It looks like Banks will need to compete harder for deposit balances in the light of new regulation, and adverse international funding costs. This is in stark contrast to the past couple of years when savers took a bath.

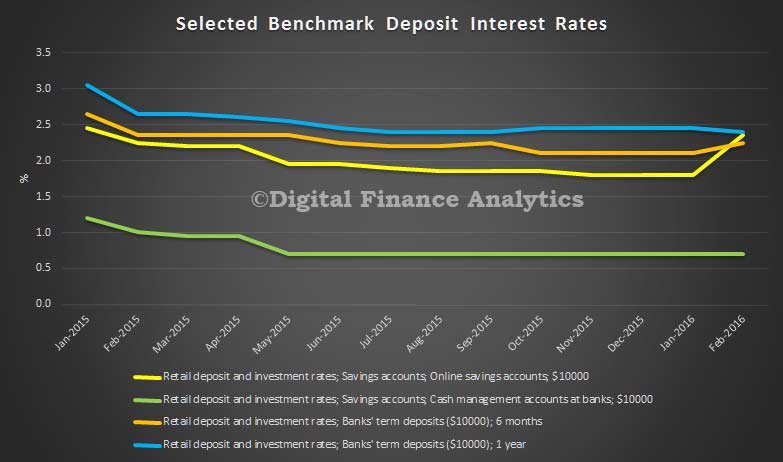

The data from the RBA (to end February) shows that key benchmark rates for some deposits lifted. This trend has continued, with some attractor rates at 3.5%, and some standard deposit rates on the rise.

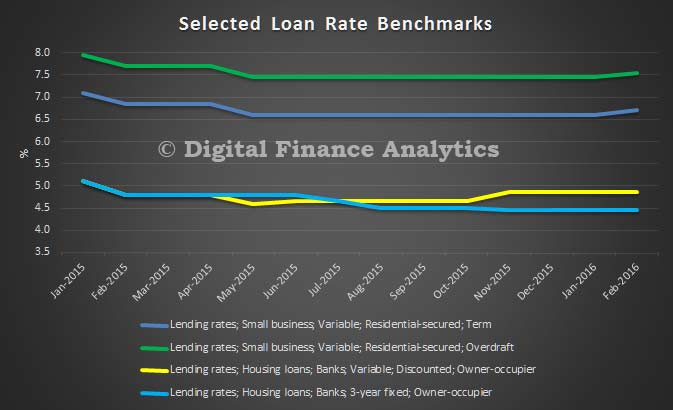

In contrast, we also see lending rates to SME’s moving up, and some mortgage rates to borrowers are also higher – though selected refinance discounting is also available to some.

In contrast, we also see lending rates to SME’s moving up, and some mortgage rates to borrowers are also higher – though selected refinance discounting is also available to some.

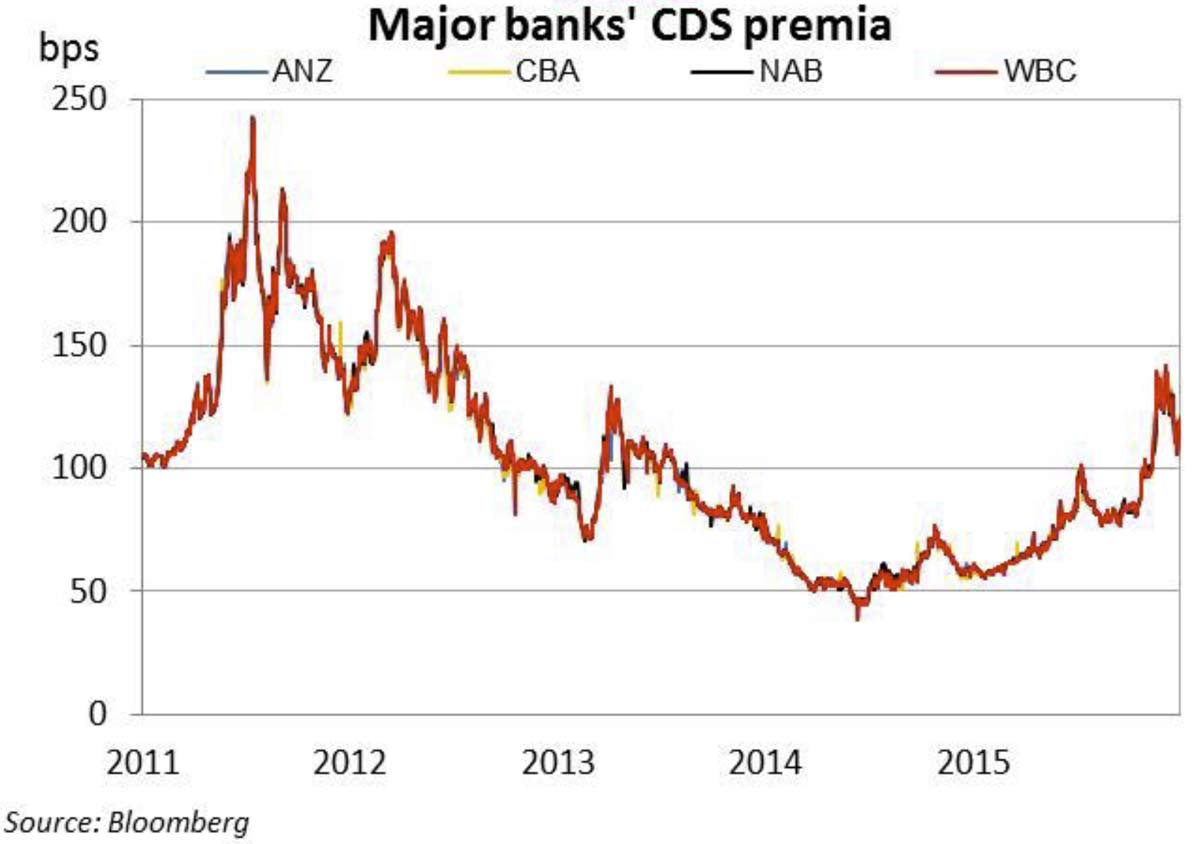

In recent times the costs of international funding, which is the other main source of bank funds, has lifted (and is also more volatile) thanks to the higher perceived international risks and possible future interest rates. For example the CDS spreads are higher now.

In recent times the costs of international funding, which is the other main source of bank funds, has lifted (and is also more volatile) thanks to the higher perceived international risks and possible future interest rates. For example the CDS spreads are higher now.

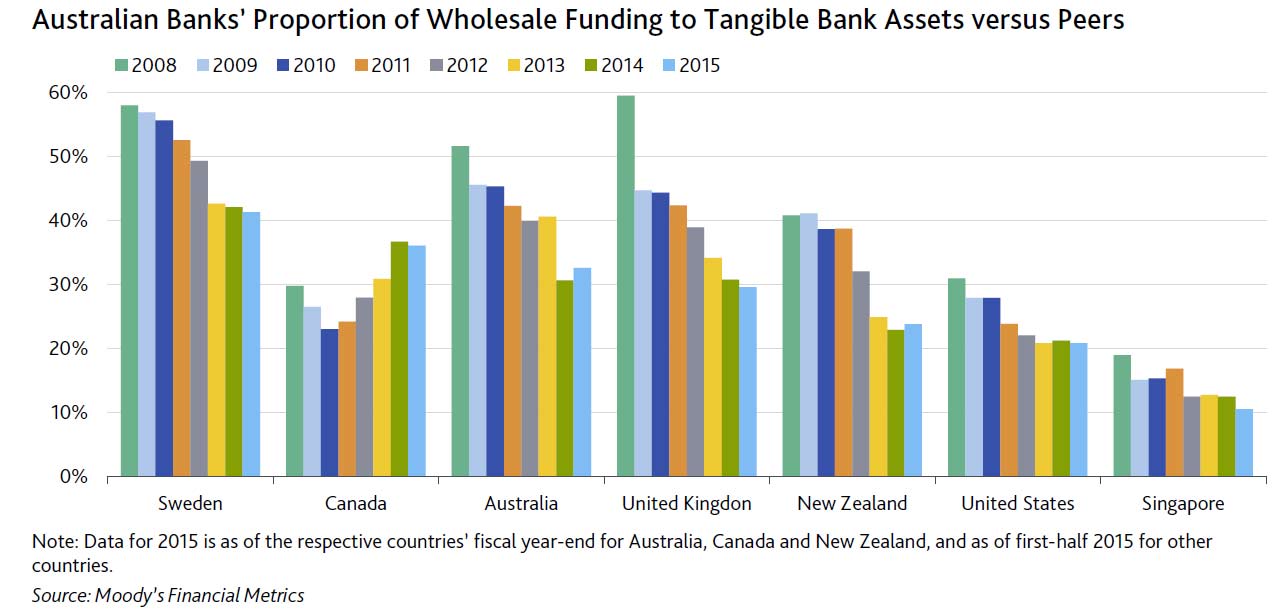

This matters, because Australian banks have a higher proportion of their loan books funded by these wholesale sources, as data from Moody’s shows. Whilst there has been a fall in the mix, compared with 2008, Australian banks are still reliant on these international capital flows. Thus any international volatility feeds though into local bank balance sheets.

This matters, because Australian banks have a higher proportion of their loan books funded by these wholesale sources, as data from Moody’s shows. Whilst there has been a fall in the mix, compared with 2008, Australian banks are still reliant on these international capital flows. Thus any international volatility feeds though into local bank balance sheets.

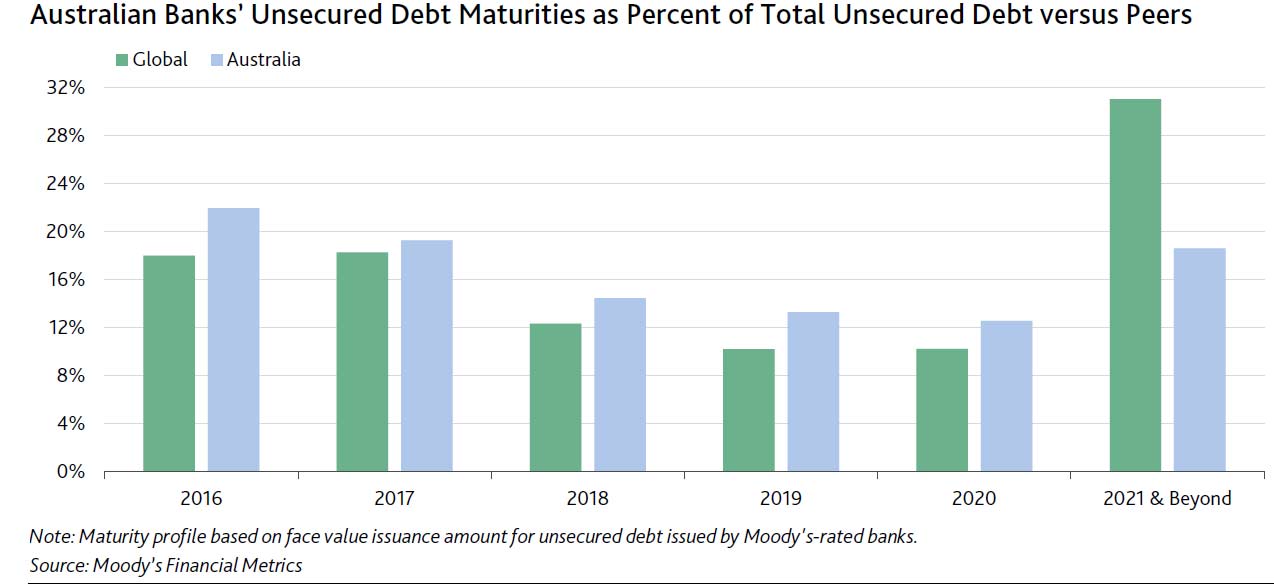

The other point to note is that Australian banks have a higher proportion of short-term funding, compared with global peers. Moody’s has provided data on this recently.

The other point to note is that Australian banks have a higher proportion of short-term funding, compared with global peers. Moody’s has provided data on this recently.

APRA’s consultation, announced last week, on Net Stable Funding Ratio will make it relatively more attractive for banks in Australia to fund their books from deposits rather than from wholesale capital markets. As a result, we expect to see competition for deposits, and potentially higher interest rates on offer. This trend will gain more momentum as the implementation date for NSFR approaches in 2018.

APRA’s consultation, announced last week, on Net Stable Funding Ratio will make it relatively more attractive for banks in Australia to fund their books from deposits rather than from wholesale capital markets. As a result, we expect to see competition for deposits, and potentially higher interest rates on offer. This trend will gain more momentum as the implementation date for NSFR approaches in 2018.

The implication of this may be we see a further fall in exposures to overseas funding, and thus less pricing volatility; but it may also mean that interest rates to some borrowers – especially SME’s who are less able to respond, and some mortgage holder segments will rise.

The question will be whether the re-balancing of all these forces will be managed so as to maintain net bank profitability, or whether the squeeze will flow to their bottom line. Nevertheless, Savers may for a change, get some good news – provided that is they shop around. We note from our surveys that more than half of households with savings on deposit do not know their current rate of return, and inertia is a powerful force stopping many maximising their savings returns.

Then of course, there is the question of whether the RBA cuts the cash rate benchmark as we progress through the year.