The RBA published their statement on monetary policy today. They point to a lower than expected growth and inflation forecast, but higher rates of unemployment. GDP is now projected at 2.25 per cent to June, and a quarter percent lower by the end of the year than their last projection. They are expecting unemployment to remain higher for longer, and above 6 per cent during 2017. Inflation is forecast at a headline level of just 1.25 per cent, thanks to lower oil prices, although the bank’s favoured core inflation measure still sits within its 2-3 per cent target.

Looking at the economic drivers, the banks said that the 9 per cent fall in exchange rates had yet to flow through into higher prices, and the fall in oil prices are estimated to have increased real household disposable income by 0.25 per cent over the last half of 2014, and will lift spending power by an additional 0.5 per cent over the first three months of this year.

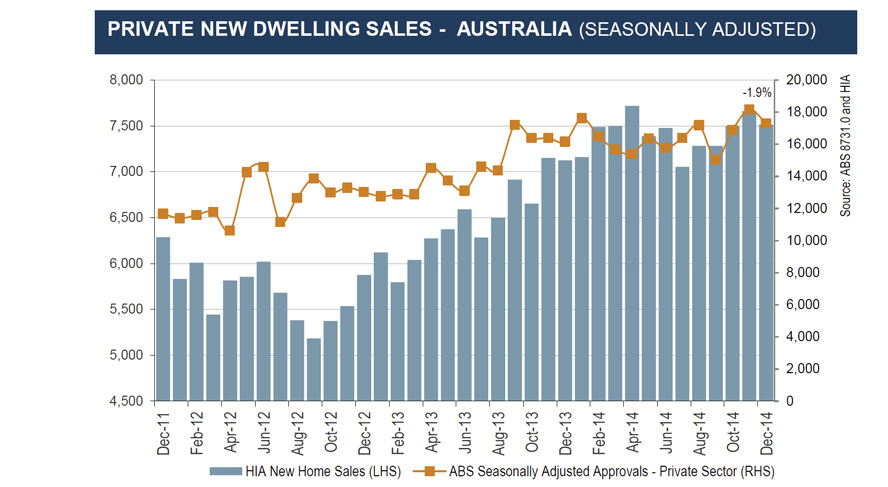

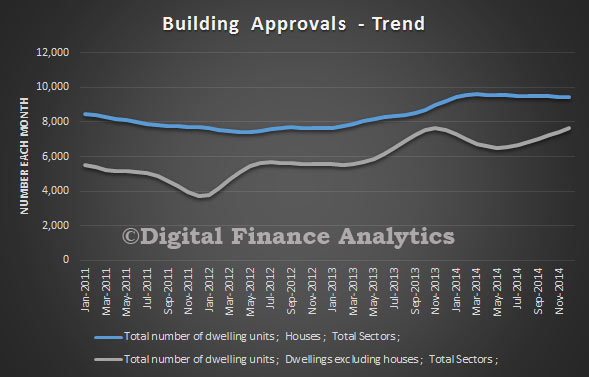

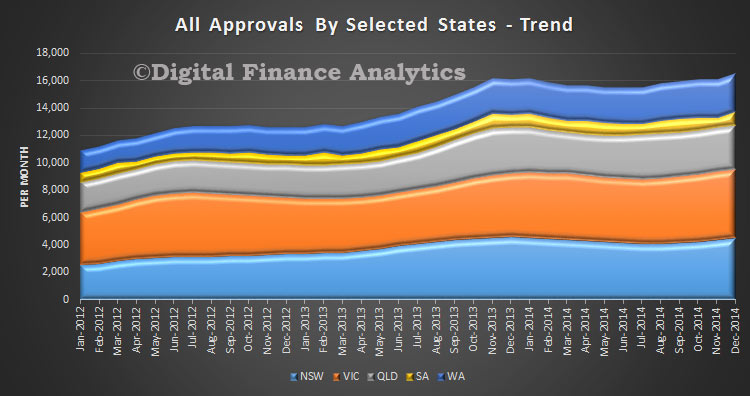

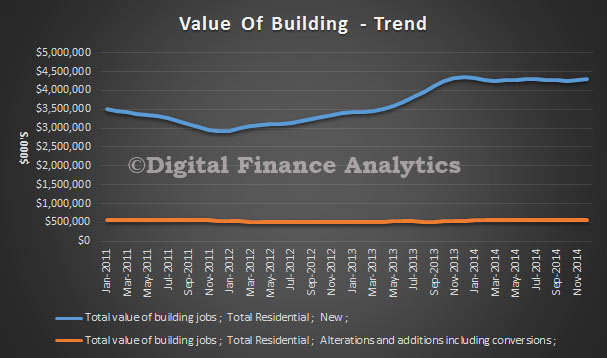

“While growth in non-mining activity has picked up a little over the past two years, all components except dwelling investment look to have grown at a below average pace over the past year,” the RBA said.

The ABS capital expenditure survey suggests that there will be only very modest growth in non-mining investment in 2015.

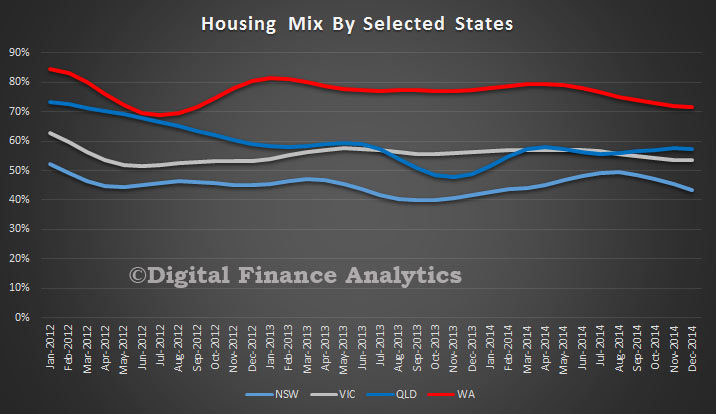

The most significant comment for me related to the behaviour of households who have experienced significant lifts in wealth thanks to rising house prices, yet may not be turning this into higher rates of consumption.

“However, another possibility is that ongoing buoyant conditions in housing markets will have less of an effect on consumption than previously. In particular, in recent years fewer households appear to have been utilising the increase in the value of their dwelling to increase their leverage or trade up”.

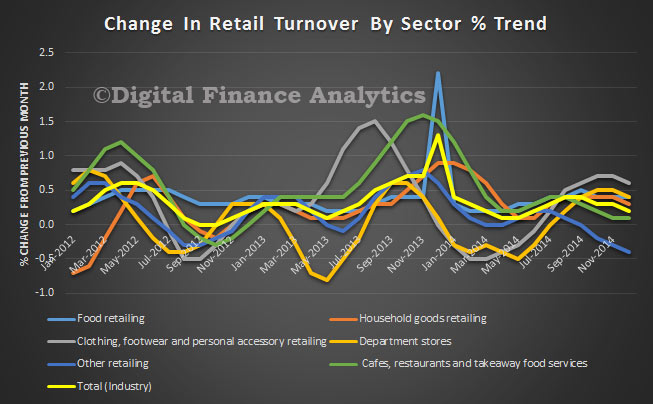

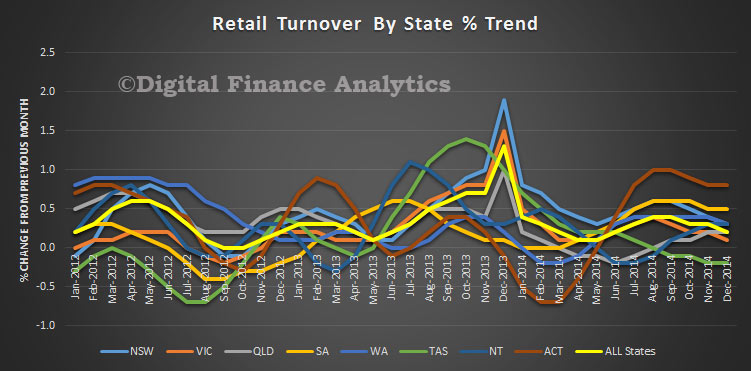

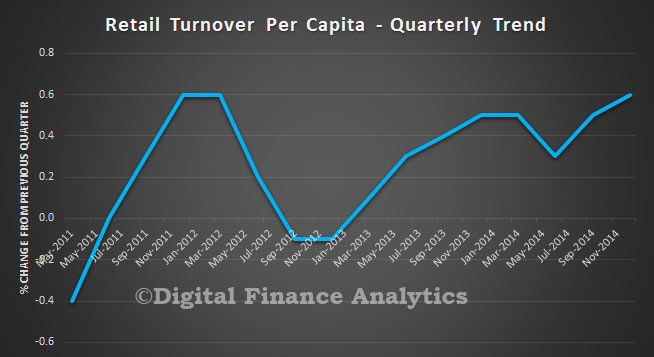

This cuts to the heart of the problem. Their core strategy was to allow housing to expand, to lift wealth, to encourage spending, to drive growth, until the business sector kicks in. However, there is mounting evidence that households are not convinced, and are unwilling or unable to spend. Retail is still below trend, and as interest rates of savings fall, households become more conservative. It could be that their core thesis is flawed. Indeed, they had previously acknowledged

“we shouldn’t expect consumption to grow consistently and significantly faster than incomes like it did in the 1990s and early 2000s, given that the debt load is already substantial”.

In our recently published household finance confidence index we noted a consistent fall. No surprise then households are not performing as expected.