Digital Finance Analytics has released the latest results from our rolling 52,000 household surveys, which examines household financial flow stress. The headline is that more households are feeling the pinch, thanks to higher costs of goods and services, fuel, child care and healthcare costs.

We examine the net cash flows of our households, and if they are consistently spending more than net income, we classify them as “stressed”. This is a better measure of financial health than a set percentage of income going on a mortgage or rental payment – often cited as 30% or more. This broad brush approach tells us very little.

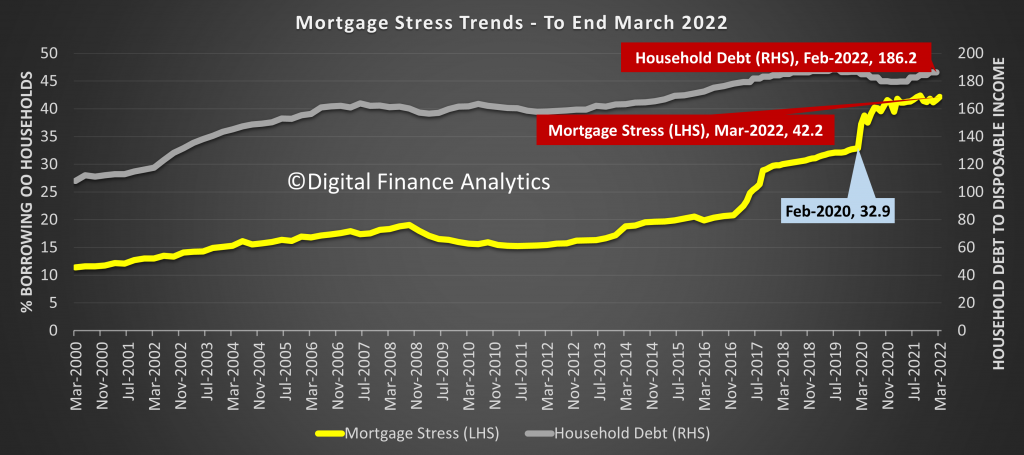

Overall 42.2% of mortgaged households are in financial flow stress, a trend exacerbated by the larger mortgages held by recent borrowers, as illustrated by the RBA’s rising debt to income ratio. This degree of stress is concerning because mortgage interest rates are likely going to rise quite fast, in line with RBA cash rate expectations.

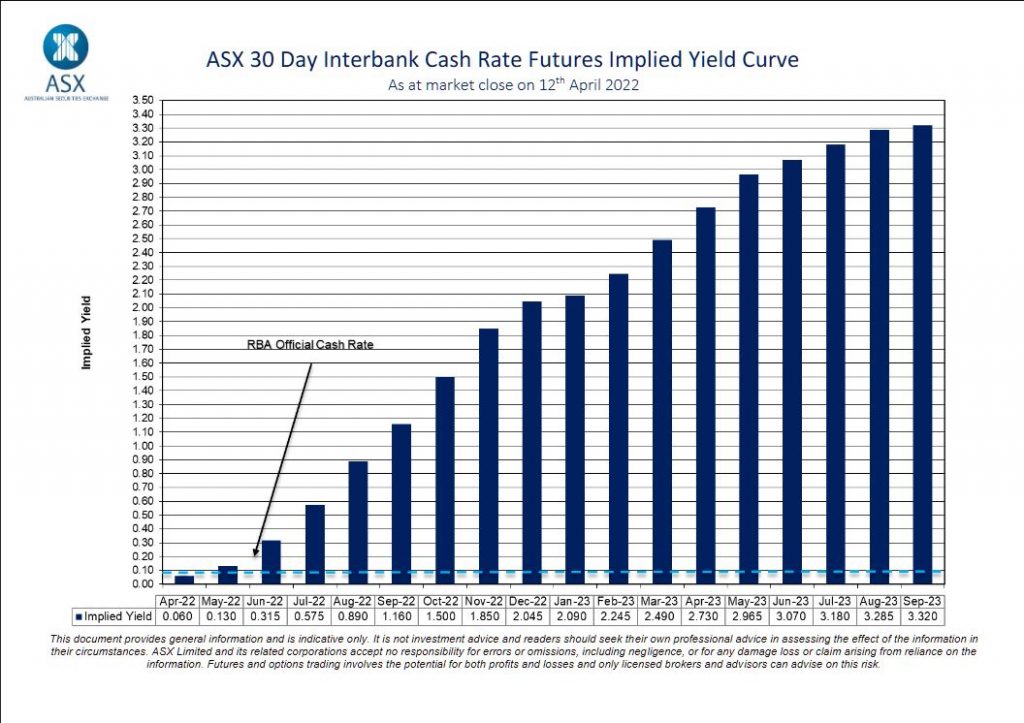

Indeed, the latest ASX market indicator suggests rates could rise by more than 3% in the next 18 month. Our own view is RBA rises will be less significant, else they will break the economy, but given the internationally rising inflation reads, and benchmark rates, we must expect mortgage rates to rise.

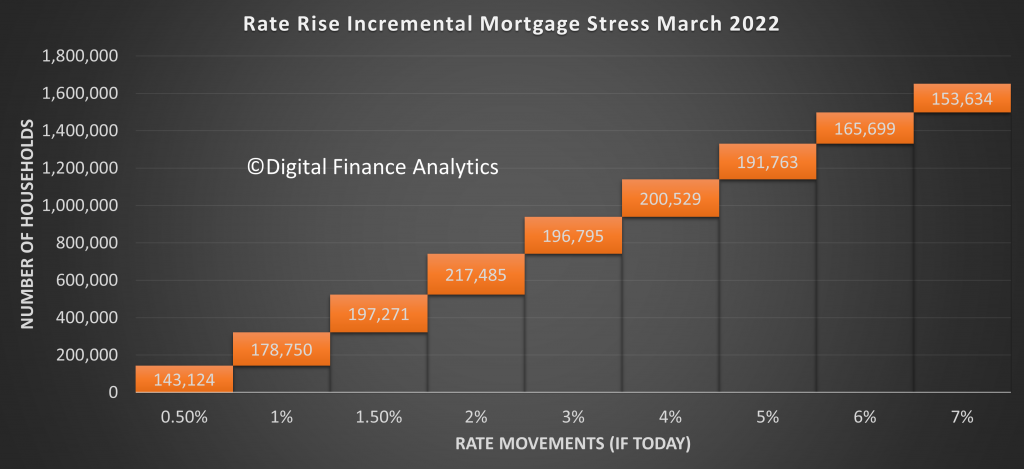

While some households are well able to handle higher rates, those in our stressed categories are less able to cope, thus stress levels would rise. Our modelling illustrated the potential additional number of households impacted by each rate increase.

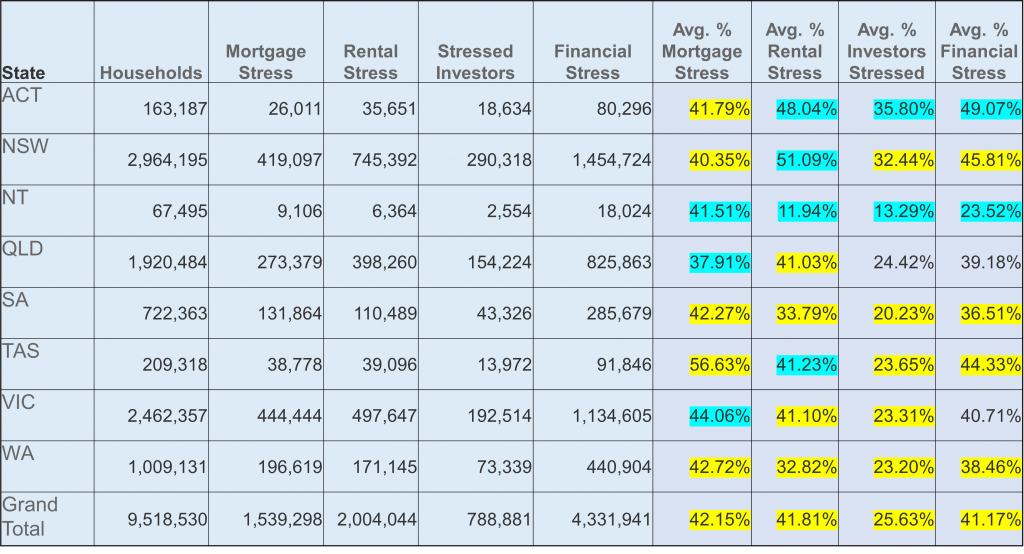

The current levels of stress are spread across most states and territories, with Tasmania the most exposed due to continued price rises, while incomes are flat or falling in real terms. Those highlighted in yellow are higher than the previous month. Rental stress is highest in New South Wales, while Investor Stress is highest in the ACT.

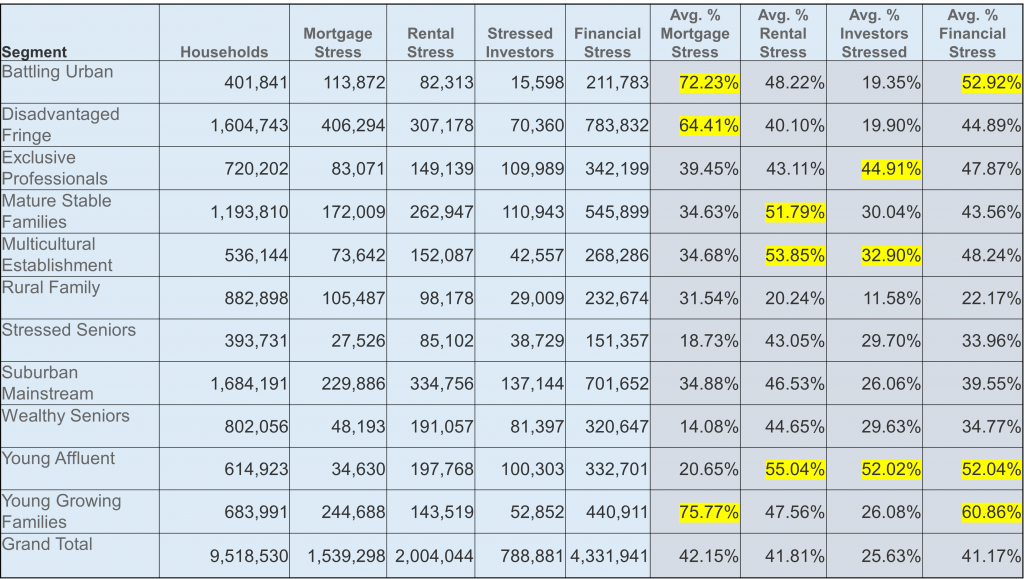

Analysis across our household segments shows significant pockets of stress among younger, often first time buyers many of whom bought in the high-growth development corridors around our major urban centres. That said no segment is untouched, and many first generation Australians are in difficulty.

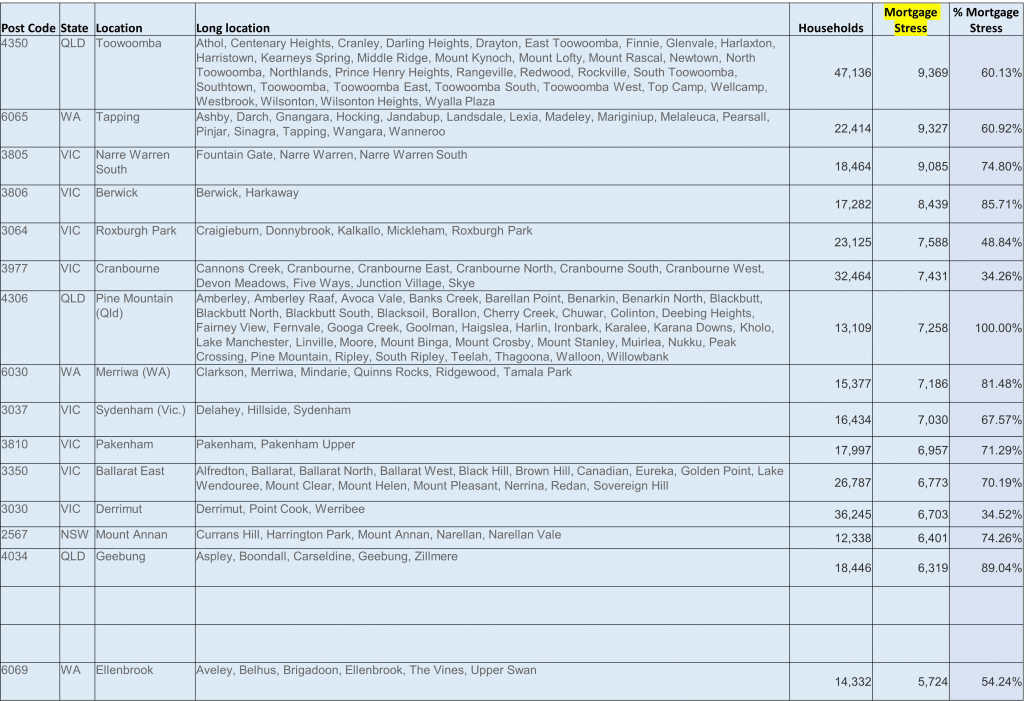

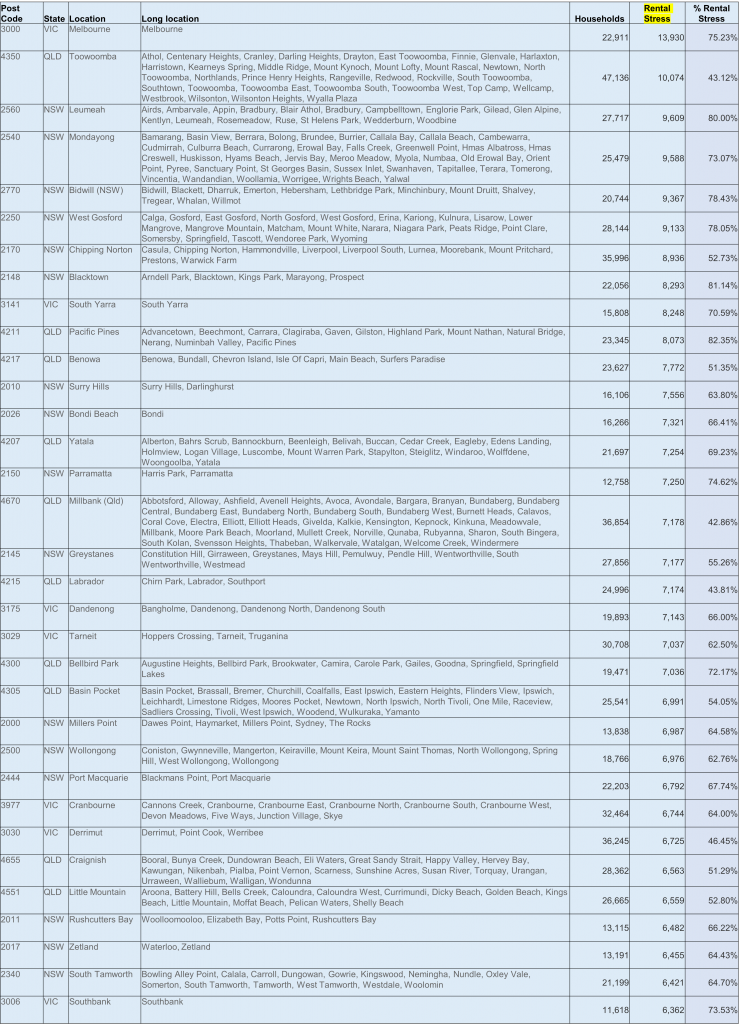

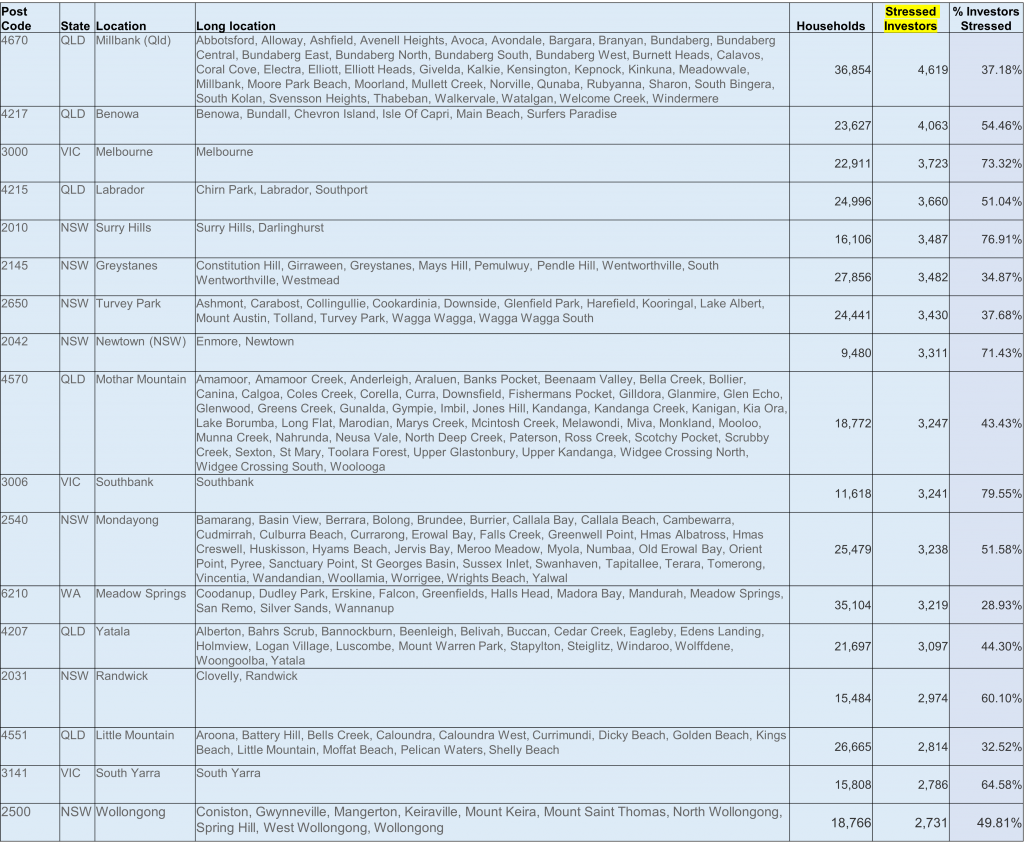

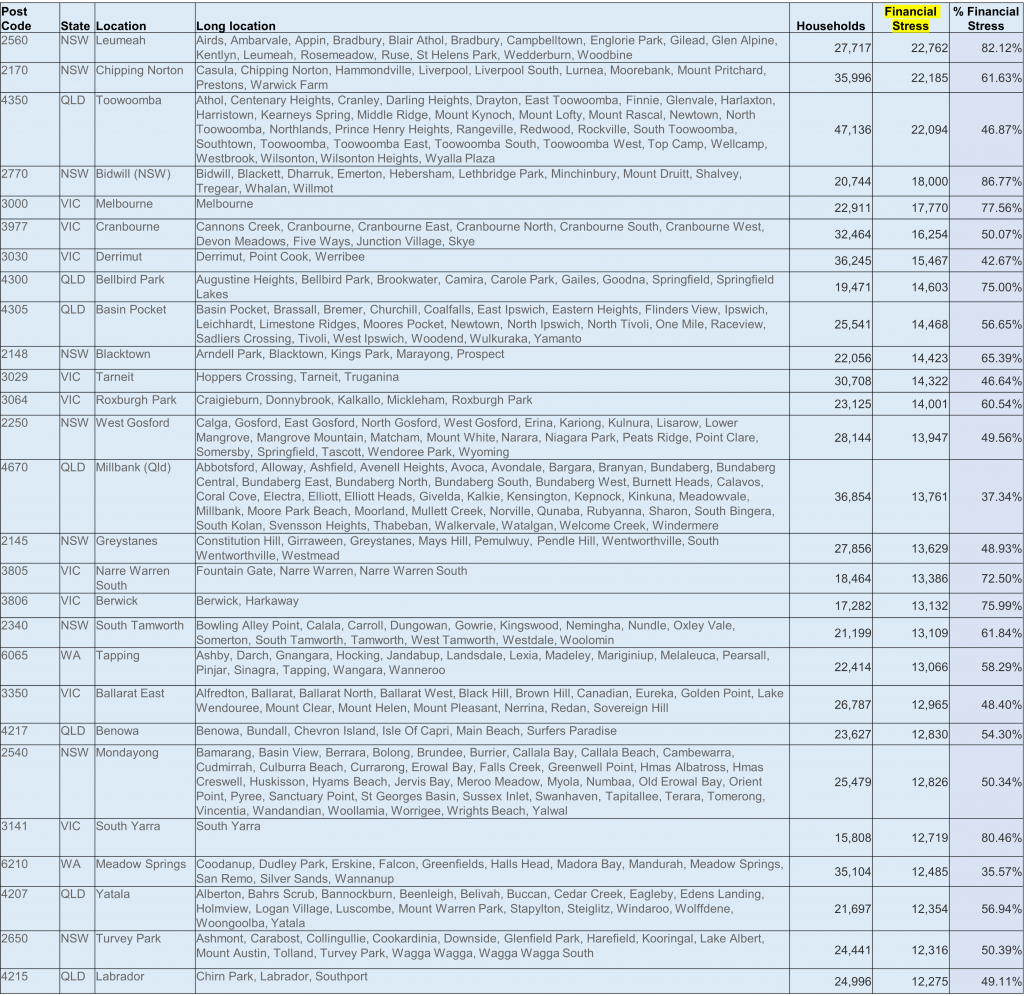

To complete the picture, we feature data on the top – most stressed post codes for our four stress categories.

Mortgage Stress – Top Household Counts

Rental Stress – Top Household Counts

Investor Stress – Top Household Counts

Financial Stress – Top Household Counts

Financial stress is an aggregate of mortgage, investor and rental stress, compared to all households.

Finally, we underscore that pressures on households are going to continue to build as inflation strengthens, and costs rise. Incomes in real terms are not. And mortgage rates are set to rise.

So households would do well to record their income and expenditure, because around half in our surveys have no clear view of their spending patterns, which makes prioritization impossible.

Households under stress with a mortgage should talk to their lender, as they have an obligation to assist – though refinancing or equity draw down are unlikely to be permanent solutions. In some cases a controlled property sale is a better option.

New borrowers would do well to ensure they have adequate buffers and not over commit at this point in the cycle, especially bearing in mind that the RBA has recently indicated property prices may well ease as rates rise.