I discuss the latest with CEC’s Robbie Barwick.

With 2 weeks left to make a Senate submission, we explore some of issues people may want to touch on, to assist.

Final date is 15th November 2019.

https://www.aph.gov.au/Parliamentary_Business/Committees/Senate/Economics/CurrencyCashBill2019

There is still time to make a submission, and stop this from becoming law. Our civil liberties depend on it.

Here’s how you make a submission: email economics.sen@aph.gov.au

Address to: Senate Standing Committees on Economics, PO Box 6100, Parliament House, Canberra ACT 2600

Some points to consider:

Civil liberties – cash is legal tender and you have the right to privacy and to not use a bank; you don’t want government and banks to “monitor and measure” everything you do.

Practical benefits of cash – power supplies and communications technology not always reliable; instant settlement of payments so can be better for commerce, good for discounts etc; whatever else.

Excuses for the law are false. Eliminating the black economy is a lie and won’t work: Australia’s black economy is small and shrinking, and cash restrictions have not reduced black economies in Europe, in fact the opposite.

Restricting cash won’t stop tax evasion, because the majority of evasion is done by large corporations and bank, assisted by the Big Four accounting firms – who want this ban. As Andrew Wilkie said, the government has enough laws to crack down on money laundering and the black economy – use them.

Real reason is to trap Australians in banks. This is explicit from the IMF: Cashing In: How to Make Negative Interest Rates Work. Won’t be able to escape negative interest rates, or bail-in.

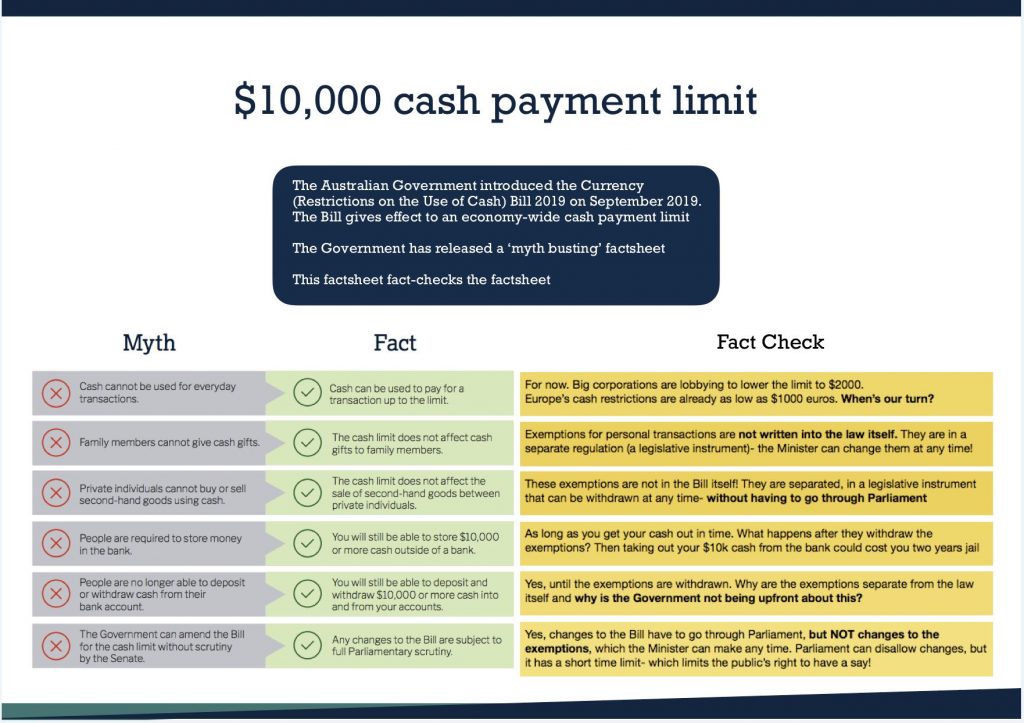

Finally, government’s reassurances are fake, not guarantees. Treasury issued a fact sheet, which Melissa Harrison quickly refuted: exemptions aren’t contained in the legislation, just in the regulation that is easily changed.