ASIC has completed a review of the exchange traded products (ETP) market in Australia, including exchange traded funds, aimed at ensuring the market is delivering on promises to investors.

Exchange traded products (ETPs) are open-ended investment products that are traded on a securities exchange market. ETPs trade and settle like shares and give investors exposure to underlying assets without owning those assets directly.

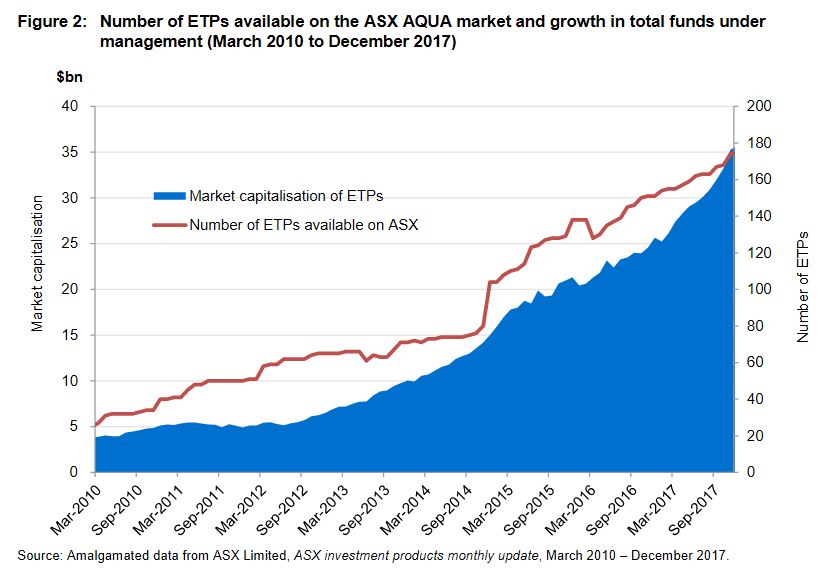

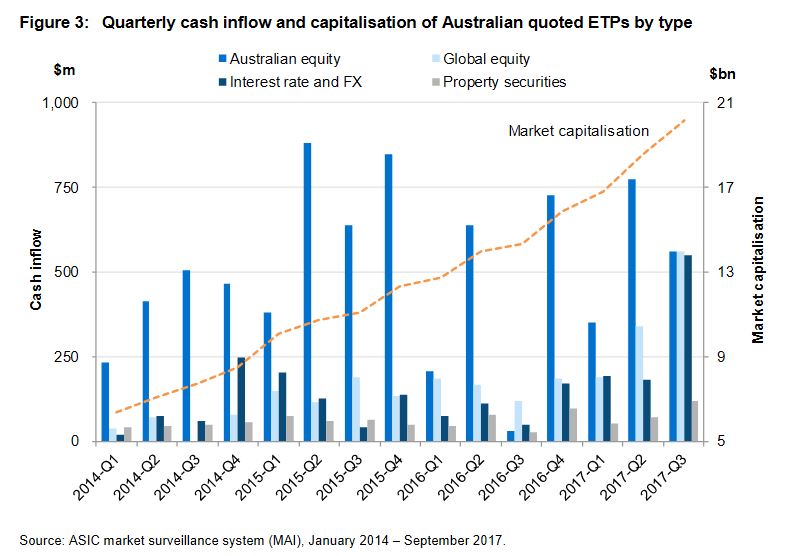

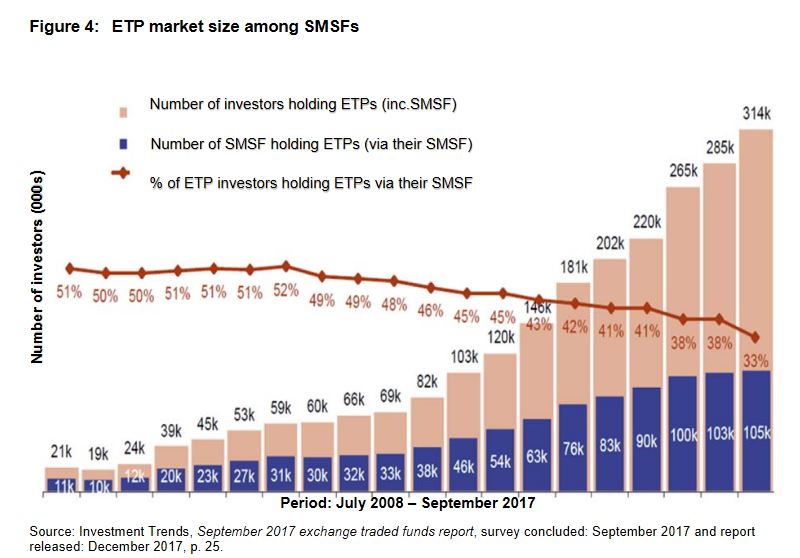

ETPs differ from listed funds because they are open-ended. Tthis means that the number of units on issue may increase or decrease daily depending on investor demand. ETPs, especially exchange traded funds (ETFs), are increasingly popular with retail investors and self-managed superannuation funds (SMSFs).This is because of their accessibility, perceived low cost, transparency, intraday liquidity, diversification benefits and ability to provide exposure to new asset classes. There has been steady growth in both funds under management and the number of ETP products available on the market in Australia

ACIS’s review focused on two types of ETPs: a) passively managed ETFs with an investment objective to track an index or benchmark; and b) funds that are actively managed to outperform a benchmark or to achieve an absolute return objective (referred to as ‘active ETFs’ and ‘managed funds’).

The review found that the market is generally performing well, and ETPs are meeting the relatively low cost and liquidity expectations of investors. However, the review identified a range of risks that require monitoring by issuers and oversight by market operators.

The large and growing investment in ETPs in Australia by retail and SMSF investors prompted ASIC to look at a number of the key premises and functions of the ETP market. The key concern identified was the potential for the bid/offer spread to temporarily widen, leading to investors paying a spread that would be considered too high, and undermining the relatively low cost proposition of some ETPs.

Further, ASIC considers that market operators and issuers should play a more proactive role in monitoring the performance of ETPs, including liquidity in the market, and where they observe spreads widening unreasonably, they should take appropriate action.

ASIC is also recommending that ETP issuers publish the indicative net asset value (iNAV) with a frequency that enables investors and financial advisers to make more informed decisions.

ASIC Commissioner John Price said, ‘We encourage issuers to continue to educate investors and their advisers about how the ETP market operates and to provide them the tools, like an iNAV, to help them make informed investment decisions’.

Another area of concern identified in the report was market maker concentration, as although there are an increasing number of new entrants in Australia that serve a growing market, most liquidity is still provided by only two entities. ASIC expects issuers and market operators to be aware of this risk and incorporate a means of managing it into their risk management framework.

While not many ETPs have closed in Australia to date, ASIC encourages issuers and market operators to develop policies for reviewing, and where necessary remove from quotation with an orderly wind down, ETPs that may not meet ongoing suitability for quotation, such as very small ETPs that may be uneconomical to operate.