COBA says that new research has found the Banking Royal Commission has made Australians more receptive to banking alternatives and switching their banking.

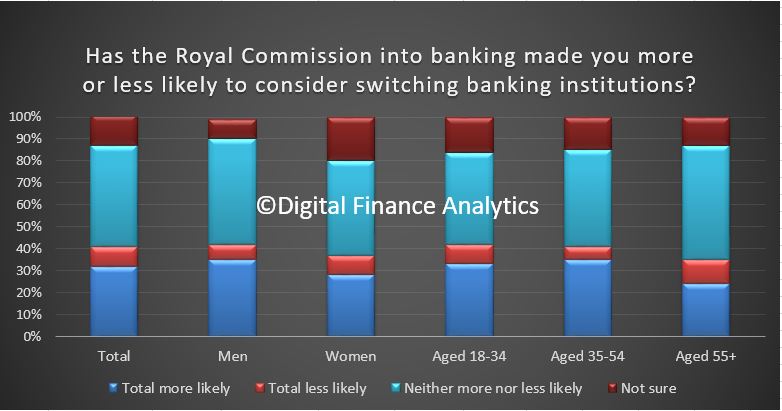

An Essential Media poll, commissioned by the Customer Owned Banking Association, found 1 in 3 people are more likely to consider switching their banking institution.

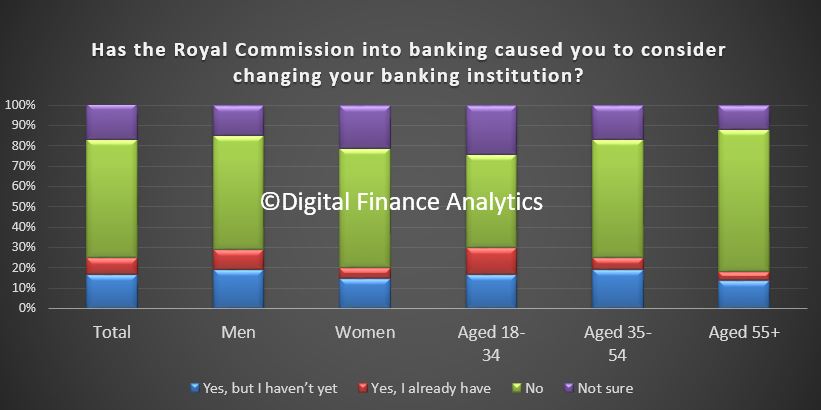

The poll also found 8% say they have already changed their provider. A further 17% say the Royal Commission has led them to consider changing, but they haven’t yet, while an additional 18% are not sure if they will consider changing.

“These findings back up the increase in interest from Australians looking to enjoy the benefits of customer owned banking,” COBA CEO Michael Lawrence said.

“The feedback we’re getting is that there is great interest in a model that puts customers first, where 100% of profits are used to benefit customers.

“The poll shows people are ready to switch to an alternative where customer interests are not in conflict with shareholder interests.

“The ‘Own Your Banking‘ campaign we launched this week is a response to encouraging support we have already seen for mutual banks, credit unions and building societies. We are particularly keen to target our campaign toward the Australians who are considering changing and those undecided.”

Customer owned banking institutions are already seeing this trend.

As Greater Bank CEO Scott Morgan says: “Customer focus is more than just one of the values of Greater Bank, it’s the foundation on which the Bank was established and an important aspect customers are increasingly looking for. Recently we have enjoyed the benefits of this focus with the Bank experiencing some of the highest levels of customer growth we have seen in many years.”

“We are encouraged by positive consumer sentiment towards the customer owned alternative,” COBA CEO Michael Lawrence said.