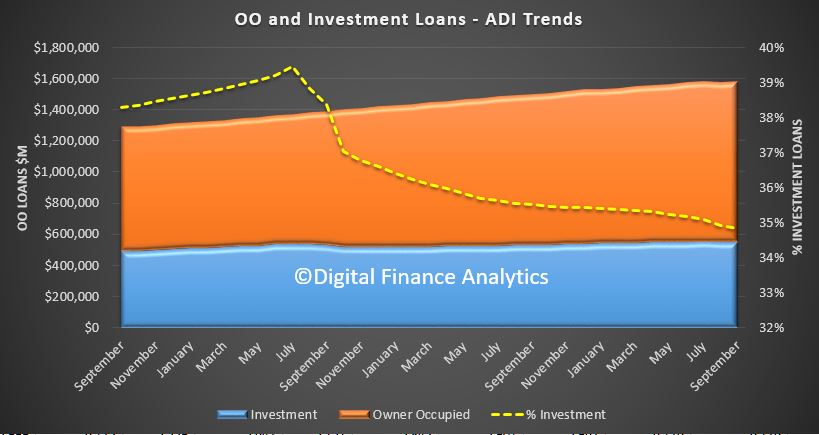

The APRA ADI data released today to September 2017 shows that owner occupied loan portfolio grew 0.48% to $1.03 trillion, after last months fall thanks to the CBA loan re classifications. Investment lending grew just a little to $550 billion, and comprise 34.8% of all loans. Overall the loan books grew by 0.3% in the month.

This confirms our view that last months results were more to do with CBA’s changing their loan classification, rather than macroprudential biting. The relative mix of investment loans did fall a little, so you could argue the tightening of interest only loans did help.

This confirms our view that last months results were more to do with CBA’s changing their loan classification, rather than macroprudential biting. The relative mix of investment loans did fall a little, so you could argue the tightening of interest only loans did help.

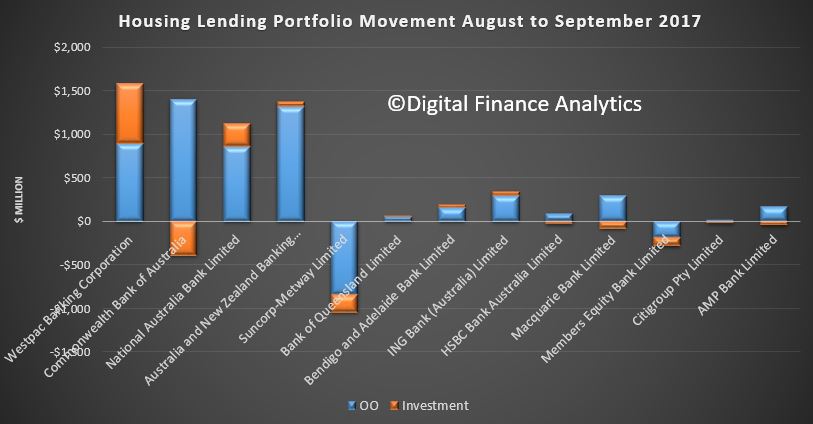

Overall market shares were pretty static with CBA still the largest owner occupied loan lender and Westpac the largest investment property lender.

Overall market shares were pretty static with CBA still the largest owner occupied loan lender and Westpac the largest investment property lender.

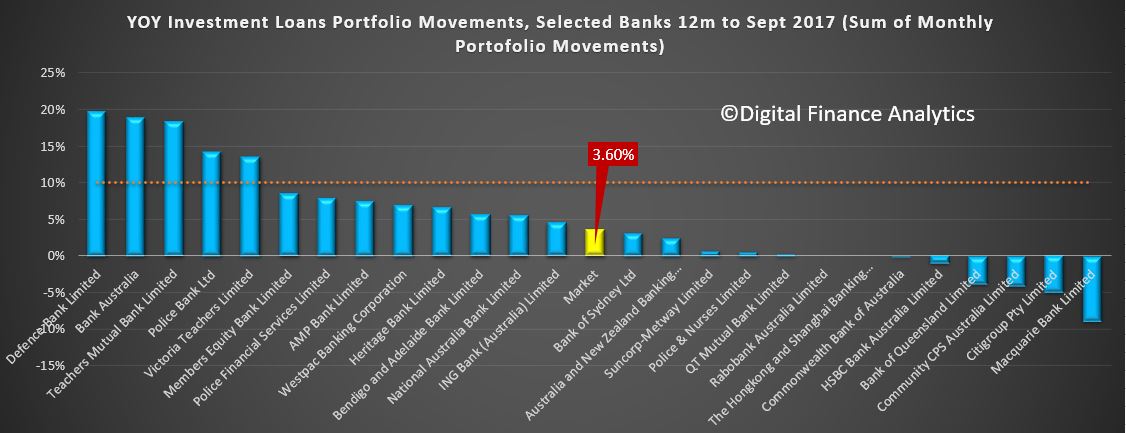

The 12 month loan growth for investor loans is well below the 10% speed limit imposed by APRA, and all the majors are below the threshold.

The 12 month loan growth for investor loans is well below the 10% speed limit imposed by APRA, and all the majors are below the threshold.

We see some significant variations in portfolio flows, with CBA, Suncorp, Macquarie and Members Equity bank all reducing their investment loan balances, either from reclassification or refinanced away. The majors focussed on owner occupied lending – which explains all the attractor rates for new business. Westpac continues to drive investor loans hard.

We see some significant variations in portfolio flows, with CBA, Suncorp, Macquarie and Members Equity bank all reducing their investment loan balances, either from reclassification or refinanced away. The majors focussed on owner occupied lending – which explains all the attractor rates for new business. Westpac continues to drive investor loans hard.

Comparing the RBA and APRA figures, it does appear the non-banks are lifting their share of business, as the banks are forced to lift their lending standards. But they are still fighting hard to gain market share, which is not surprising seeing it is the only game in town!