The latest edition of our finance and property news digest with a distinctively Australian flavour.

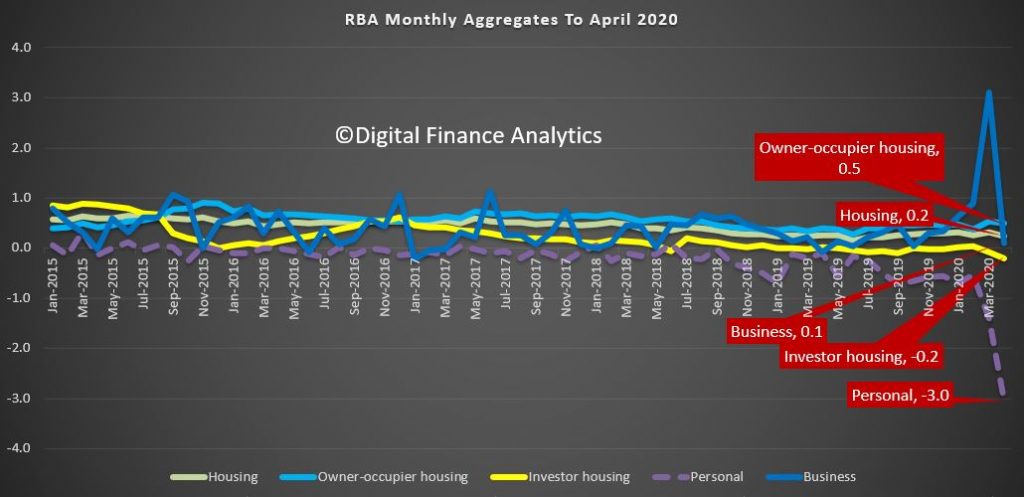

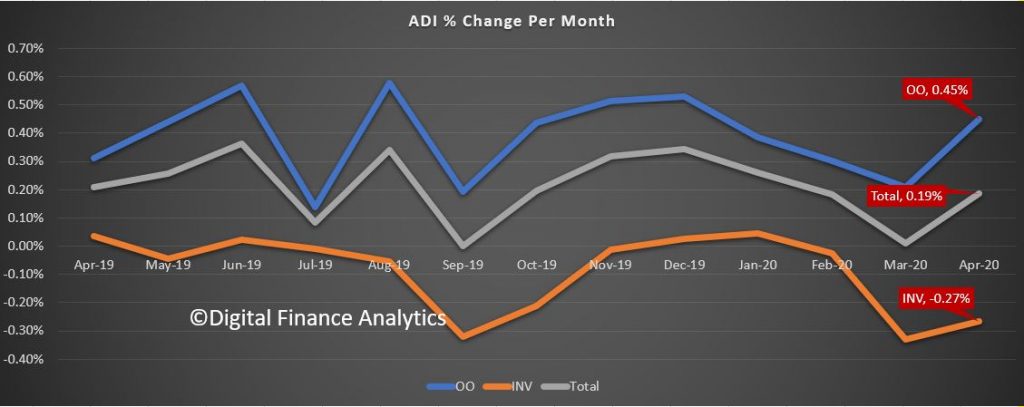

Being the last working day of the month, we got the latest credit data for April from both the RBA and APRA. Overall the RBA reported that private credit was flat over the month, with owner occupied balances up 0.5%, investment lending down 0.2%, making net housing up 0.2% – reflecting deferred repayments in part, business was up just 0.1% after a big spike last month, and personal credit dropped 3% over the month – a noticeable drop by any standards.

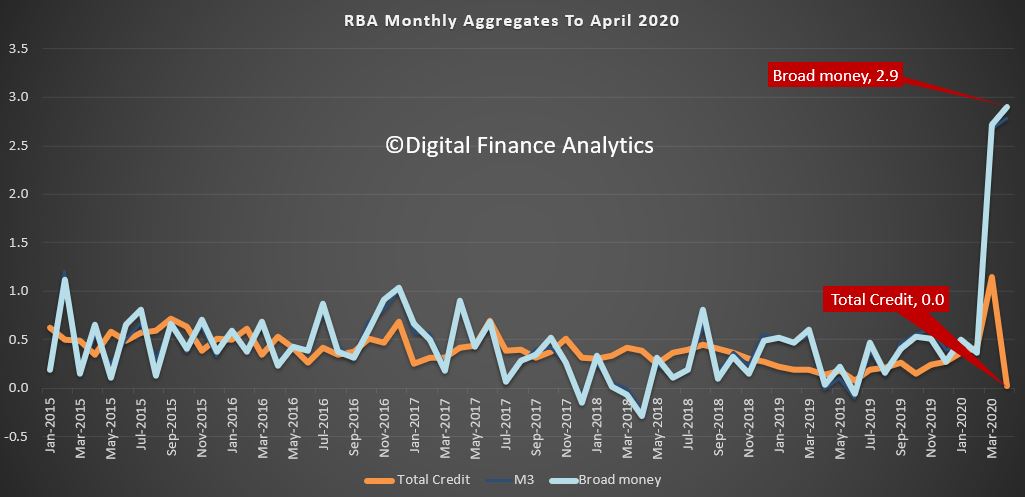

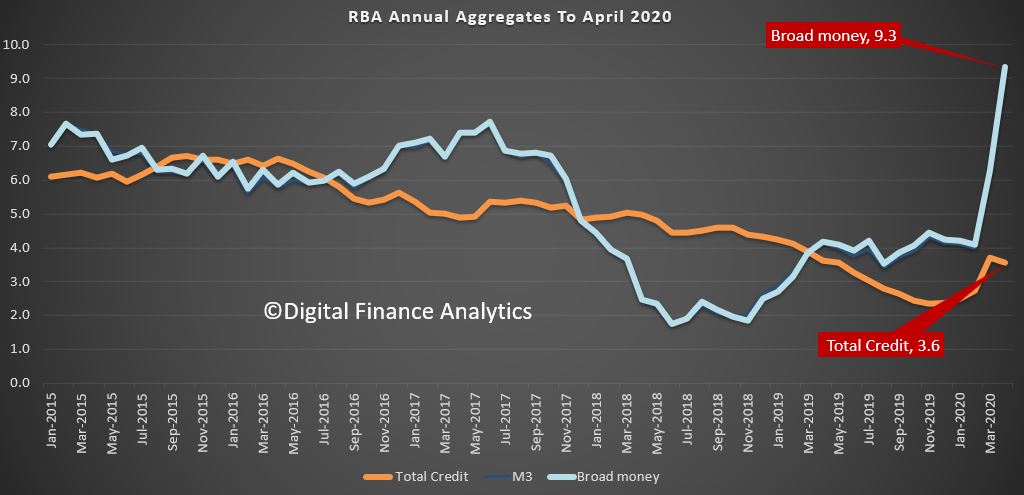

Although total credit was flat, the broad money measure rose 2.9% over the month thanks to the various government and RBA schemes to support the economy. Something to bear in mind when we talk about removing the stimulus!

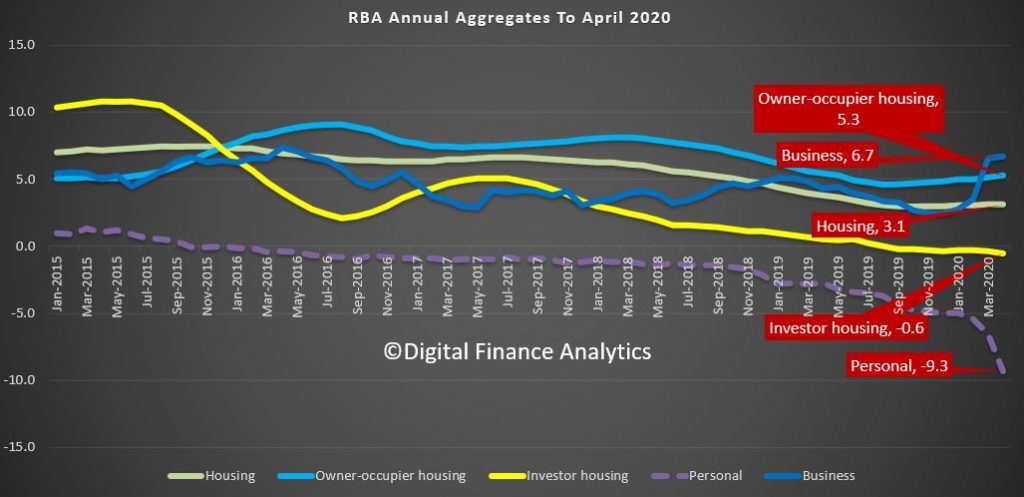

Annualised, owner occupied growth was at 5.3%, while investors were down 0.6% over the year and total housing lending was 3.1% and a little lower than last month. Personal credit is down 9.3% over the year and business credit is up 6.7% thanks to last month spike.

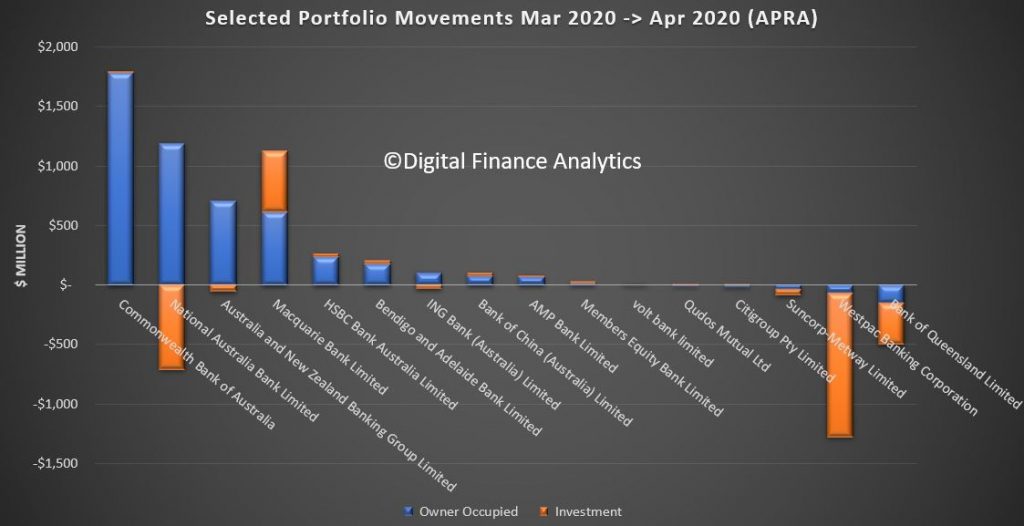

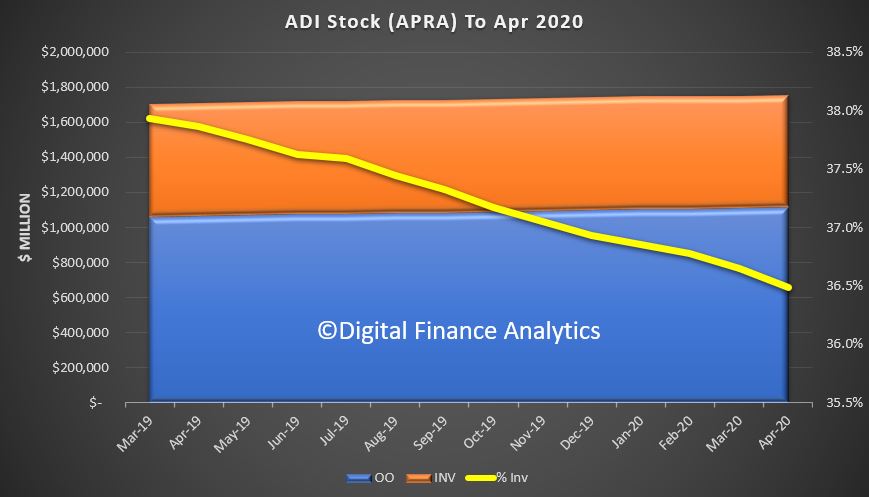

APRA showed that total bank lending for mortgages rose 0.19% over the month, with lending balances for owner occupiers up 0.45% to $1.11 trillion dollars while investor lending fell again, down 0.27% to 0.64 trillion dollars. Investor lending dropped again to 36.5% of balances.

Total mortgage credit is another new high 1.754 trillion dollars.

Looking at the individual movements, CBA wrote the largest net increase in owner occupied loans, followed by NAB, ANZ and Macquarie. Macquarie was streets ahead on investor lending, while NAB, Westpac and Bank Of Queensland saw the biggest falls. ME Bank was back in line this month after the securitisation deal last month. Once again bear in mind this is as reported to APRA, and reflects the net of new loans written, balances extended, and loans paid off. On these numbers many banks are shedding investment loans quite fast. Question is – is this by design or accident?