A really interesting, if technical paper from the Reserve Bank New Zealand, Analytical Note Series “Funding cost pass-though to mortgage rates“. It shows the weaker linkage now between the official cash rate and mortgage rates, compared with before the GFC. It also shows that variable rates are more susceptible to lags in rates compared with fixed rates, and that fixed rates are were the competition is stronger.

These results emphasise the role of wider funding costs, not just monetary policy, for how banks set their mortgage rates. This is particularly the case for fixed-rate mortgages, given increased variability in funding costs and the composition of bank funding. It also shows how competition, and margin preservation are in play within the banks. We suspect the same in true in Australia.

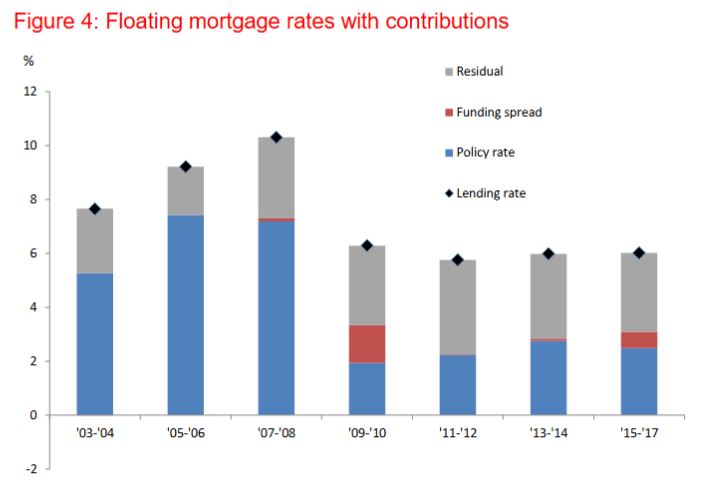

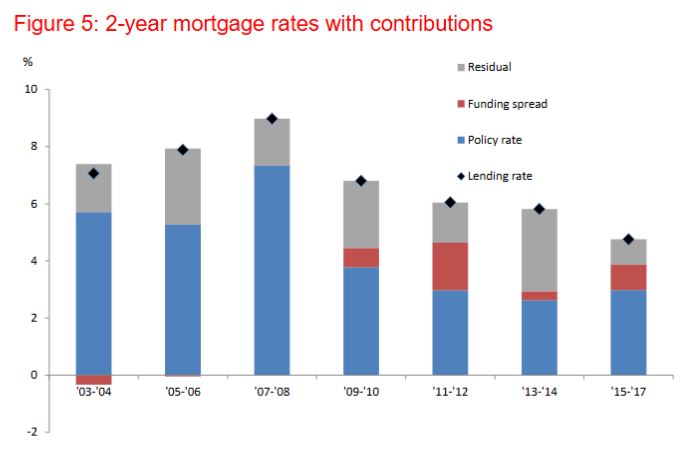

Prior to the global financial crisis (GFC), there was a relatively stable relationship between the Official Cash Rate (OCR) and retail mortgage rates. Changes in the OCR were typically accompanied by a proportional change in floating mortgage rates. However, this relationship has deteriorated since the GFC and the OCR on its own has not been a good proxy for bank funding costs. This paper examines the change in the transmission of the OCR, and the role of other funding costs for retail mortgage rates since the GFC.

Banks now place greater reliance on more stable (but more costly) sources of funding. They rely on domestic deposits and long-term wholesale funding more, and less on short-term wholesale funding. This has resulted in a wider and more volatile spread between mortgage rates and the OCR. Not all changes in the OCR have passed through one-for-one into floating mortgage rates, as funding costs from other sources have sometimes been offsetting.

We construct a comprehensive estimate of bank funding costs using a weighted average of the cost of domestic deposits, short-term wholesale funding and long-term wholesale funding. This weighted-average measure is further decomposed into a monetary policy rate component and a funding spread component. We use an error correction framework to measure the relative contributions of the policy rate and funding spreads to the level of mortgage rates in New Zealand, and estimate the speed of pass-through to mortgage rates from changes in funding costs.

Our results suggest that funding spreads have been larger post-GFC, and have had a larger impact on the level of fixed-rate mortgages than on floating rates. There has also been a significant slowdown in the pass-through from policy and funding spreads to the floating mortgage rate.

The speed of pass-through to fixed-rate mortgages has slowed only slightly.

Note: The Analytical Note series encompasses a range of types of background papers prepared by Reserve Bank staff. Unless otherwise stated, views expressed are those of the authors, and do not necessarily represent the views of the Reserve Bank.

Note: The Analytical Note series encompasses a range of types of background papers prepared by Reserve Bank staff. Unless otherwise stated, views expressed are those of the authors, and do not necessarily represent the views of the Reserve Bank.