ASIC has just released their Strategic Outlook. “Our Strategic Outlook sets out the trends shaping our regulatory focus and examples of our responses to key risks we see in 2014–15. Next financial year, we will build on this initiative and publish a detailed Risk Outlook and Strategic Plan.”

There is an interesting set of issues highlighted. For example, a statement about the potential for Digital disruption.

Traditional business models in financial services and markets are being disrupted by new digital strategies at an accelerating pace. In financial services, crowdfunding and peer-to-peer lending platforms are disrupting traditional ways of accessing capital. In our markets, we see digital disruption in high-frequency trading and dark liquidity. These strategies offer investors and financial consumers additional ways of interacting with our financial services and markets, create competition, and raise new challenges for firms and regulators. We expect continuing developments to create additional opportunities for digital disruption, including:

- more advances and take-up in the use of mobile technology for financial transactions, online investment advice, and peer-to-peer platforms that connect investors and businesses seeking finance

- increased use of ‘big data’ by financial services providers to customise their marketing, and

- increased opportunities to engage and empower consumers through interactive data innovations, such as calculators and product comparison tools.

The potential of digitisation in the financial system is yet to be fully realised. Firms and regulators need to continue to work together to harvest the opportunities from digital disruption, while mitigating the risks – in particular, we need to think about how we achieve outcomes in an increasingly digital world.

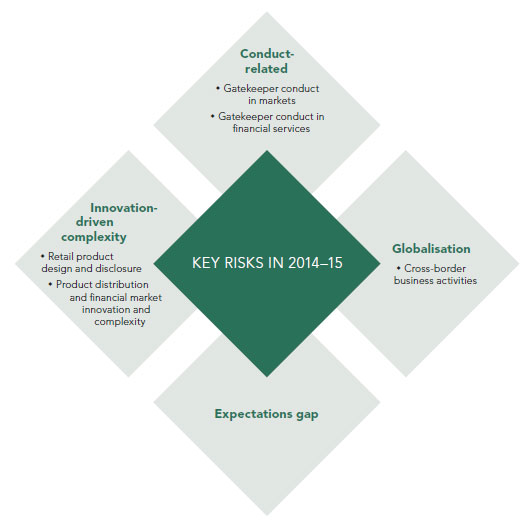

They also highlight the main areas of potential risk, using a simple framework.

- Poor conduct of some gatekeepers, companies, principals and intermediaries can jeopardise market integrity and investor outcomes

- Weak compliance systems, poor cultures, unsustainable business models and conflicted distribution may result in poor advice, mis-selling and investor loss, especially in managed investments

- Poor retail product design and disclosure and misleading marketing may disadvantage consumers, particularly at retirement

- Innovation and complexity in product distribution and financial markets through new technology can deliver mixed outcomes for retail investors, financial consumers and issuers

- Globalisation and cross-border businesses, services and transactions may lead to compromised market outcomes

- Different expectations and uncertainty about outcomes in the regulatory settings can undermine confidence and behaviour

Whilst we cannot quarrel with these statements, DFA’s perspective is they are high-level and the devil will be in the detail. Given their critical market conduct role, it is important they get it right. Some recent events suggest they need to be more proactive. We also see contention between the various stakeholders they are required to consider.

One thought on “ASIC’s “Motherhood and Apple Pie” Strategic Outlook”