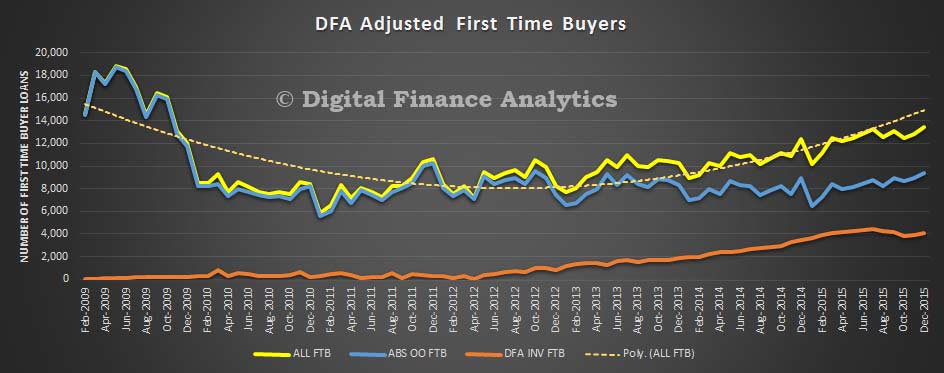

Continuing our series on the results from our latest household surveys, today we look at first time buyers. Data from our surveys, combined with recently released ABS data, highlights that first time buyers are more active now compared with last year. Whilst many first time buyers are seeking to buy a place to call home, an increasing number are looking to go direct to the investment sector to buy a cheaper place as a means of getting on the property ladder, assisted by tax breaks and negative gearing. This trend continues to build.

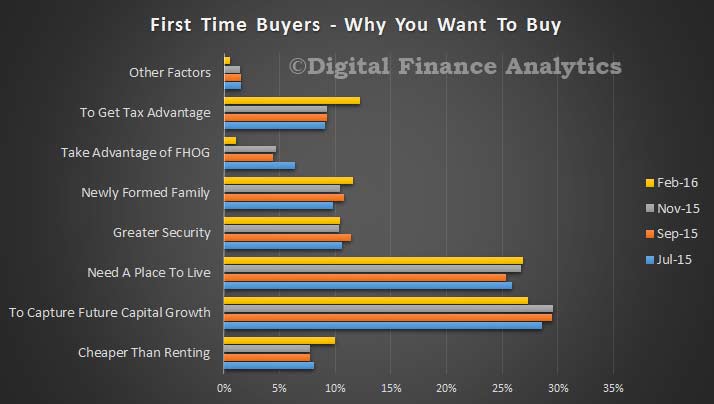

So, looking at first time buyer motivations, we find that prospective capital growth is the strongest driver (27%), compared with needing a place to live (26%). Significantly, tax advantage figures as a decision driver (12%), up from 9% last year. This is worth noting in the context of the current quasi-discussion about negative gearing! The fact that buying is cheaper than renting (10%), up from 8% last year influences the decision, as does forming a family (12%). The potential to access first home owner grants (FHOG) has reduced in importance as their availability has diminished (and that is a good think, because FHOG’s simply are another market distortion).

So, looking at first time buyer motivations, we find that prospective capital growth is the strongest driver (27%), compared with needing a place to live (26%). Significantly, tax advantage figures as a decision driver (12%), up from 9% last year. This is worth noting in the context of the current quasi-discussion about negative gearing! The fact that buying is cheaper than renting (10%), up from 8% last year influences the decision, as does forming a family (12%). The potential to access first home owner grants (FHOG) has reduced in importance as their availability has diminished (and that is a good think, because FHOG’s simply are another market distortion).

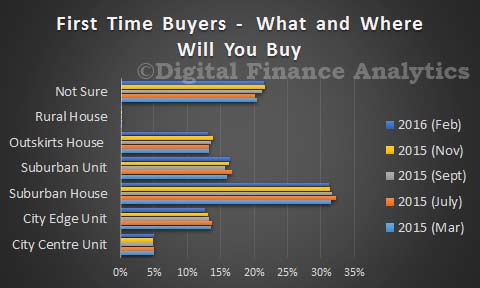

Many first time buyers are not all that sure where to buy, with a high 21% saying there is no simple choice. A significant proportion (33%) will look for a unit whilst nearly 60% still want to buy a house.

Many first time buyers are not all that sure where to buy, with a high 21% saying there is no simple choice. A significant proportion (33%) will look for a unit whilst nearly 60% still want to buy a house.

Most prospective first time buyers going direct to the investment sector are seeking to buy a unit, as the purchase price will be significantly lower. Purchasing preference is spread from CBD (12%), city fringe (35%) and suburban outskirts/regional centres (23%). Underlying this is a strong motivation to get onto the housing escalator anyway they can. We also noted that around 35% of prospective first time buyers were expecting to get help from the wider family to assist in the purchase, so the “bank of mum and dad” remains an important factor in the first time buyer equation. Yesterday we highlighted that more than half of prospective first time buyers believe house prices will continue to rise – so they wish to transact to avoid seeing prices move further against them and to enjoy capital appreciation at a time when interest rates are really low. Property purchase is hard wired into the Australian psyche.

Most prospective first time buyers going direct to the investment sector are seeking to buy a unit, as the purchase price will be significantly lower. Purchasing preference is spread from CBD (12%), city fringe (35%) and suburban outskirts/regional centres (23%). Underlying this is a strong motivation to get onto the housing escalator anyway they can. We also noted that around 35% of prospective first time buyers were expecting to get help from the wider family to assist in the purchase, so the “bank of mum and dad” remains an important factor in the first time buyer equation. Yesterday we highlighted that more than half of prospective first time buyers believe house prices will continue to rise – so they wish to transact to avoid seeing prices move further against them and to enjoy capital appreciation at a time when interest rates are really low. Property purchase is hard wired into the Australian psyche.

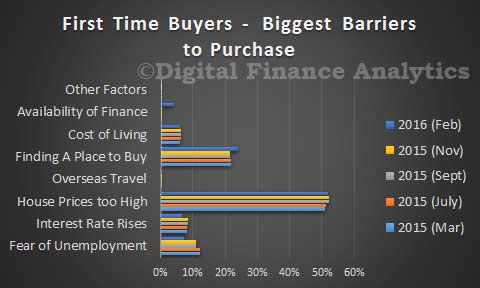

Finally, there are a number of barriers first time buyers are encountering. More than half think property prices are too high (this has been pretty constant in recent surveys), 22% said they were having difficulty finding a place to buy (lack of supply, and competition with investors – both local and overseas) and around 5% said that they are finding it difficult to get finance. This reflects tightening lending criteria and flat incomes in real terms and is a marked change from last year. More than 60% of first time buyers will be consulting a mortgage broker to assist with finding a loan.

Finally, there are a number of barriers first time buyers are encountering. More than half think property prices are too high (this has been pretty constant in recent surveys), 22% said they were having difficulty finding a place to buy (lack of supply, and competition with investors – both local and overseas) and around 5% said that they are finding it difficult to get finance. This reflects tightening lending criteria and flat incomes in real terms and is a marked change from last year. More than 60% of first time buyers will be consulting a mortgage broker to assist with finding a loan.