ANZ released a trading update for the nine months to 30 June 2016. The results are unaudited. Essentially, in a slower-growth environment, overall revenue is flat, costs are controlled, and bad debts are managable, though consumer delinquencies are rising slightly. No real surprises.

The statutory net profit is $4.3 billion whilst the Cash Profit (“Adjusted Proforma”) was $5.2 billion, down 3%.

The profit before provisions was up 5%, with income increasing at a faster

rate than expenses. Increased technology, D&A and project costs were offset by productivity savings including lower employee (FTE) numbers. FTE reduction continued at a steady rate through the period.

The group Net Interest Margin (NIM) was stable at 2.01% assisted by portfolio rebalancing in Institutional offset by increased funding costs and asset pricing competition.

The total provision charge was $1.4 billion comprised of individual provisions of $1.34 billion and collective provisions of $60 million. The third quarter individual provision charge was in line with the average of the First Half. The 3rd Quarter loan loss charge was circa A$480m and a little higher than expected.

APRA Level 2 Common Equity Tier 1 (CET1) ratio was a strong 9.7% at 30 June. However, it would fall under the higher IRB mortgage risk weighting.

APRA Level 2 Common Equity Tier 1 (CET1) ratio was a strong 9.7% at 30 June. However, it would fall under the higher IRB mortgage risk weighting.

Excluding the payment of the 2016 interim dividend (net of the dividend reinvestment plan), CET1 increased 44 bps in the third quarter, primarily driven by cash earnings generation and capital benefits from the continued reduction of lower return assets in Institutional.

Here is an interview with the CEO Shayne Elliott.

The Retail businesses in both Australia and New Zealand performed well. Retail experienced modest asset growth and margin pressure in a competitive market for mortgages and deposits. Small Business Banking remains an area of good growth in both markets, while conditions in Corporate and Business Banking remained highly competitive.

The re-balancing of the Institutional business continued with further

reductions in lower yielding assets supported by business restructuring.

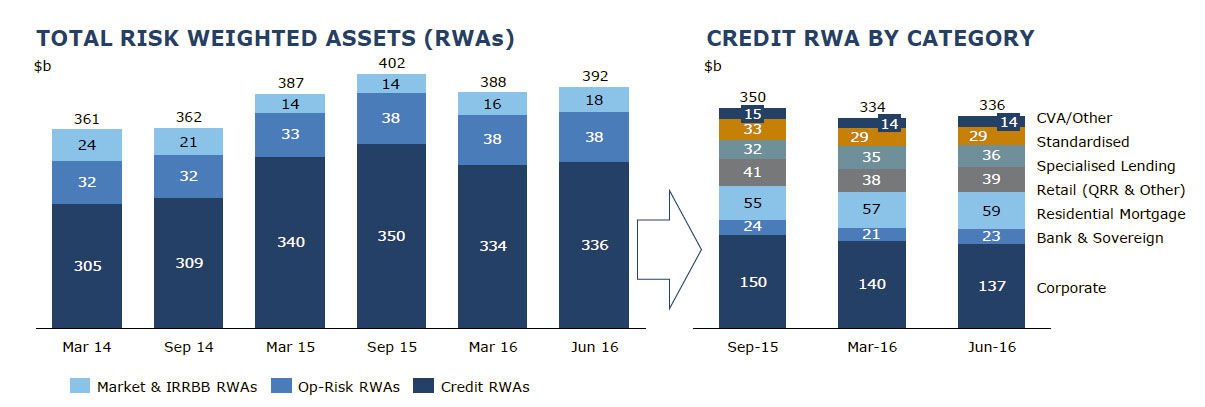

The ongoing focus on reducing and improving the quality of Risk Weighted Assets (RWA) has delivered a $15 billion decrease in Credit Risk Weighted Assets (CRWA) on a constant currency basis. Momentum has been consistent throughout the year to date with approximately a third of that total reduction in CRWA occurring in the third quarter.

Divisional revenue decreased by a lower percentage than the reduction in RWAs. At period end cost growth was in the low single digits benefitting from prior period productivity initiatives. The re-balancing of the business had a positive impact on the Division’s margins of approximately 5 bps (excl Global Markets). Including Global Markets margins declined 5 bps. Global Markets income was $1.5 billion, 90% of which came from Customer Sales flows.