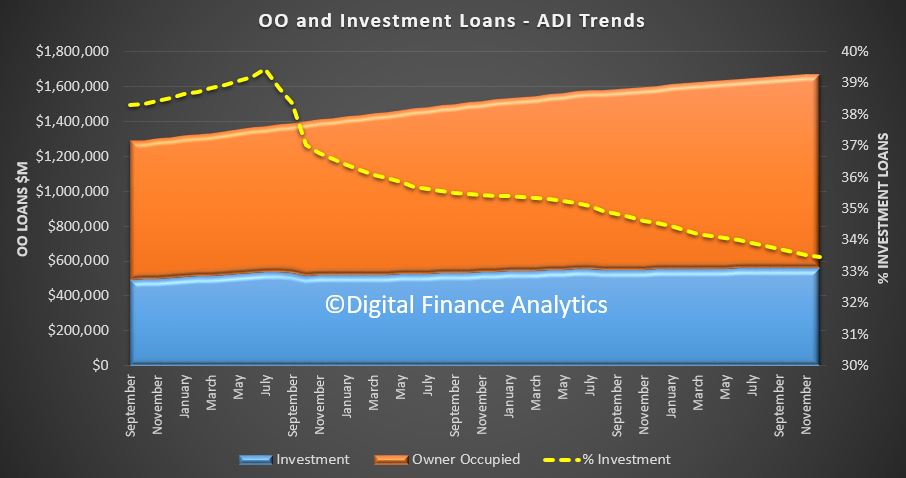

APRA released their monthly banking statistics to end December 2018 today. Total loan stock for housing was $1.67 trillion dollars, up 0.23% from last month (equivalent to 2.8% if annualized). Another record.

Within that loans for owner occupied housing rose to $1.11 trillion dollars, up 0.33% from November, or $3.7 billion dollars, while investment loans rose $173 million. Overall investment loans fell to 33.45% of portfolio.

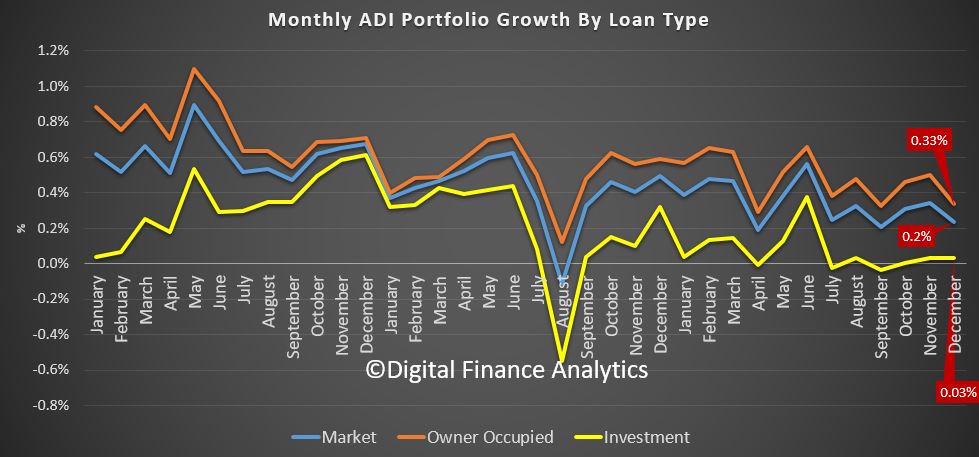

The movements show a steady decline in owner occupied loans, and a slight rebound in investor loans, from a very low base.

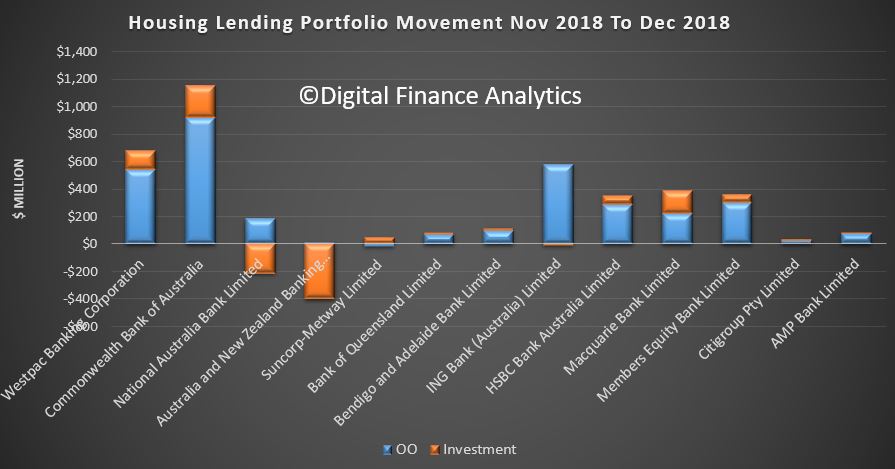

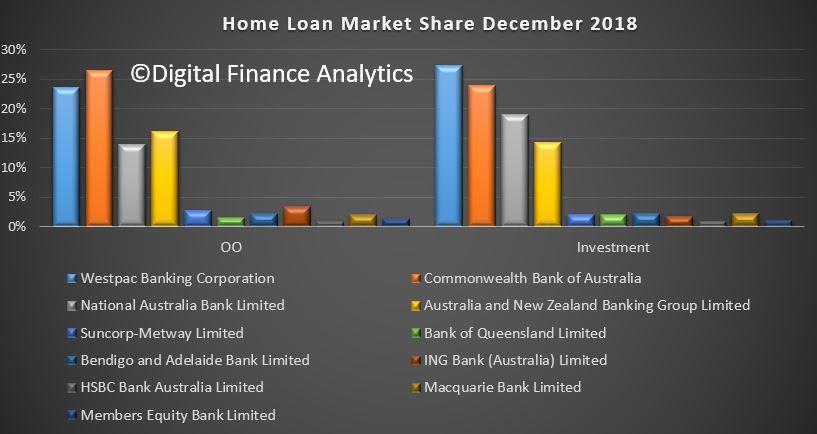

Looking at the banks’ portfolio movements, we see significant variations in strategy, with Westpac and CBA still lending, especially on owner occupied loans, alongside ING, HSBC and Members Equity. But NAB and ANZ have slowed their growth, and in fact dropped their share of investment loans a little in December.

That said the portfolio moves are at the margin, with CBA and Westpac maintaining their leading positions in owner occupied and investment loans respectability.

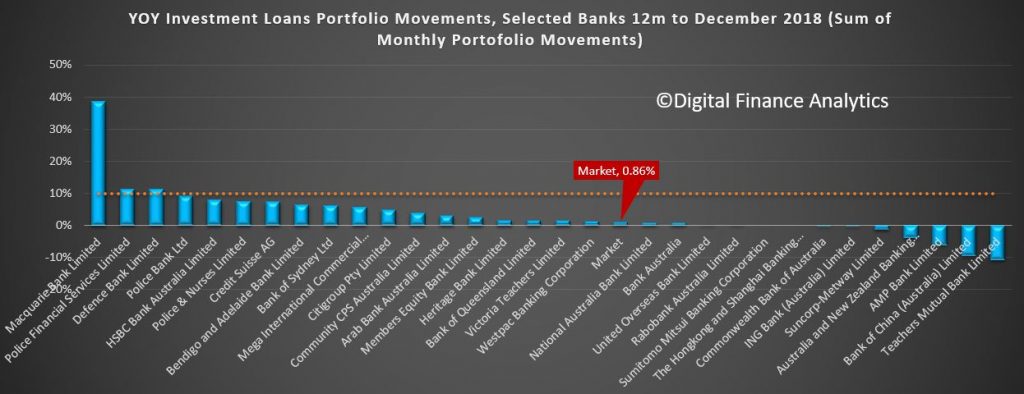

For completeness, we show the growth in investor loans by lender, despite the APRA speed limit is now removed. Macquarie holds the prize for portfolio growth. Investor loan growth has slowed to a crawl.

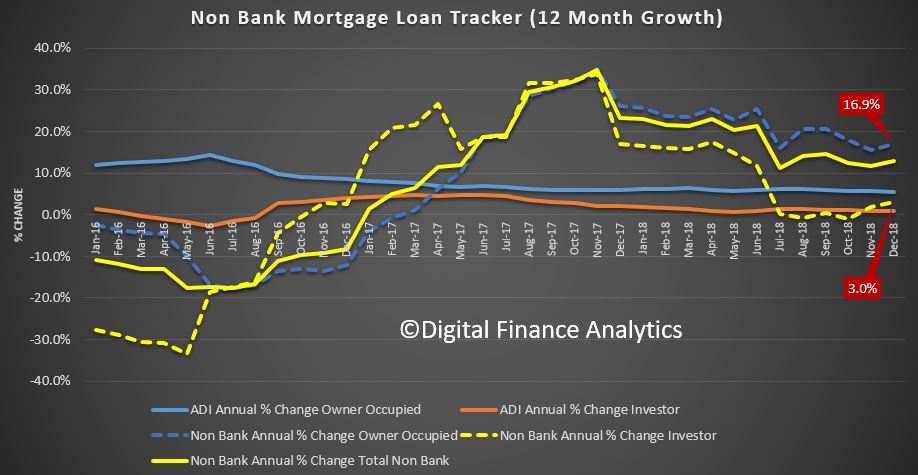

Finally, we can estimate the relative growth of the banks and non-banks by combining the RBA and APRA data. It is approximate, but clear the non-banks are growing their portfolios faster than the ADI’s because although they have the same responsible lending rules, they are not constrained by APRA’s capital rules.

It is clear the non-banks, growing on an annualized 16.9% basis for owner occupied loans and 3.06% for investment loans are taking up the slack. But this should be a warning to regulators, as risks here are rising, as households who fail the stricter bank underwriting standards turn to the non-banks; even if they have to pay a higher rate of interest!

APRA needs to wake up, on this one. In fact the story is one of loan flow being deflected away from the big four, to some smaller banks, and non-banks. It will be interesting to see if the Royal Commission report changes the game when it is released.