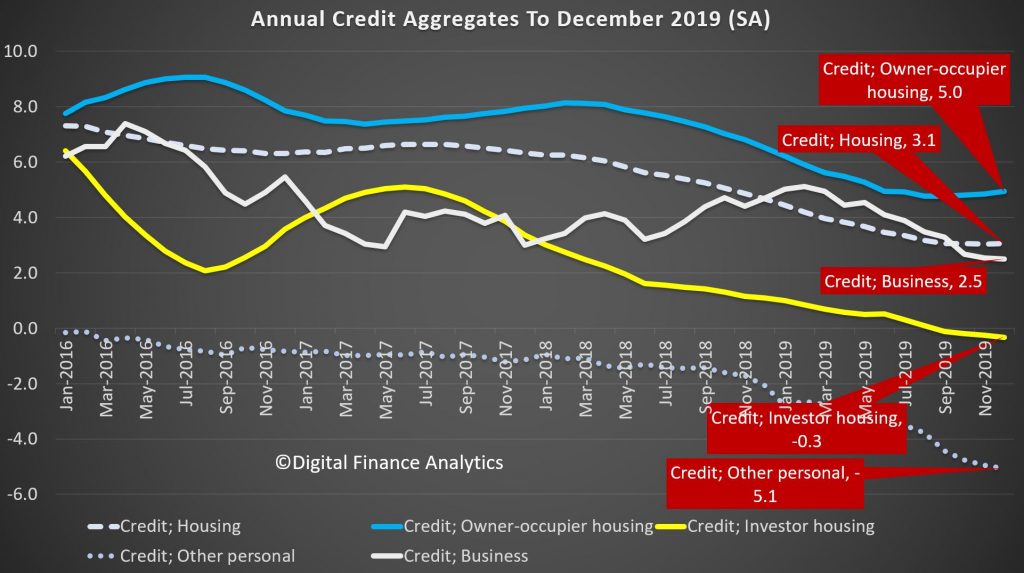

Australian banks have been dialing back their wealth management businesses in response to the Royal Commission, fees for no service issues and the confusion about advice models. The focus has been towards the simplification of their businesses with a focus on mortgage lending, despite this being at a time when lending growth, according to the RBA is at historic lows, and low cash rates are crushing margins, and competition destroying fee income. Housing credit to December was at a low 3.1%.

Elsewhere, especially in the US, the large investment banks are pivoting away from trading markets and lending TOWARDS wealth management. Bloomberg for example reported that Morgan Stanley has agreed to buy discount brokerage E*Trade Financial Corp. for $13 billion, pushing further into the retail market in the biggest acquisition by a Wall Street firm since the financial crisis.

The all-stock takeover adds E*Trade’s $360 billion of client assets to Morgan Stanley’s $2.7 trillion, the companies said Thursday in a statement. Morgan Stanley also gets E*Trade’s direct-to-consumer and digital capabilities to complement its full-service, advisory-focused brokerage.

“Our clients increasingly want digital access and digital banking, and their clients want wealth-management advice,” Chief Executive Officer James Gorman said in an interview. “It’s the continuing evolution of Morgan Stanley into a stable, well-diversified business.”

In reshaping the firm since the financial crisis, Gorman has been emphasizing Morgan Stanley’s wealth-management powerhouse. Purchasing E*Trade helps him add clients who are less wealthy than its traditional customers. The New York-based company has lost some business to the retail brokerages in recent years as those firms invested heavily in their web platforms.

“Wall Street banks continue to covet Main Street customers,” Greg McBride, an analyst at Bankrate.com, said in an email. The acquisition “gives them access to brokerage customers, employees with company stock, and the lifeblood of financial services — low-cost retail bank deposits.”

The retail-brokerage industry is being reshaped by price wars and consolidation. In early October, Charles Schwab Corp. eliminated commissions for U.S. stock trading, spurring other brokerages to follow suit and sweeping away an important revenue stream.

The following month, Schwab agreed to buy rival TD Ameritrade Holding Corp. for about $26 billion and create a mega-firm with $5 trillion in assets, forcing smaller brokerages like E*Trade to contend with a much more formidable competitor.

For Morgan Stanley, the deal “deepens the ‘safe’ wealth-management franchise — rich in fees and stability,” credit analyst David Havens at Imperial Capital wrote in a note to clients. “It reduces reliance on the more mercurial trading and markets businesses.”