APRA released the latest quarterly property exposures data today to December 2018. The new loans flow data shows that owner occupied lending is still running at a pretty good clip, while new investor loans are sliding – and the share of all loans interest only, have dropped considerably.

The mapping between investment loans and interest only loans is probably more than coincidence, as we know the bulk of IO loans are for investors, but APRA does not [conveniently?] split them apart.

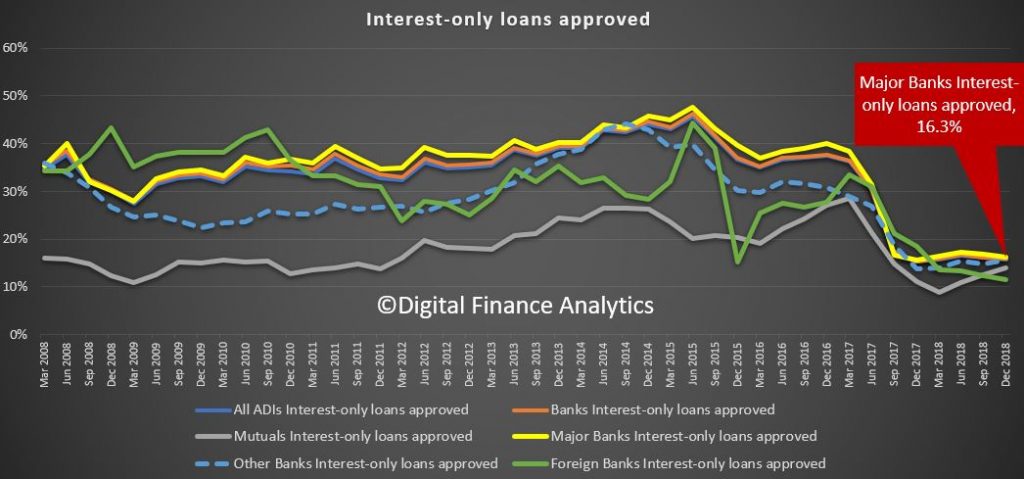

We can look at IO loan approvals by lender type. Major banks had 16.3% of their loans interest only, well down from their peak of 40%.

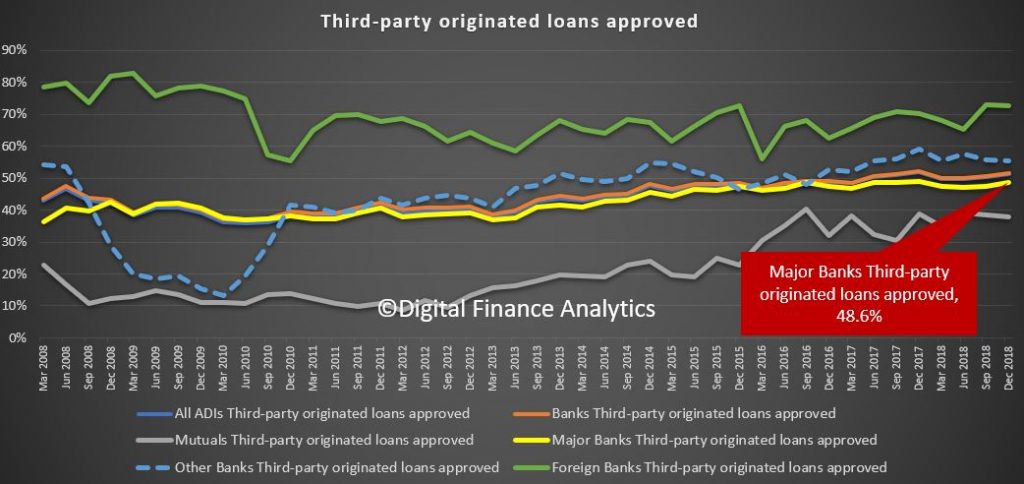

Mortgage brokers are still originating a significant share of new loans (even if volumes are lower). Foreign banks have the largest share via brokers, the majors are at 48.6%.

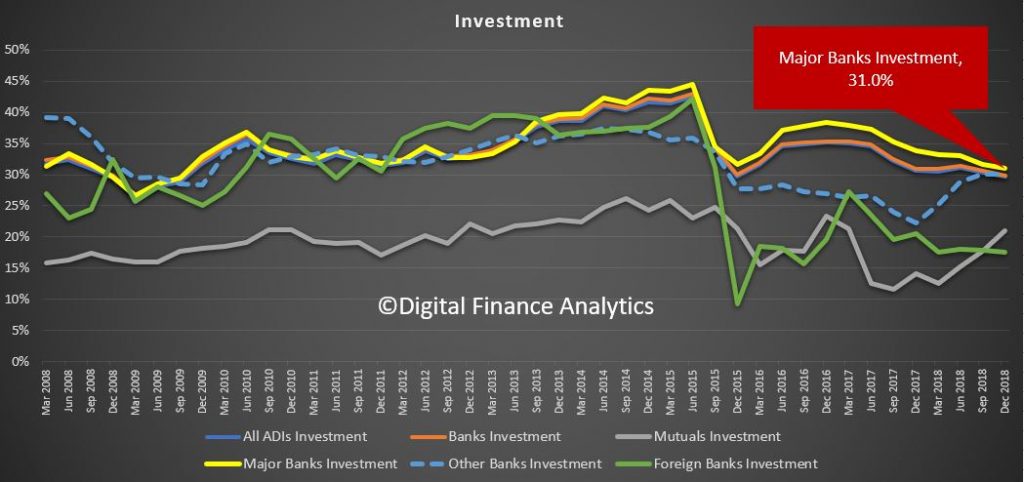

The proportion of investor loans being written has fallen, with major banks writing about 31% for investment purposes. Still a big number!

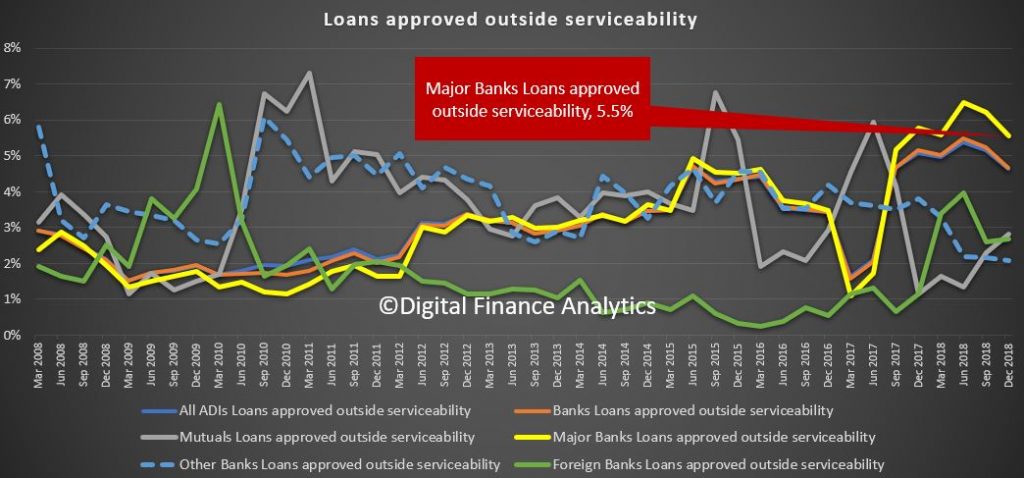

Loans outside serviceability are still high, reflecting tighter standards. Major banks are at 5.5% outside serviceability, down a little from past couple of quarters, but still a significant issue. Tighten the rules, then break the rules!

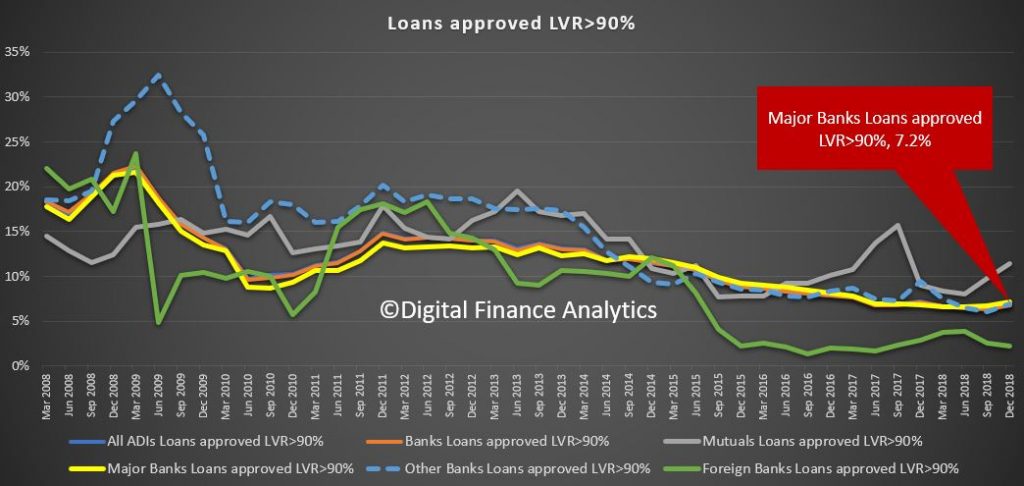

Finally, we can look at high LVR lending, important seeing as in some areas of Sydney prices are now down more then 20%. Over 90% LVR loans are still being written – 7.2% of all loans by major banks (so if prices fall another 10% ALL of these will be in negative equity. Also the trend is higher, especially for mutuals.

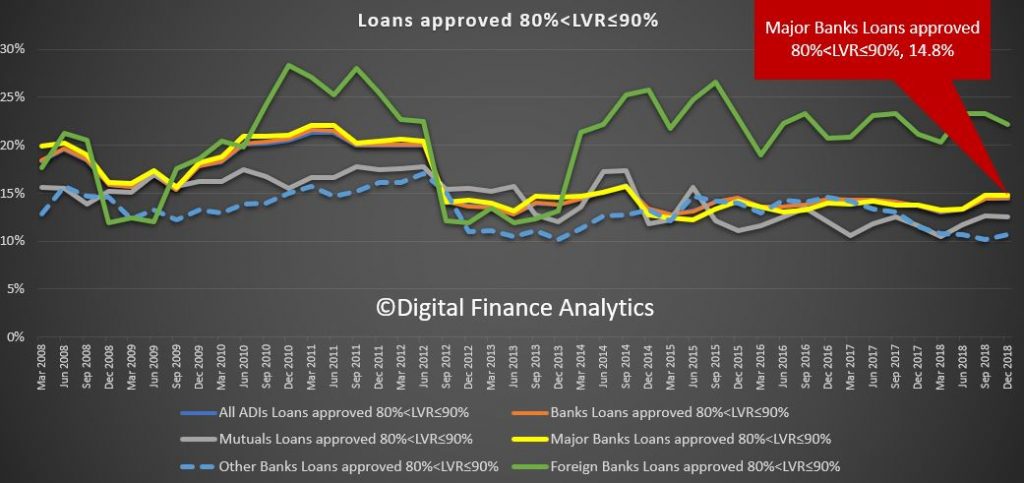

And the 80-90% LVRs are at 14.8% of all new loans from the major banks. Foreign banks are higher.

So a further fall of 20% would put more than 22% of new loans underwater.

These results suggest the banks are still lending excessively in the current environment. Expect more trouble ahead.