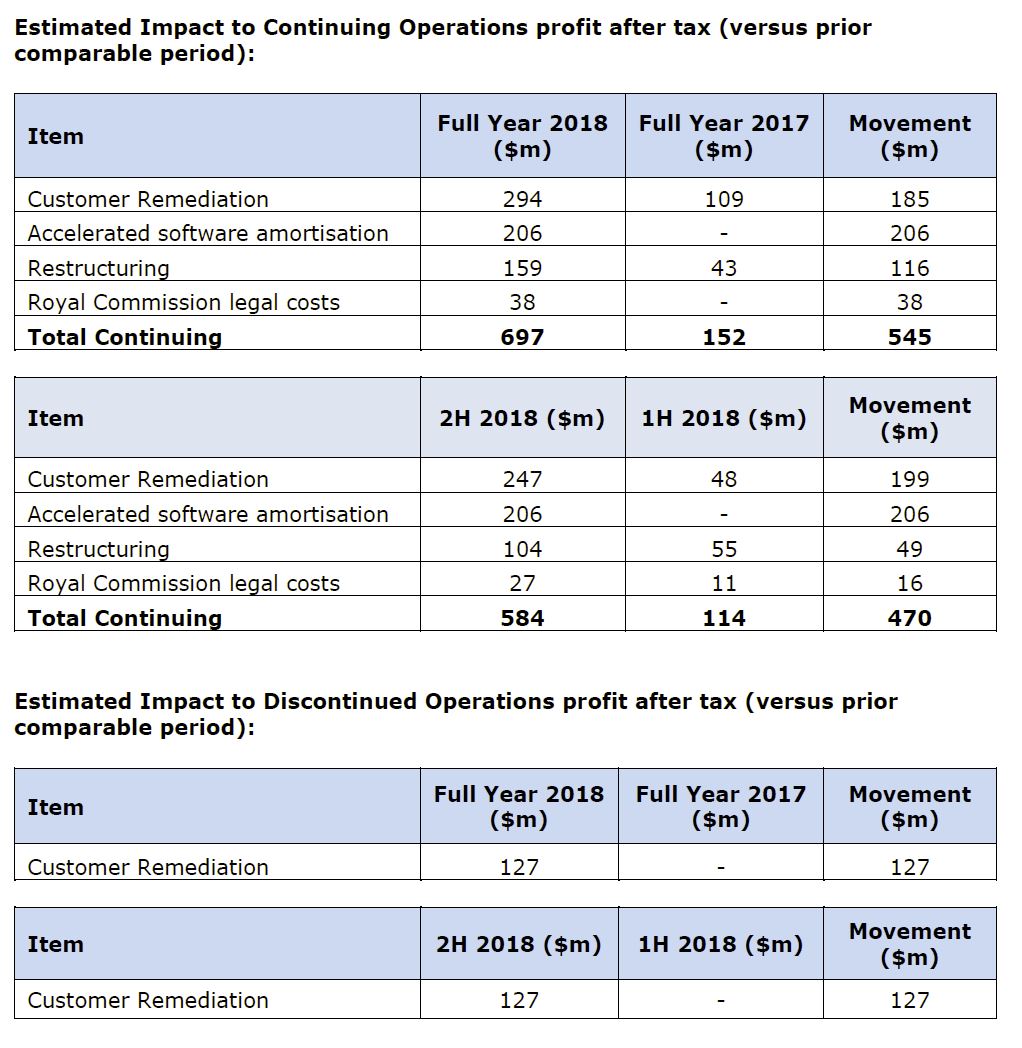

ANZ has warned today that their Full Year Cash Profit will be impacted by additional charges for customer compensation, accelerated amortisation of software and other notable items.

Charges of $374 million have be recognised in 2H18 for refunds to customers and related remediation costs. These relate to issues that have been identified from reviews to date. These reviews remain ongoing.

Charges of $374 million have be recognised in 2H18 for refunds to customers and related remediation costs. These relate to issues that have been identified from reviews to date. These reviews remain ongoing.

Approximately 57% relates to customer refunds impacting revenue, with the balance relating to remediation costs recorded as n expense. The total remediation charge is split approximately 66%/35% between Continuing and Discontinued operations.

Key items of customer remediation include:

- Compensating customers for issues arising from product review in the Australian division.

- Compensation for customers receiving inappropriate advice or for services not provided within ANZ’s former aligned dealers group. (These were sold to IOOF on 1 October 2018).

ANZ has accelerated the amortisation of certain software assets, predominantly relating to its International business. This follows a recent review of the International business along with a number of divestments announced or completed this year. Accelerated amoritisation expenses of $206 million will be recorded in 2H18.

Along with announced divestments and the matters above, they also declared:

- Restructuring charge of $104 million in 2H18, largely relating to the previously announced move of the Australian and Technology Divisions to agile ways of working.

- External legal costs associated with responding to the Royal Commission which will total $55 million (pre-tax) for FY18.

The impact of these additional charges on ANZ’s Common Equity Tier 1 capital position compared to 1H18 is expected to be less that 10 basis points.

ANZ’s FY18 Results Announcement will be released on 31 October 2018.