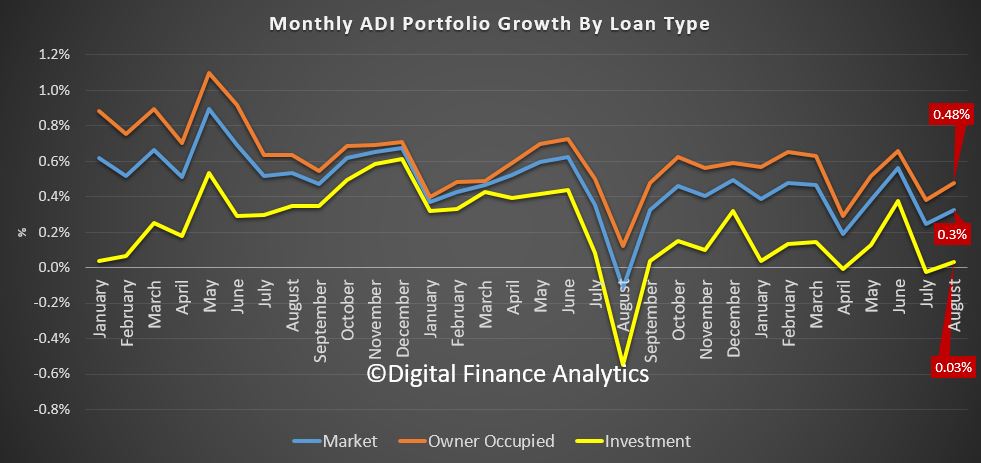

APRA has released their latest banking stats to end August 2018. Total lending for residential homes rose by 0.33% in the month to a total of $1.65 trillion. Another record. That would be an annual rate of 3.9% if repeated each month, a little lower, but still nearly twice wages growth, so household debt is STILL climbing.

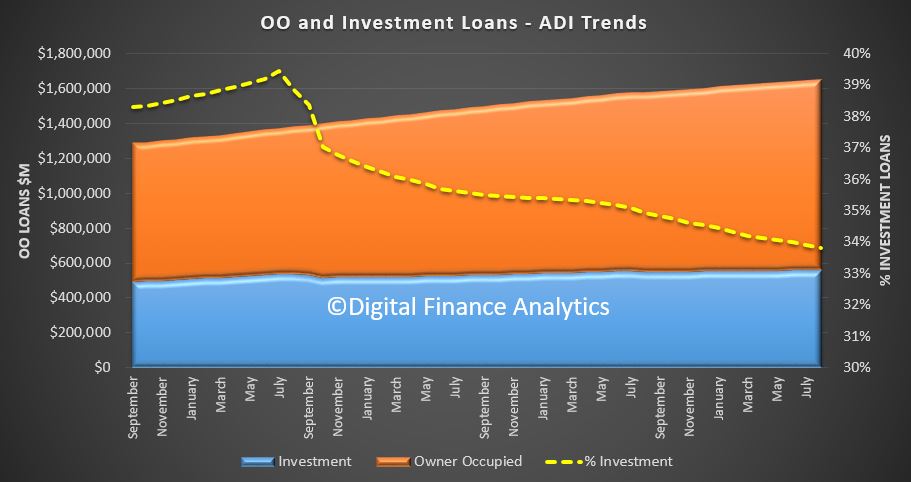

Within that lending for owner occupation rose 0.48% to $1.09 trillion and lending for investment purposes rose 0.03% to $557.6 billion (last month it dropped by 0.02%). 33.8% of loans are for investment purposes.

Within that lending for owner occupation rose 0.48% to $1.09 trillion and lending for investment purposes rose 0.03% to $557.6 billion (last month it dropped by 0.02%). 33.8% of loans are for investment purposes.

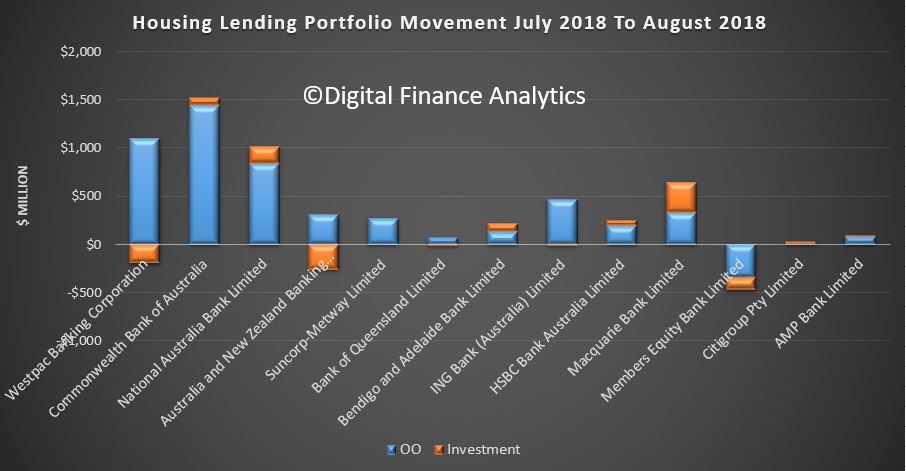

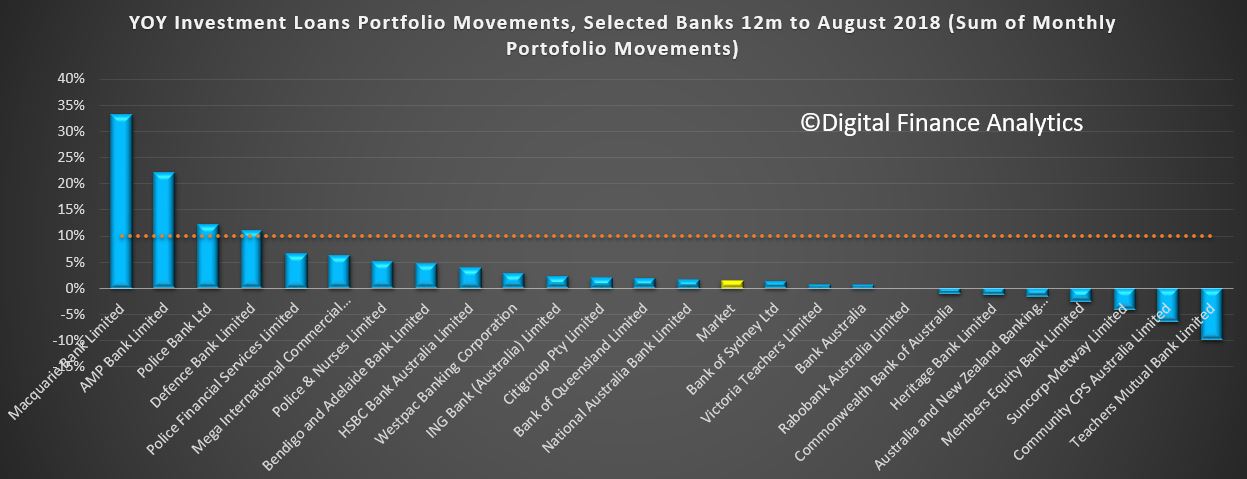

Looking at the portfolio movements, NAB, CBA, Bendigo, HSBC and Macquarie reported a lift in investor loan balances. Westpac and ANZ reported a fall. ME Bank appears to be losing relative share on both fronts.

Looking at the portfolio movements, NAB, CBA, Bendigo, HSBC and Macquarie reported a lift in investor loan balances. Westpac and ANZ reported a fall. ME Bank appears to be losing relative share on both fronts.

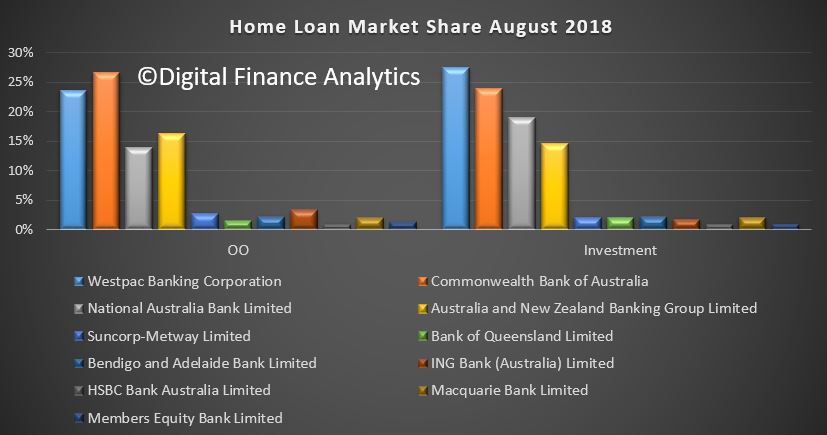

The market share of the major players hardly moved, with CBA the largest owner occupied lender and Westpac still holding the largest portfolio of investment loans.

The market share of the major players hardly moved, with CBA the largest owner occupied lender and Westpac still holding the largest portfolio of investment loans.

Whilst officially the 10% speed limit on investor loans has been sidelined, it is worth observing that over the past year, Macquarie, AMP and some of the smaller players are running way ahead of the market rate of growth.

Whilst officially the 10% speed limit on investor loans has been sidelined, it is worth observing that over the past year, Macquarie, AMP and some of the smaller players are running way ahead of the market rate of growth.

The RBA will post their aggregates later this morning, and we will then have a market view – and we can impute the non-bank lender share which we expect to be higher again.

The RBA will post their aggregates later this morning, and we will then have a market view – and we can impute the non-bank lender share which we expect to be higher again.

But for now it is worth highlighting that despite all the grizzles from the property spruikers, mortgage lending is STILL growing…. and faster than inflation. We have not tamed the debt beast so far, despite failing home prices. No justification to ease lending standards – none.

The Federal budget status moving towards a technical surplus earlier (remember this is new debt, not the total outstanding debt…) may take the risk premium on Australia down a tad, but I still expect higher mortgage rates ahead – not least as the banks struggle to fund the fallout from the various legal claims and penalties which are being, and will be imposed; to say nothing of higher international funding costs.

So debt is STILL rising rather than dropping!

More mortgages are being signed up for and committed on without any increase in wages.

The fall in housing values is perhaps going to be a contributor to further debt growth rather than a deterrent. As values fall, they become more accessible to those who have been previously locked out due to being unaffordable. Now they are looking more easily in reach and with the deposits previously saved, now is the time to lash out and put down the money on a more affordable home.

Perhaps the answer should have been to make the properties even more expensive in order to have people save more towards paying for a home. It’s a difficult position for many. Those want to maximize the value of the property they are selling, those who want to buy in at the low end and those who are looking to make a quick buck selling at the expense of either end.

One thing is for sure, too many are too indebted and not managing what they have. They need to take more personal responsibility in taking control of their money and maximizing debt elimination today or face a life with less tomorrow.