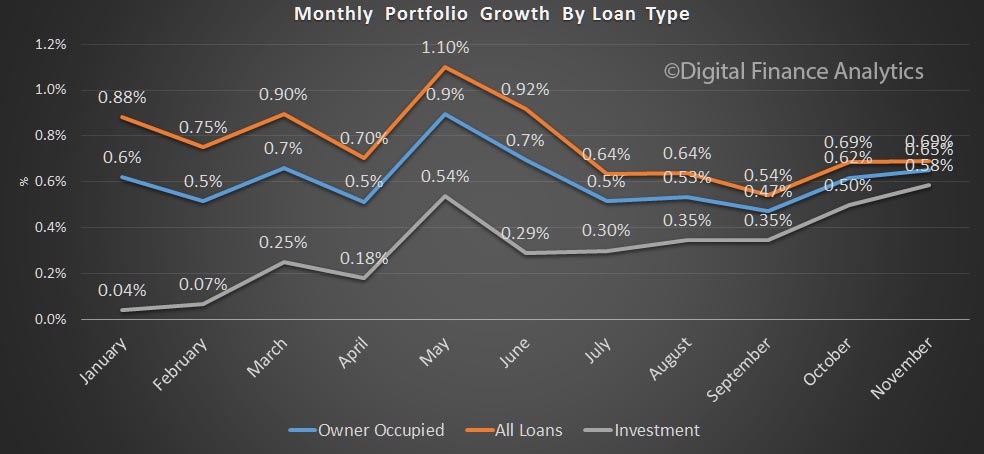

APRA released their monthly banking stats for November 2016. The total loan portfolio rose 0.65% in the month to a new high of $1.51 trillion. Within that, owner occupied lending rose 0.69% by $6.7 billion, to $977 billion and investment lending rose 0.58%, by $3.1 billion to $536 billion; accounting for 35.44% of all loans. We see investment lending still accelerating (as expected, based on our household surveys).

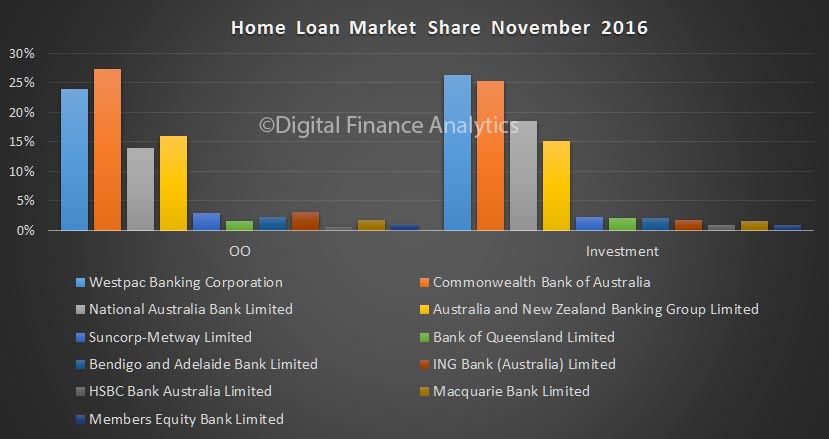

Looking at the individual lenders, CBA wrote more investment loans than WBC in the month, though WBC just holds on to its prime position for investment loans.

Looking at the individual lenders, CBA wrote more investment loans than WBC in the month, though WBC just holds on to its prime position for investment loans.

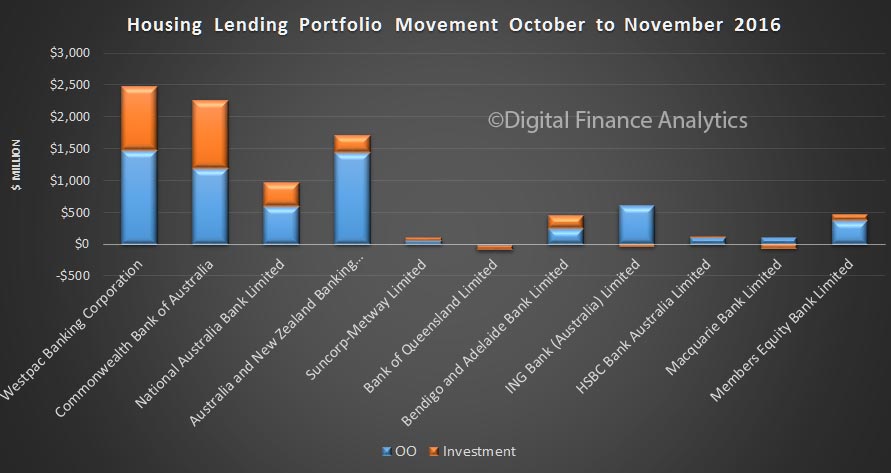

Overall WBC wrote the most new business, $2.48 billion. compared with CBA’s $2.26 billion.

Overall WBC wrote the most new business, $2.48 billion. compared with CBA’s $2.26 billion.

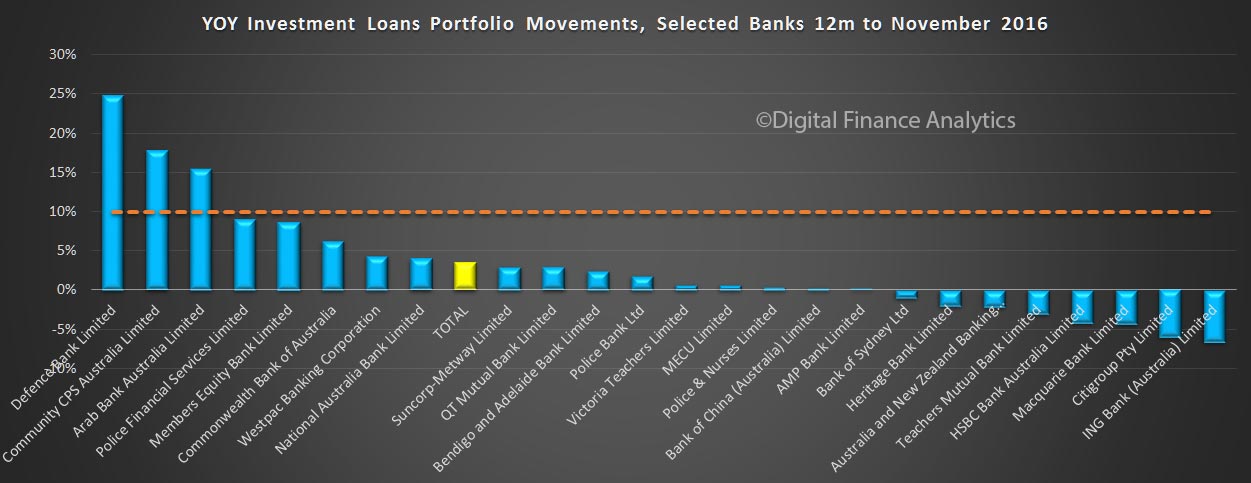

The 12 month system investment portfolio movement is 3.5%, but has accelerated in recent months. Testing against the 10% APRA speed limit, we see that most lenders are well below this threshold. We think the limit should be dropped, as investment loan momentum is too strong, and well above inflation and wage growth. APRA never really explained why they picked 10% – time for more macro-prudential action!

The 12 month system investment portfolio movement is 3.5%, but has accelerated in recent months. Testing against the 10% APRA speed limit, we see that most lenders are well below this threshold. We think the limit should be dropped, as investment loan momentum is too strong, and well above inflation and wage growth. APRA never really explained why they picked 10% – time for more macro-prudential action!

The RBA data will be out soon, so we will see if the market – including the non-banks moved the same way.

The RBA data will be out soon, so we will see if the market – including the non-banks moved the same way.