In a speech at the Open University, The Bank of England’s Chief Economist, Andy Haldane explores why interest rates in advanced economies have got “stuck” and how policymakers should respond. Highly relevant given the recent BIS report which said there was too much reliance on risky low interest rate monetary policy.

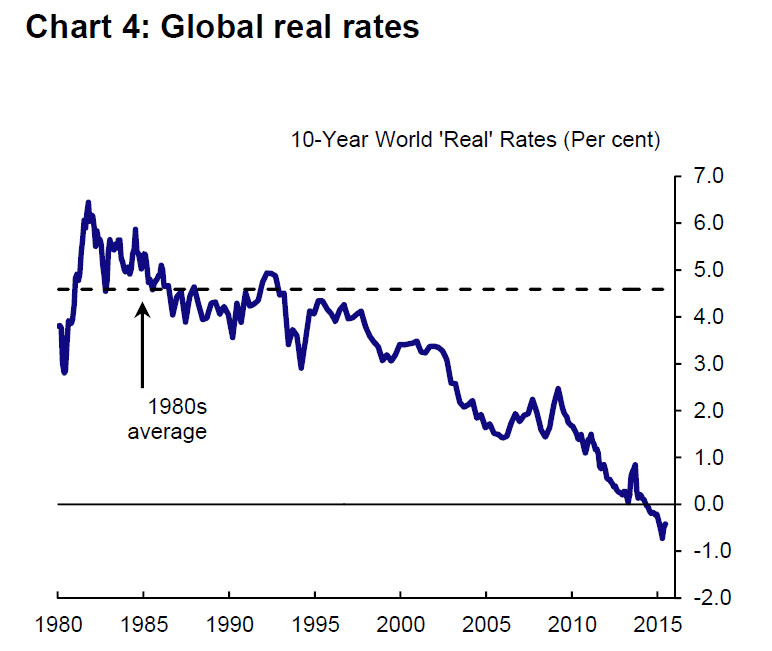

Official interest rates in the major economies remain stuck at unprecedentedly low levels. Central banks have made vigorous attempts to dislodge them, including through special liquidity schemes, asset purchases and forward guidance. Yet interest rates remain stuck. This stickiness in interest rates has surprised both policymakers and financial markets. After they hit their floor, financial markets expected official rates in the US to unstick in 6 months, in the UK in 10 months, in Japan in 13 months and in the euro-area in 14 months. But they have remained stuck: in Japan for over 20 years and in the US, the UK and the euro-area for over 6 years. Indeed, the expected time to lift-off remains as many months away today as when rates first hit their floor: in the US 9 months, in the UK 10 months, in the euro-area 34 months, in Japan 72 months. In Australia, rates are as low as they have been in living memory, and some advocate further cuts still.

Andy explores two possible factors that may have contributed to current low levels of interest rates: “dread risk and recession risk. The first generates an elevated perception of risk, the second an asymmetric balance of risk. Both are relevant to explaining the path of interest rates, the likely fortunes of the economy and the optimal setting of monetary policy.”

Andy explores two possible factors that may have contributed to current low levels of interest rates: “dread risk and recession risk. The first generates an elevated perception of risk, the second an asymmetric balance of risk. Both are relevant to explaining the path of interest rates, the likely fortunes of the economy and the optimal setting of monetary policy.”

The effects of dread risk have, Andy argues, “proved lasting and durable.” The fear of a further financial crisis and the risk-averse behaviours that follow help “explain the sluggishness of the recovery, and the adhesiveness of interest rates, since the crisis.” And, “if the past is any guide, these scars may heal only slowly.”

In a discussion of recession risk, Andy considers what we can expect for future growth on the basis of past trends. He finds that “the probability of an expansion lasting for longer than 10 years is, on past evidence, less than 10%.”

“If a recession were to strike in the period ahead, a relevant question for monetary policy is how much room for manoeuvre might be necessary to cushion its effects.” Comparing the magnitude of previous loosening cycles to the current path of the yield curve Andy finds, “recession probabilities exceed interest rate threshold probabilities by a factor of anywhere between 1.5 and 4.”

“Put differently, based on these estimates there is a considerably greater chance of interest rates needing to be cut to their floor to meet recessionary needs than of them gliding back to levels that could safely cushion a recession. Even after interest rates have lifted off from their floor, it is more likely than not they may return there over a ten-year horizon.”

What, therefore, are implications for monetary policy of continued dread and recession risk? Using the forecast from the May Inflation Report Andy has updated the interest rate trajectories he produced earlier this year. “As then, they suggest the optimal path for interest rates involves an immediate cut in rates for about a year, which pushes inflation back to target and closes the output gap. Thereafter, interest rates rise gradually in line with the market curve.”

However, the trajectories are illustrative and may “underplay the effects of risk” such as the dread risk and recession risk he has focused on here. He argues these risks have led to a cautious response to the recovery by both households and, to some extent, businesses which may “skew growth risks to the downside”. As a result, while April’s wage data was “encouraging news… one swallow does not a summer make.” “Wage growth is causing some fluttering, but not in this dovecote.”

This, in combination, with the downside risk to the MPC meeting its 2% inflation target two years hence, gives Andy “considerable sympathy” with the argument that interest rates should be “lower for longer” to manage the risks from raising rates too soon. A rate rise “however modest” would be a further example of bad news to already cautious consumers: “A policy of early lift-off could be self-defeating. It would risk generating the very recession today it was seeking to insure against tomorrow.”

This leads Andy to conclude: “my judgement on the appropriate monetary stance in the UK is relatively little altered from earlier in the year. The current level of interest rates remains, in my view, appropriate to assure the on-going recovery and to insure against potential downside risks to demand and inflation. Looking ahead, I have no bias on either the size or direction of future interest rate moves.”

One thought on “Are Interest Rates Stuck At Historic Lows?”