Economist John Adams and I discuss the latest of the question on deposit account “Bail-In” and try to answer John’s question “Is Parliament “Too Stupid to be Stupid”?

Either way, the question of deposit bail-in remains unclear in our view.

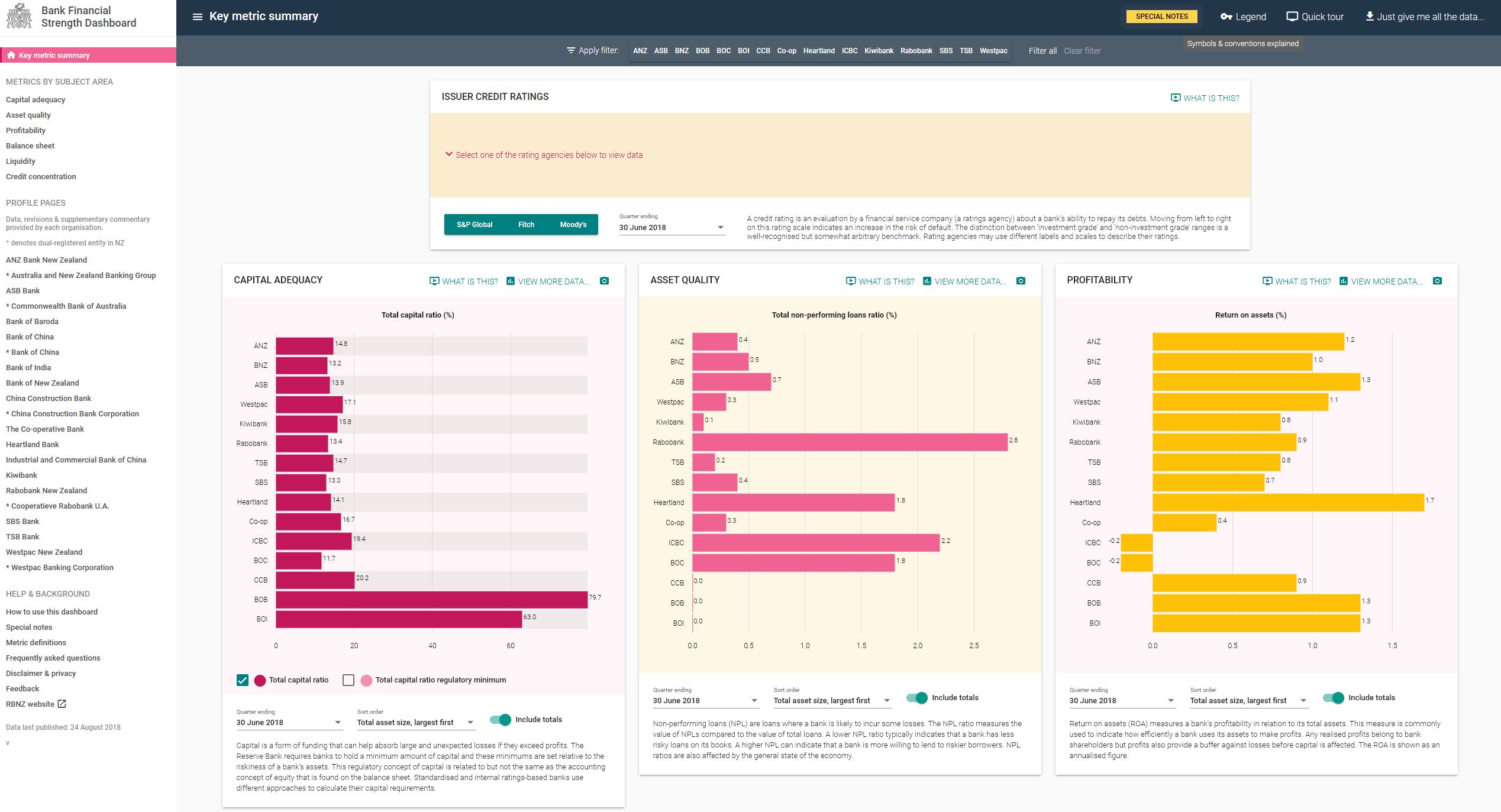

We also discuss the Reserve Bank of New Zealand Dashboard which is designed to assist Kiwi’s as they try to pick which bank to place their deposits with. In New Zealand it is QUITE CLEAR, bank deposits are available for “Bail-In”!

I agee that NZ deposits are very clearly subject to bail-in risk and that this is a poor policy choice. Australian deposits have the benefit of the government guarantee (for relatively small deposits) but more importantly they have a preferred claim on Australian assets of the bank. So shareholders equity, subordinated debt and senior unsecured debt stand before deposits in the loss hierarchy. Why do you think that these considerations don’t insulate deposits from the bail-in risk you envisage?

Thanks, simply,the relative size of the various liability pools – given the support required in a severe downturn, Deposits would be a tempting source of funding and in NZ, there is no clear indication they would go after other liability classes first… Unless you know different.

In NZ, my understanding is that deposits rank parri passu with senior unsecured funding. The RBNZ rationale seems to be that they believe that this creates market discipline but I believe this is a dry bad idea given that deposits are the majority of the money supply. The consequences for the economy of imposing loss on deposits do not bear thinking about.

In Australia, there is a substantial pool of loss absorption standing in front of deposits so I don’t get why it would be attractive to “go after” this super senior pool when there is so much that is both contractually junior and in fact to varying degrees intended to take this risk.

The bail-in rules envisage that the pool of potentially loss absorbing liabilities will be increased (the technical term is Total Loss Absorbing Capital) and the quantum that would be in place is likely to substantially exceed the kinds of losses that even very poorly managed banking systems have managed to lose in the past.

The poor level of “expert advice” received by our politicians is from what I have seen and experienced widespread and I’d encourage you to watch “Rules for Rulers” on Youtube to understand why. Most people think politics has no relevance to them and no impact on the economy to that I say its politics that spends the most in most countries economies.

The short version is politicians vote for what is in their political interest above national interest.

So irrespective of what legislation is or is not in place my expectation is the government would do a Crete in a heartbeat if it suits their political interest.