APRA just released their Superannuation Fund-level Profiles and Financial Performance (interim edition). Superannuation funds included in this publication represent the vast majority of superannuation assets regulated by APRA. It contains data for all APRA-regulated superannuation funds with more than four members. Pooled superannuation trusts (PSTs) have been excluded from the publication publications as their assets are captured in other superannuation funds. Exempt public sector superannuation schemes (EPSSS) have also been excluded.

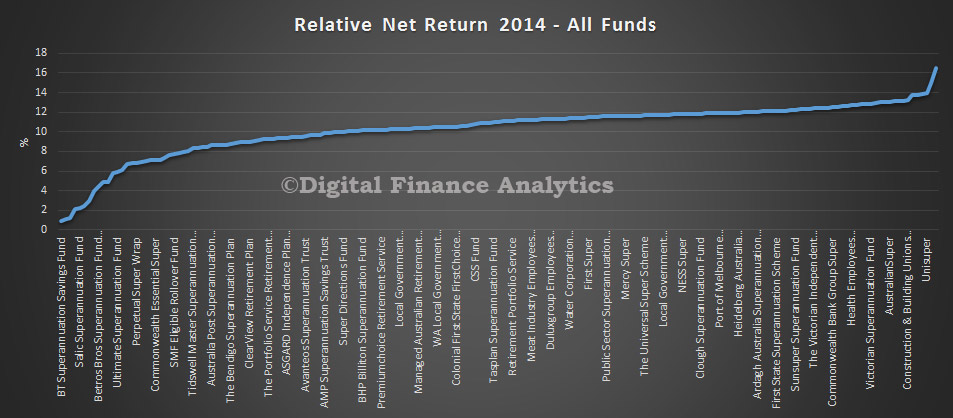

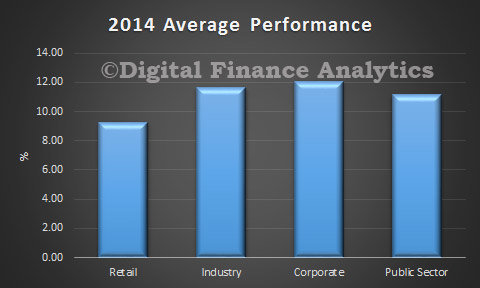

The fund by fund data tells an interesting story. The average across retail, corporate, public sector and industry funds was 13%. This is calculated by taking the returns and costs at a fund level to create a net fund return. Individual members within a fund will see different true returns, based on the options they choose and other elements. However, it gets interesting if we look across the nearly 2oo funds. Several funds are returning below 5%, and a few above 14%.

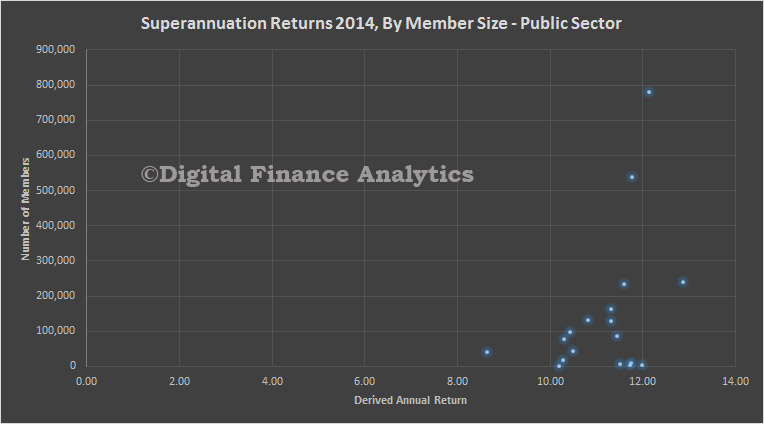

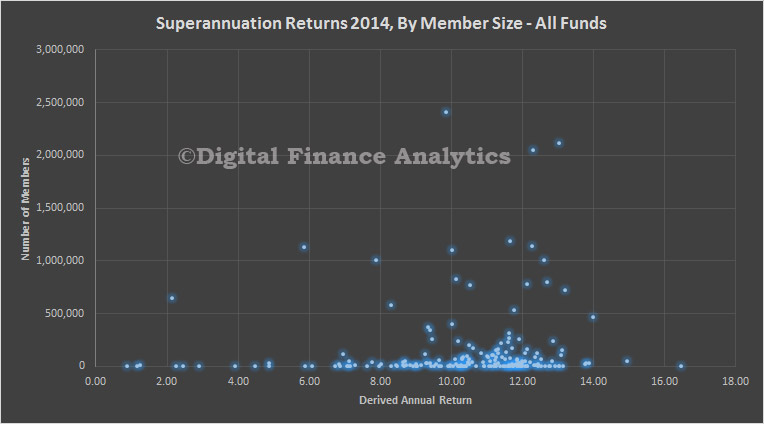

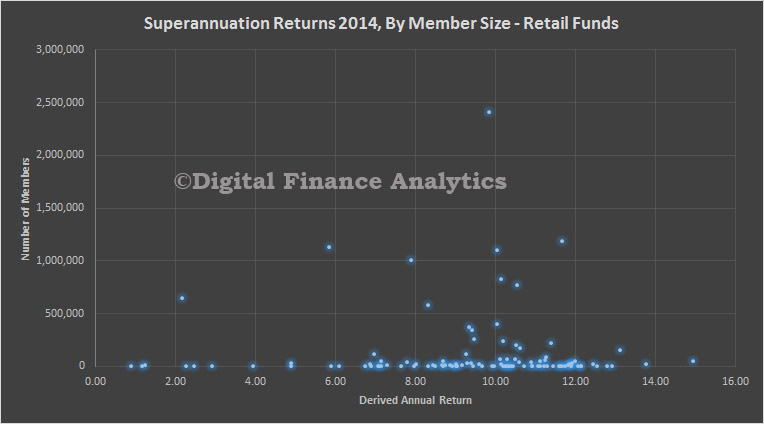

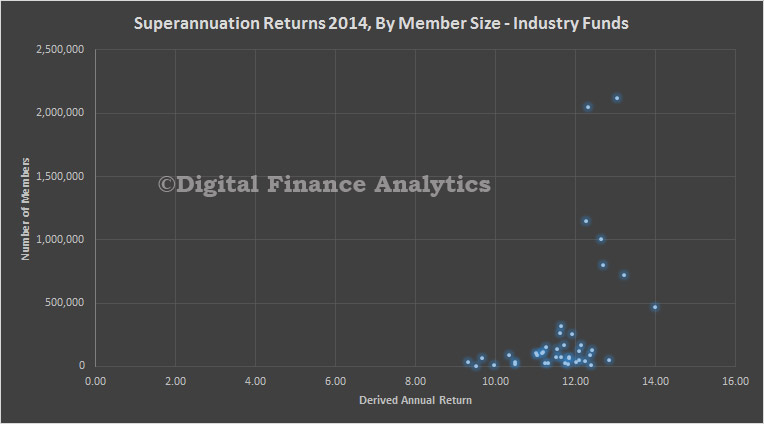

What is even more interesting is that the size of the fund is not a good predictor of performance. We can see this by mapping returns to number of members. The biggest fund returned under 10%, the next two between 12% and 14%. But we see some smaller funds out performing, and others languishing. That said, one year’s performance is not necessarily a good indicator of longer term performance anyhow.

What is even more interesting is that the size of the fund is not a good predictor of performance. We can see this by mapping returns to number of members. The biggest fund returned under 10%, the next two between 12% and 14%. But we see some smaller funds out performing, and others languishing. That said, one year’s performance is not necessarily a good indicator of longer term performance anyhow.

What is clear, is that Industry Funds, on average, still return more than retail funds. Corporate (private) funds do even better.

What is clear, is that Industry Funds, on average, still return more than retail funds. Corporate (private) funds do even better.

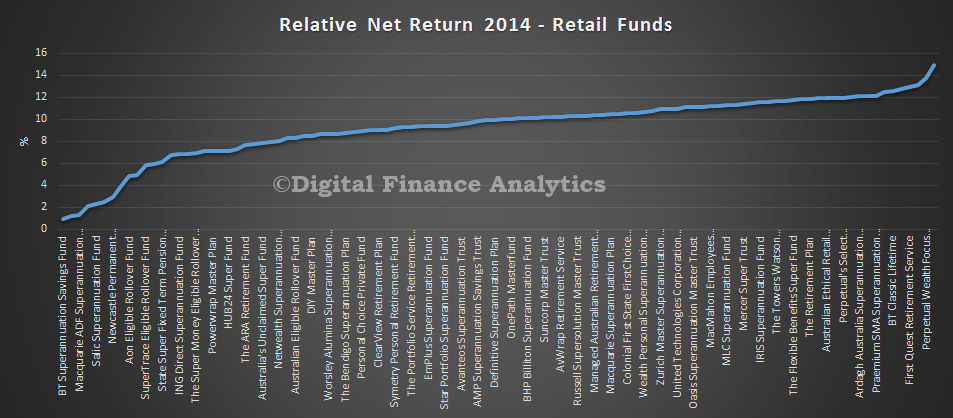

So, we can then look across each of the main types of fund. First, retail. There are about 100 retail funds. The average returns varies widely. Not all individual funds are listed here, but the graph includes all data points.

So, we can then look across each of the main types of fund. First, retail. There are about 100 retail funds. The average returns varies widely. Not all individual funds are listed here, but the graph includes all data points.

If we look across the membership, and return map, we see wide variations again. Some smaller funds outperformed the larger ones in 2014.

If we look across the membership, and return map, we see wide variations again. Some smaller funds outperformed the larger ones in 2014.

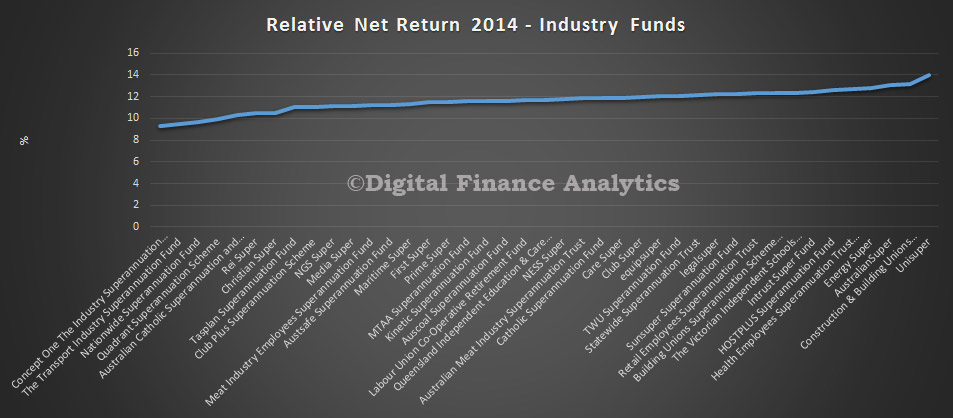

The industry funds, of which there are more than 40, did better, with no funds below 8%, even if their peak performance was 14%.

The industry funds, of which there are more than 40, did better, with no funds below 8%, even if their peak performance was 14%.

We also see that larger industry funds did better than the smaller ones, on average in 2014.

We also see that larger industry funds did better than the smaller ones, on average in 2014.

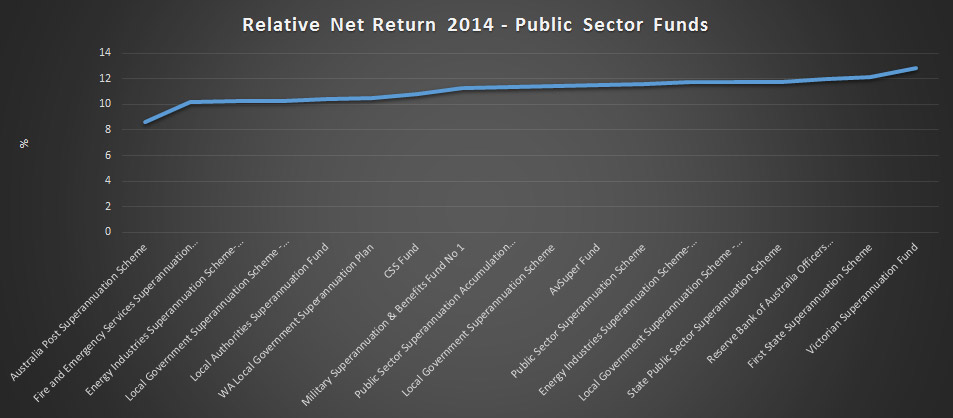

Finally, we look at public sector funds. The 18 funds here did better than retail funds …

Finally, we look at public sector funds. The 18 funds here did better than retail funds …