The Australian Competition and Consumer Commission is reminding large businesses of a new ban on charging consumers excessive payment surcharges, which commences today.

“The new law limits the amount a large business can charge customers for use of payment methods such as most credit and debit cards. Businesses can only pass on the permitted costs of the payment method such as bank fees and terminal costs,” ACCC Chairman Rod Sims said.

“The new law has caused many large businesses to review their pricing practices. We expect to see a move from flat-fee surcharges for purchasing items like flights, towards percentage-based or capped surcharges. The ACCC is aware that some event ticketing companies are intending to change their pricing practices from 1 September such that consumers will no longer be charged fees based on the payment method chosen.”

The RBA has indicated, as a guide, that the costs to merchants of accepting payments by debit cards is in the order of 0.5%, by credit card is 1-1.5%, and for American Express cards it is 2-3%. Some merchants’ costs might be higher than these indicative figures.

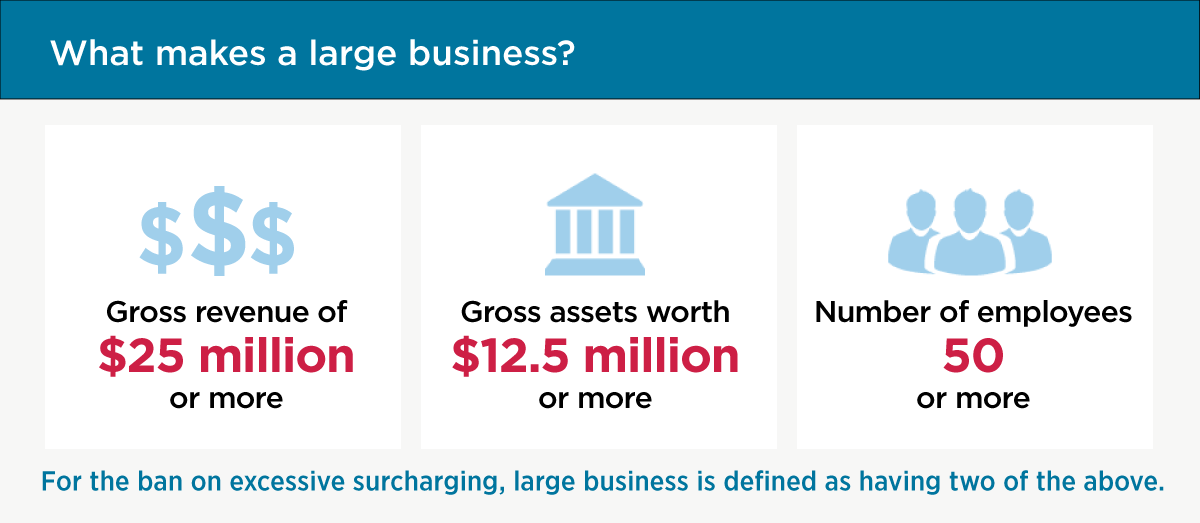

For the first year the law only applies to large businesses, defined as having two of the following: gross revenue of $25 million or more, gross assets worth $12.5 million or more, or with 50 or more employees. It will apply to all businesses from 1 September 2017.

The ACCC has been raising awareness of the ban in the lead up to 1 September, including engaging with many large businesses to ensure they are aware of their obligations.

Consumers who believe they have been charged an excessive surcharge can contact the ACCC via our website.

“We will be enforcing these new rules from today, and the ACCC encourages all large businesses that haven’t already to ensure their payment charging methods are in line with the new law,” Mr Sims said.

It is important to note that businesses can still charge other fees, such as ‘booking fees’ or ‘service fees’ which apply regardless of the method of payment. In doing so, those businesses must still comply with the Australian Consumer Law in terms of ensuring the disclosure of any such fees is upfront and clear.

Passing on the cost of processing debit and credit card payments is not mandatory for businesses. Indeed, the ban has no effect on businesses that choose not to impose a payment surcharge.

The ACCC has published online guidance material for consumers and businesses.