A new online toolkit developed by ASIC’s MoneySmart will enable Australians to better understand and navigate the financial advice process.

ASIC’s MoneySmart Financial Advice Toolkit is available on ASIC’s MoneySmart website.

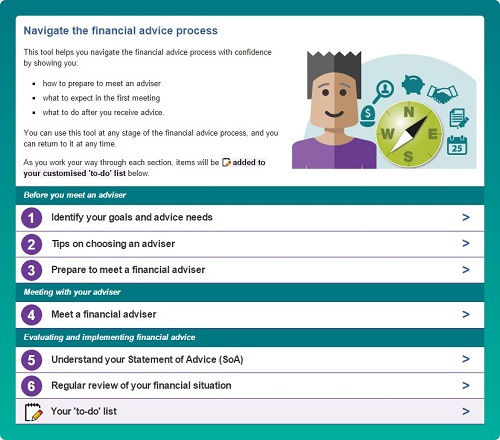

ASIC’s MoneySmart Financial Advice Toolkit is a free educational tool that breaks down the complexity around the financial advice process. It will assist consumers with their research and help them evaluate the financial advice they receive.

ASIC’s MoneySmart Financial Advice Toolkit provides an overview of the financial advice process and gives impartial guidance on:

- Identifying financial goals and advice needs;

- Tips on choosing an adviser;

- Preparing to meet a financial adviser;

- Understanding your Statement of Advice; and

- Reviewing your financial situation.

Consumers can use the toolkit to create a customised ‘to do’ list which they can modify to suit their personal financial needs. The toolkit also includes links to ASIC’s Financial Advisers Register where consumers can check a financial adviser’s credentials – their licence, authorisations, experience and qualifications, and whether they have ever been banned or disqualified from providing financial services.

‘Australians face major financial decisions throughout their lifetime, many of which can be complex and confusing. Yet only about one in five Australians obtain financial advice. ASIC recognises the value that quality advice can deliver and wants to see this increase,’ said Mr Peter Kell, ASIC Deputy Chairman.

‘ASIC’s new toolkit is a practical resource to help Australians assess the quality of the advice they receive and make better financial decisions.’

The resource is a new digital tool that complements and supports ASIC’s regulatory and enforcement work in the financial advice sector and is designed to improve demand-side capability at critical financial moments.

Background

ASIC is the Australian Government agency responsible for financial literacy, consistent with its strategic priority to promote consumer confidence and trust in the financial system. Financial literacy is about having the knowledge, skills, attitudes and behaviours to make good financial decisions.

ASIC leads and coordinates the National Financial Literacy Strategy, which sets out a national framework for financial literacy work in Australia. The Strategy highlights the importance of providing people with tailored resources and tools, and of responding to the financial issues facing vulnerable sectors of the community. People experiencing high financial stress and crisis are identified as one of a number of priority audiences in the National Strategy.

ASIC’s MoneySmart website provides impartial and trusted financial guidance and tools to support informed financial decision-making for all Australians.