-point of the target range, and employment remains around its maximum sustainable level.