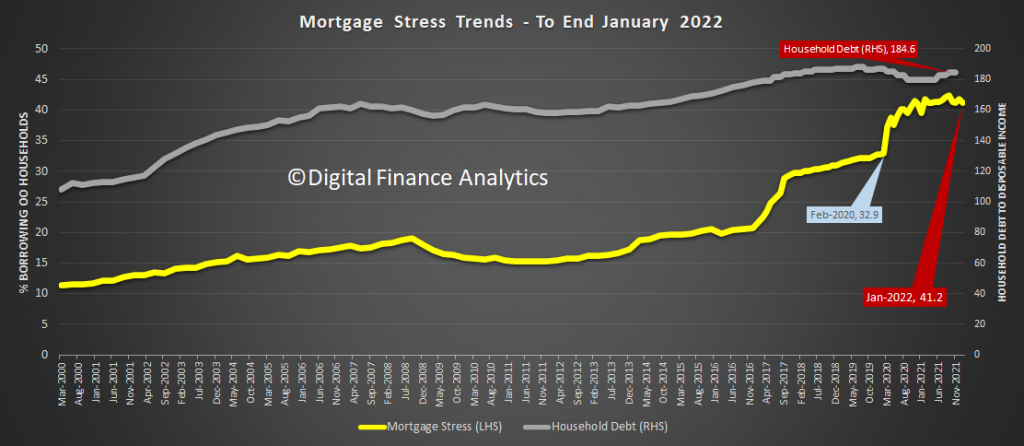

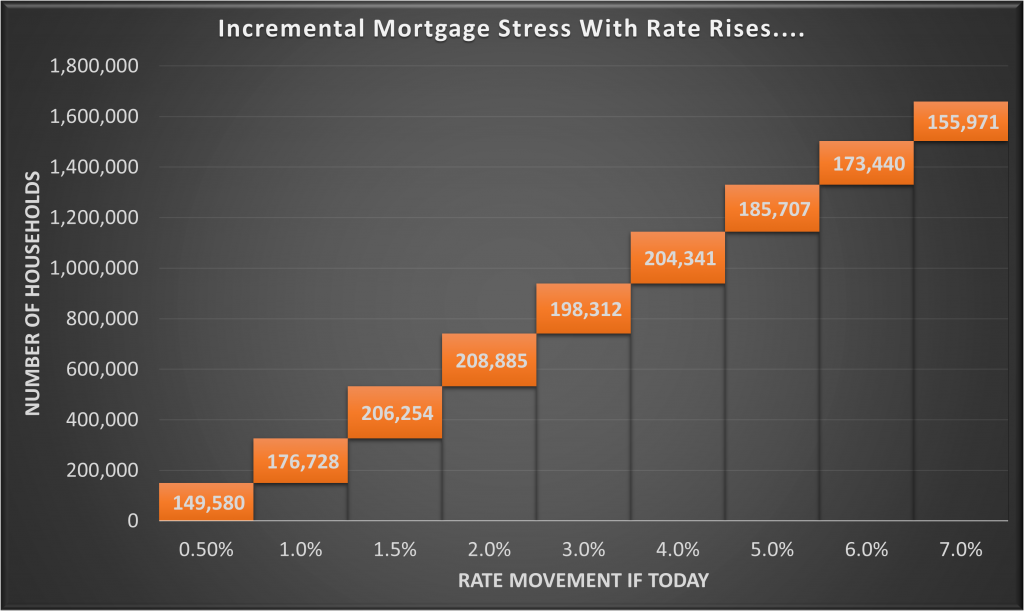

A deep dive of our mortgage stress analysis to end of January 2022, plus some rate sensitivity analysis and mapping. Where are the hot spots? How many households are under pressure?

Go to the Walk The World Universe at https://walktheworld.com.au/

Digital Finance Analytics (DFA) Blog

"Intelligent Insight"

In today’s show we discuss the week on the market, starting in the US and ending in Australia. As I need to remind you, we here are not disconnected from the events on those other major markets. We are a cork on the ocean.

Wall Street stocks ended sharply lower on Friday (for the second straight session, as investors fretted about deepening tensions between Russia and Ukraine and the fallout from prospective higher rates. Just remember the FED has NOT lifted rates, nor started quantitative tightening .. yet.

Nine of the 11 major S&P 500 sector indexes declined, led by technology, down 3.0 per cent, and consumer discretionary, down 2.8 per cent. The energy sector index surged 2.8 per cent as oil prices hit seven-year highs.

With investors already fretting about inflation and rising interest rates, selling on Wall Street accelerated after Washington warned that Russia had massed enough troops near Ukraine to launch a major invasion, and that an attack could begin any day.

Go to the Walk The World Universe at https://walktheworld.com.au/

My Friday afternoon chat with Journalist Tarric Brooker, as we unpack the weeks news, and considers the inflation story.

Tarric, as usual presents a great selection of slides and they are available to view at: https://avidcom.substack.com/p/charts-that-matter-from-dfa-appearance

He is on Twitter as @AvidCommentator.

Go to the Walk The World Universe at https://walktheworld.com.au/

Stocks finished with sharp losses in the US on Thursday, dropping after the January consumer-price index showed a much hotter-than-expected 7.5% year over year jump. And Equities took another leg lower in afternoon trade after St. Louis Federal Reserve Bank President James Bullard told Bloomberg that he would like to see the central bank deliver 100 basis points, or 1 percentage point, worth of rate increases over its next three meetings.

The Dow Jones Industrial Average dropped 1.47%, to close near 35,242, while the S&P 500 fell 1.81%, to close near 4,504. The NASDAQ Composite tumble 2.1%, ending near 14,186.

The Treasury Yield shot higher, with the 10 year up 5.67% to 2.036 – cross the 2% level for the first time since 2019. The two year was up 18.62% to 1.599. The markets thinks rates are going higher faster.

US inflation hit a 40-year-high in January after food, electricity, and shelter drove a bigger than expected rise in the consumer price index and pushed financial markets to price in a higher chance the Federal Reserve will hike rates by 0.50 percentage points in just over a fortnight.

Excluding the volatile food and energy components, so-called core prices increased 6% from a year ago, the most since 1982, and 0.6% from a month earlier.

Go to the Walk The World Universe at https://walktheworld.com.au/

Today’s post is brought to you by Ribbon Property Consultants.

If you are buying your home in Sydney’s contentious market, you do not need to stand alone. This is the time you need to have Edwin from Ribbon Property Consultants standing along side you.

Buying property, is both challenging and adversarial. The vendor has a professional on their side.

Emotions run high – price discovery and price transparency are hard to find – then there is the wasted time and financial investment you make.

Edwin understands your needs. So why not engage a licensed professional to stand alongside you. With RPC you know you have: experience, knowledge, and master negotiators, looking after your best interest.

Shoot Ribbon an email on info@ribbonproperty.com.au & use promo code: DFA-WTW/MARTIN to receive your 10% DISCOUNT OFFER.

I caught up with Steve from his bond kingdom. We discussed the latest from the FED, and the expected trajectory of inflation, bond rates and the potential for deflation as stimulus is withdrawn.

Why are the markets in inflationary la-la land?

Steven Van Metre, Certified Financial Planner™ Professional, (CA Insurance License #0D45202 & Investment Advisory Representative with Atlas Financial Advisors, Inc., a Registered Investment Advisory firm.) is a financial planner, portfolio manager, and President of Steven Van Metre Financial. He specializes in retirement income strategies and the direct management of client assets.

https://www.youtube.com/channel/UCRIQM-CUkxVazVPv980YZsw/videos

Go to the Walk The World Universe at https://walktheworld.com.au/

Join us for a live discussion as I discuss the current state of the property market with Veronica Morgan, the Founder and Principal of Good Deeds Property Buyers. She is also the co-host of the popular series Location Location Location Australia and Relocation Relocation Australia with Bryce Holdaway on Foxtel’s The Lifestyle Channel Australia.

You can tune into Veronica as she co-hosts the Your First Home Buyer Guide podcast & The Elephant in the Room property podcast, which investigates who is really in control when you buy property. She’s also recently co-founded Home Buyer Academy, which provides online support for first home buyers so they can get onto the property ladder without making costly mistakes.

You can ask a question live.

Go to the Walk The World Universe at https://walktheworld.com.au/

In the past few days, global bond markets, have entered a strong bear phase, thanks to Central bank messaging about controlling inflation – transitory now having been largely dropped (perhaps except in Australia), and so as bond prices fall, bond yields rise with a renewed push toward new multi-year highs.

There is clear bearish momentum, on bonds, but it is also supported both by technicals and data outcomes such as the upside surprise in the US jobs report last Friday. In the US, the market was already debating the prospects for a 50bps hike in March and that speculation is only likely to grow, despite the fact that the forward cash profile already implies more than 5 rate hikes in 2022.

US 10yr yields are up 20bps, while the 2yr counterparts which are higher by 30bps over the past fortnight. So, we should expect a move toward 2% for US 10yr bond yields and above.

As to what happened beyond, there is on one hand a clear path to higher bond yields, as prices continue to fall, so many holders will be looking to sell into any strength, to de-risk. But we need also to ask the impact on corporate bonds, and other loans, because, higher rates cost.

But the point is this seismic shift in rates will have consequences, and you have to ask how things will play though into equities. The short answer is, prices will fall, but the longer answer is it will depend on the sector with companies able to pass rising costs on, and with positive cash flow and lower debt better placed.

To me the investment landscape is highly uncertain, so perhaps a time to remain cautious, rather than chasing the next meme.

Go to the Walk The World Universe at https://walktheworld.com.au/

Today’s post is brought to you by Ribbon Property Consultants.

If you are buying your home in Sydney’s contentious market, you do not need to stand alone. This is the time you need to have Edwin from Ribbon Property Consultants standing along side you.

Buying property, is both challenging and adversarial. The vendor has a professional on their side.

Emotions run high – price discovery and price transparency are hard to find – then there is the wasted time and financial investment you make.

Edwin understands your needs. So why not engage a licensed professional to stand alongside you. With RPC you know you have: experience, knowledge, and master negotiators, looking after your best interest.

Shoot Ribbon an email on info@ribbonproperty.com.au & use promo code: DFA-WTW/MARTIN to receive your 10% DISCOUNT OFFER.

The latest from Edwin Almeida, our property insider.

https://www.ribbonproperty.com.au/

Go to the Walk The World Universe at https://walktheworld.com.au/

NAB has revised down its outlook for property prices in 2022 and 2023, after predicting the first interest rate hike to occur in November this year.

Property prices are now expected to reach a “turning point” in the second half of 2022 before falling in 2023, according to the latest residential property survey from NAB’s Group Economics, led by group chief economist Alan Oster.

“Overall, we see dwelling prices rising around 3 per cent in 2022 before a decline of around 10 per cent in 2023,” NAB said.

A federal housing affordability inquiry is expected to hand down its final report in the coming weeks outlining recommendations on ways to improve housing affordability.

The Reserve Bank has emphasised the importance of lending standards as housing and business loans have bounced back following lockdowns.

The latest edition of our finance and property news digest with a distinctively Australian flavour.

Go to the Walk The World Universe at https://walktheworld.com.au/

We walk through the latest RBA chart pack. Some interesting facts to consider…

https://www.rba.gov.au/chart-pack/

The latest edition of our finance and property news digest with a distinctively Australian flavour.

Go to the Walk The World Universe at https://walktheworld.com.au/