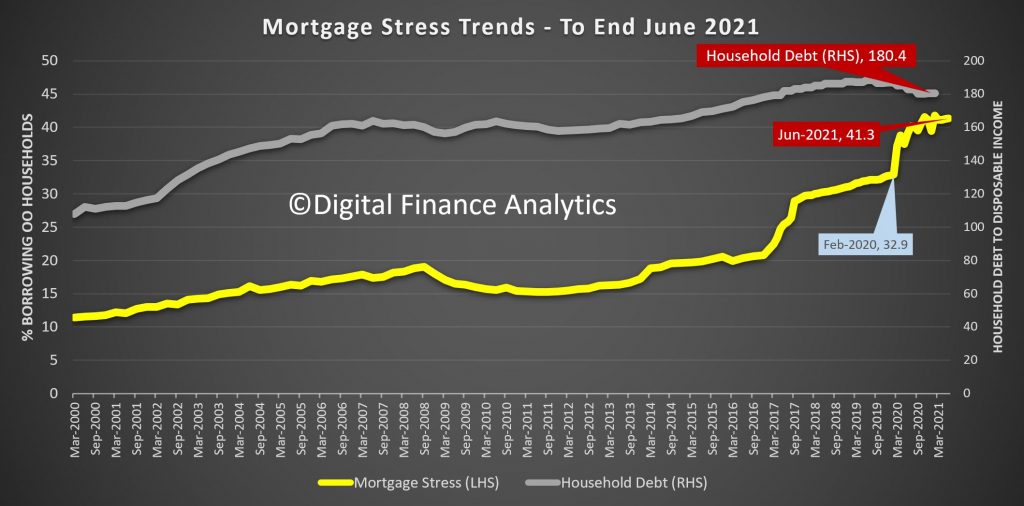

The latest data from our running household surveys reveal that overall levels of household financial stress – measured in available cash flow, continues to trouble many households. Mortgage stress stands at 41.33% of households or 1.53 million households.

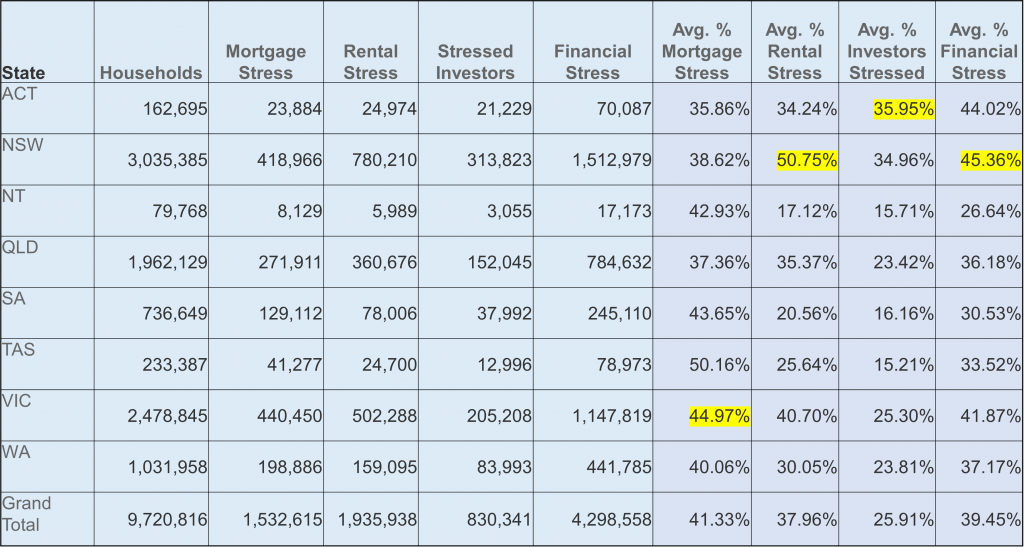

Overall financial stress (an aggregate of our stress metrics, weighted to all households) was highest at 45.4% in NSW, with 1.51 million households under pressure.

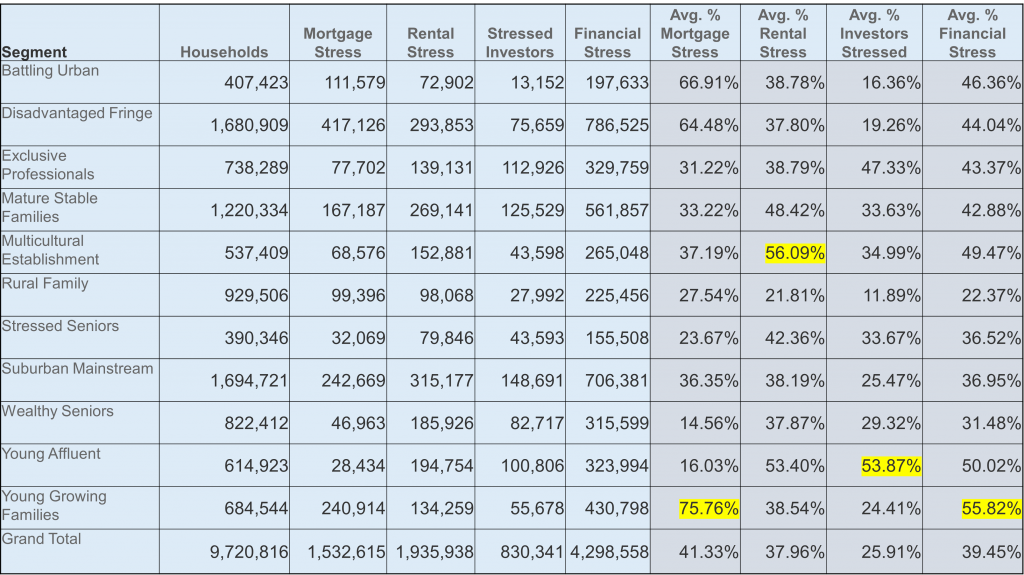

We continue to see many younger households who are highly leveraged into either buying their first home, or into property investment. Rental stress at 56.09% is highest among first generation Australians. Financial stress overall is highest among Young Growing Families.

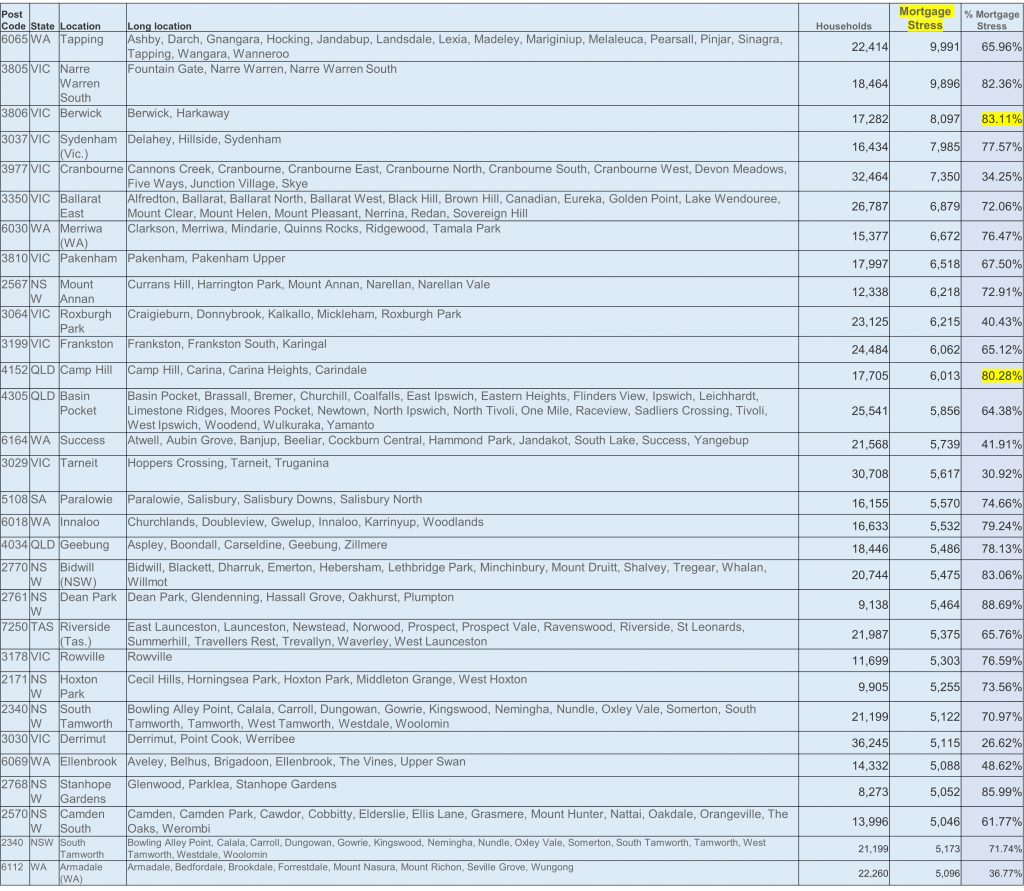

Top mortgage stressed post codes (by number of households stressed) are concentrated in the high growth corridors of Melbourne, as well as regional centres such as Ballarat.

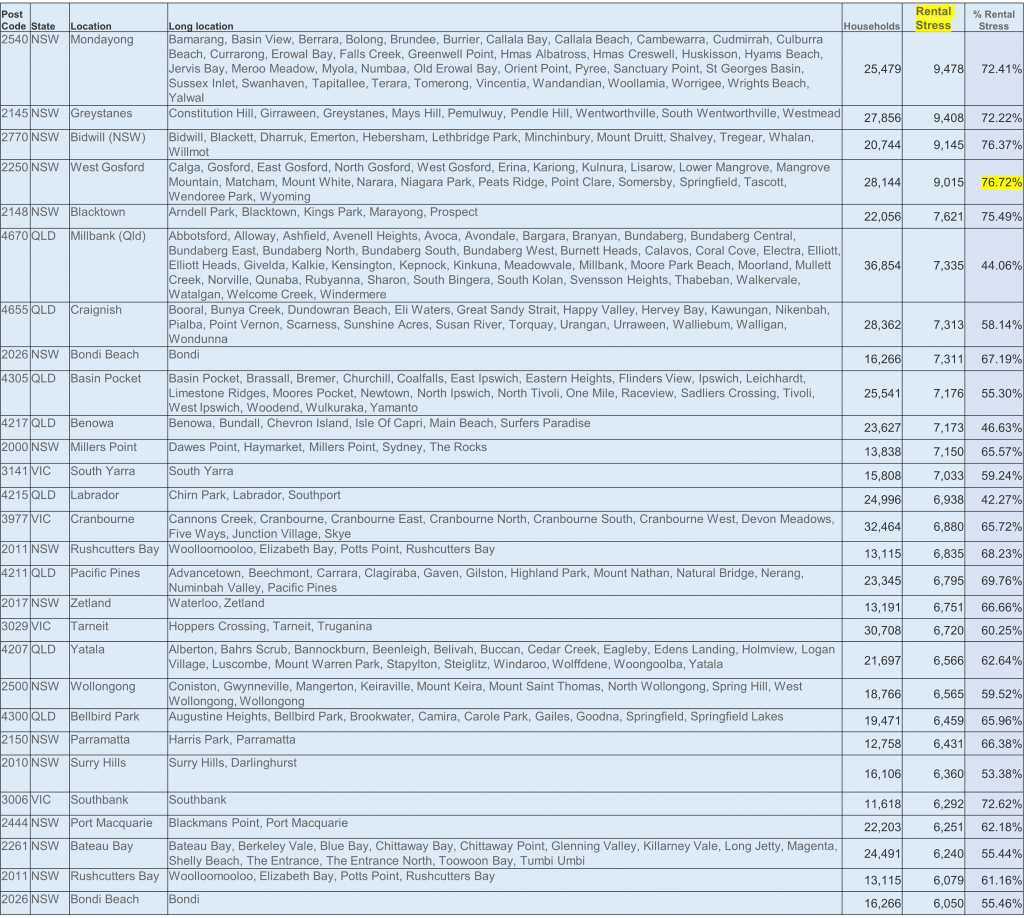

Rental stress is centred on areas of New South Wales, including in regional areas, including the South Coast and Central coast as well as high growth corridors, and some more central areas such as Bondi (2026) Central Sydney (2000) and Central Melbourne. Family formation is varied in different areas, from singles, through to larger family blocks.

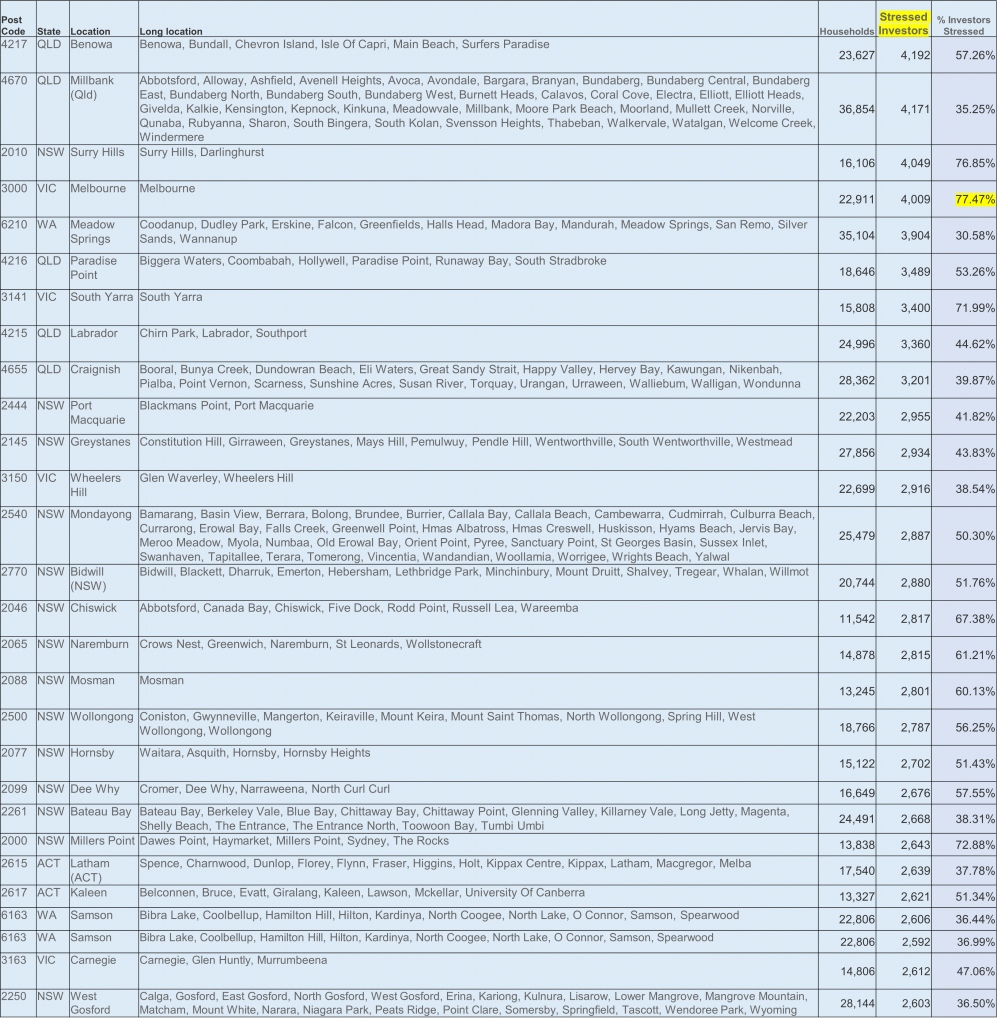

Investor stress (defined as property investors who are under water from a cash-flow perspective, or who cannot let their property, or who are trying to sell) ranges from areas in Queensland around Surfers Paradise (4217) and Bunderberg (4670). Surry Hills in Sydney and Central Melbourne are also pressure points – with many vacant units, either unlet, or deeply discounted.

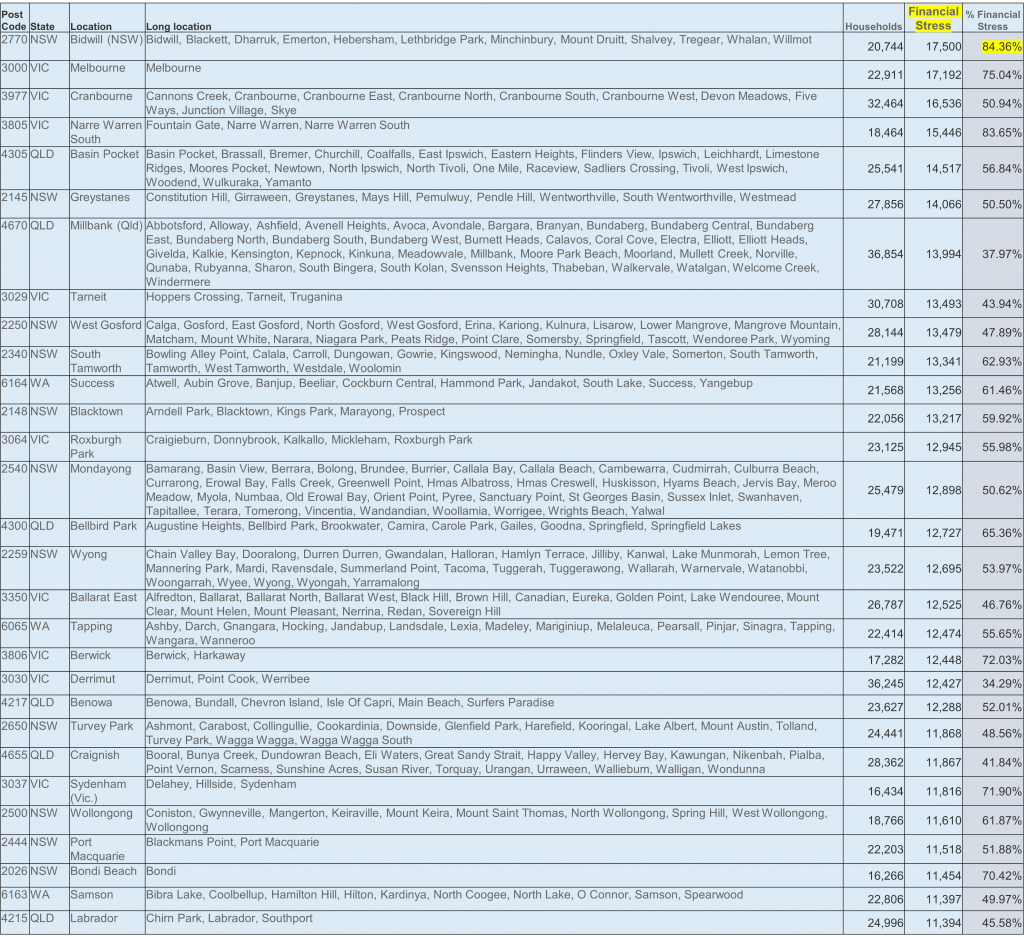

Overall financial stress registered most strongly in areas such as Mount Druitt (2770), central Melbourne (3000) and high growth suburbs including Cranbourne (3977) and Narre Warren (3805). But the stress patchwork is widespread across the country.

We discussed this data in our recent live show, including geo-mapping several areas to illustrate the findings.

The overall conclusion remains that the financial settings in Australia, with raging home prices, and high debt, against an uncertain economic outlook and made worse by recent lock-downs – is putting pressure on many households. This belies the “official narrative” the the recovery is booming.

We continue to see many households trying to get by using more credit (including Buy Now Pay Later) and draining savings for every day expenses. Many still do not maintain cash flow records, so are not clear about their real exposures.

Importantly, those with mortgage commitments who continue to struggle would do well to speak to their bank. Given continued flat income, the virus conditions in some suburbs, and other factors, we do not expect this to change ahead. Many are hoping for a magic bullet but in the current environment this is unlikely.