The 2019 half year results from BOQ today really underscores the pressures on the banks – especially regional ones – as home lending slows, and competition for the remaining business rises. And they see similar pressures ahead.

Banking is no longer the cash generating machine it use to be. Expect more loan repricing ahead to try and stablise the business. Their shares were lower. The dividend was cut.

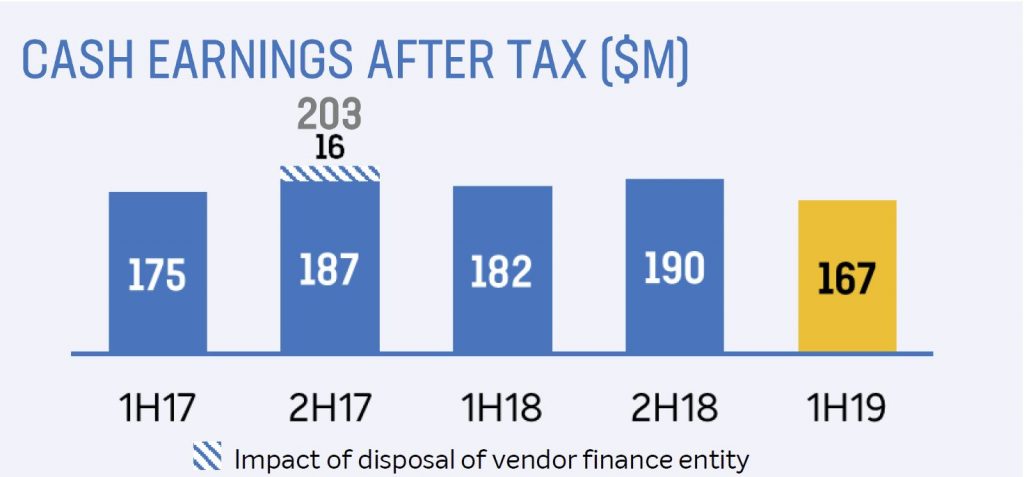

Their cash earnings after tax of $167 million, down 8% compared with 1H18, and 12% down on 2H18. This was pretty much as expected.

Their statutory net profit after tax of $156 million, down 10% on 1H18, or 4% down on 2H18.

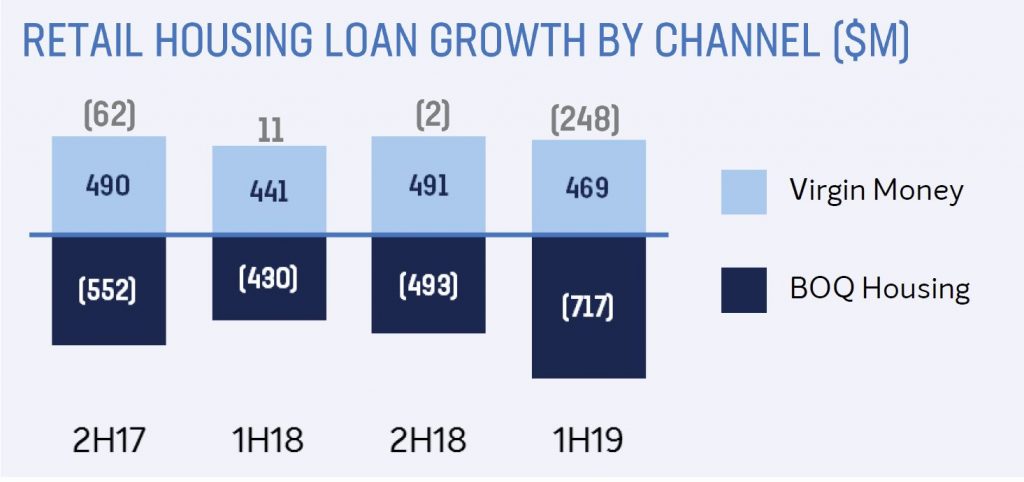

Gross loan growth was 2% in a slowing market, with housing growth through Virgin Money and BOQ Specialist, offset by contraction in branch network.

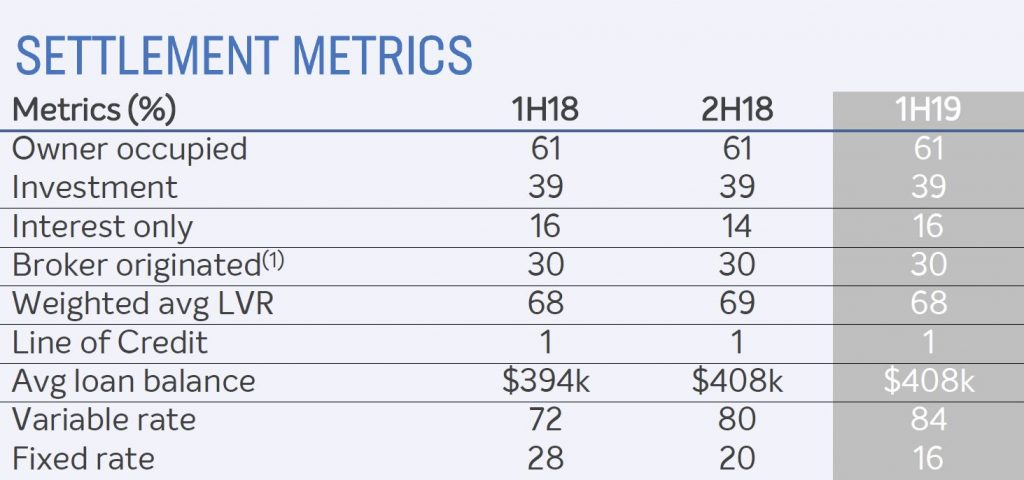

Home lending settlements included 39% investment lending (higher than the current industry average), 30% via brokers, and 16% interest only lending.

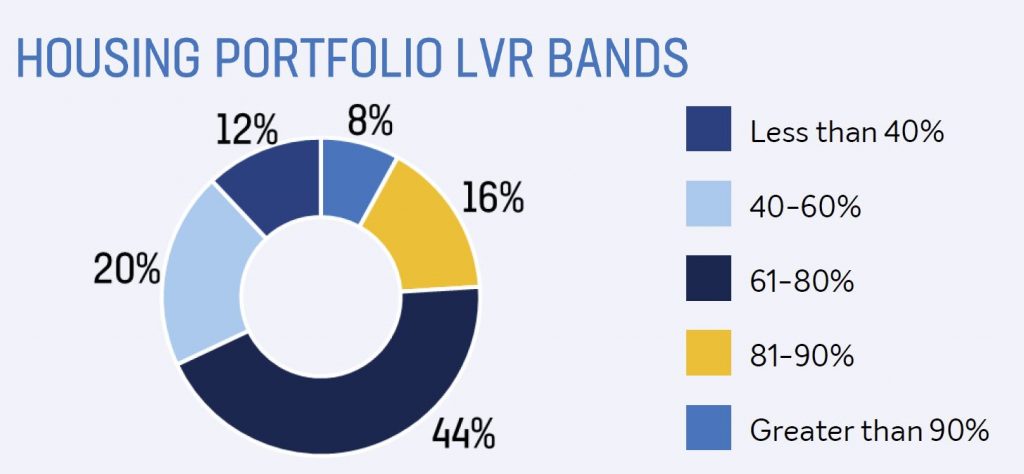

Home Lending LVR’s included 24% above 81% LVR in portfolio. Could become a problem is home prices go on falling.

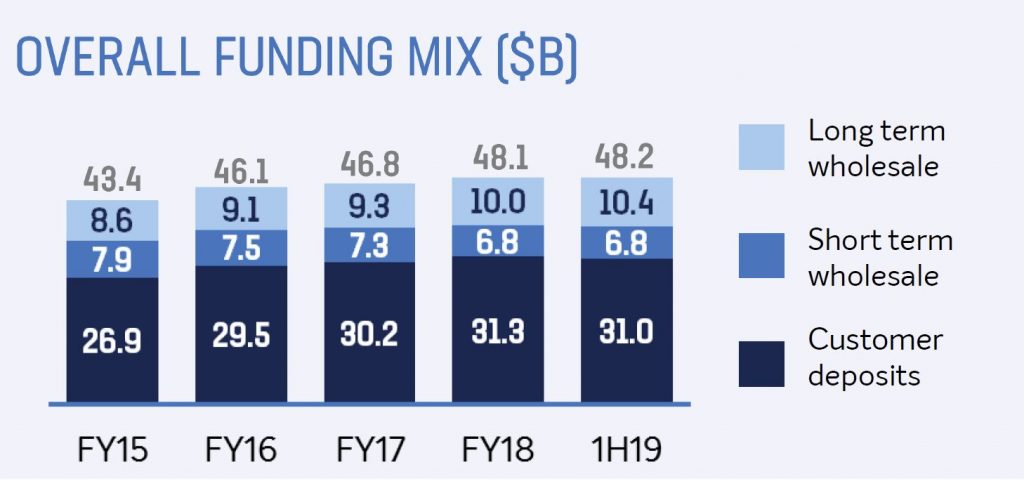

Customer deposits contracted, driven by a reduction in higher cost Term deposits, with a deposit to loan ratio of 68%

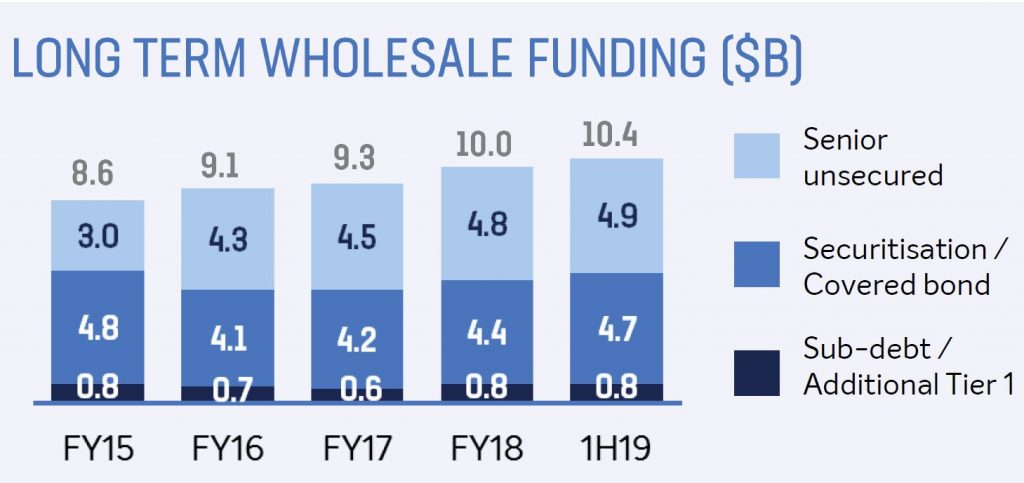

They took advantage of more favourable conditions for long term wholesale issuance

Net interest income was $215m, down 5% compared with 1H18 for the retail banks, and $216m, up 4% for the business bank.

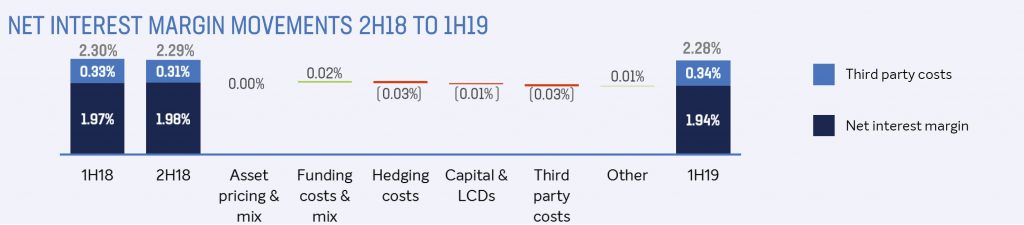

Net Interest Margin was down 4 basis points to 1.94%

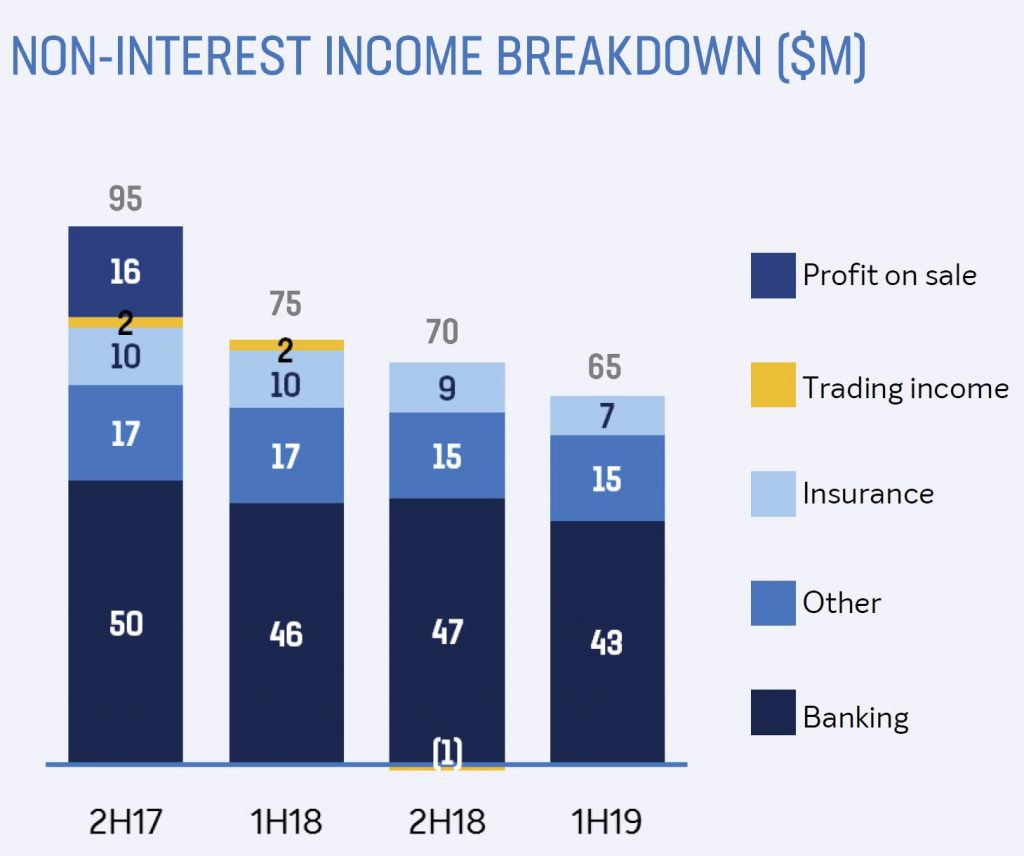

Non interest income was lower at $65m compared with $75m 1H18.

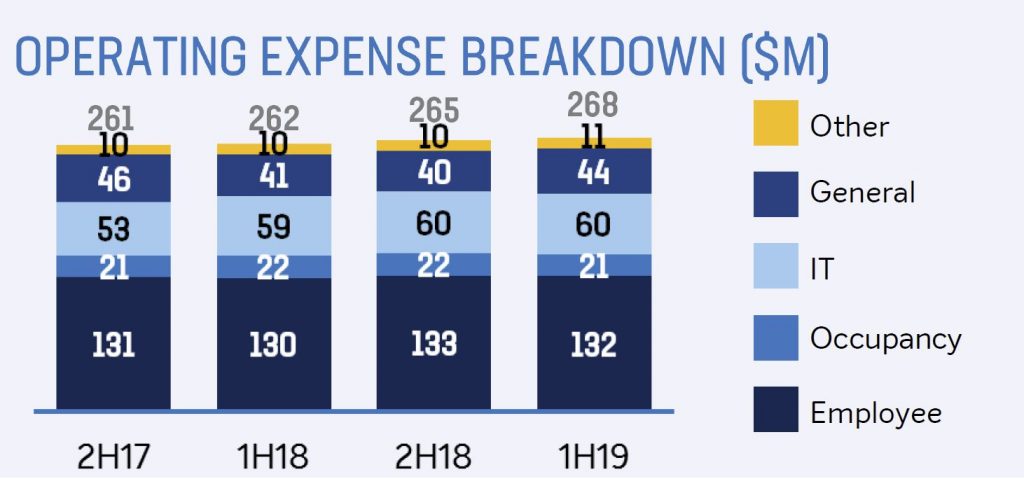

Their cost to income ratio was up 190 bps to 49.5%; They expect amortisation to increase with ongoing investment, plus rising regulatory & compliance costs expected going forward. In fact BOQ took a further $3m below the line for regulatory and compliance spend and $1m for legacy costs.

Operating expense growth was 2% to $268m and they expect higher costs ahead, with an additional $10m for regulatory costs.

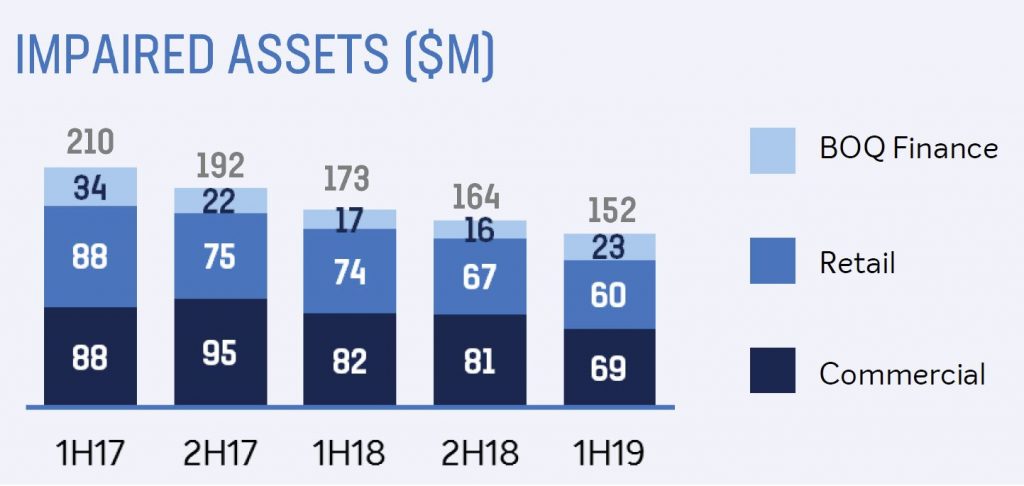

Impaired assets were down to $152m 1H19.

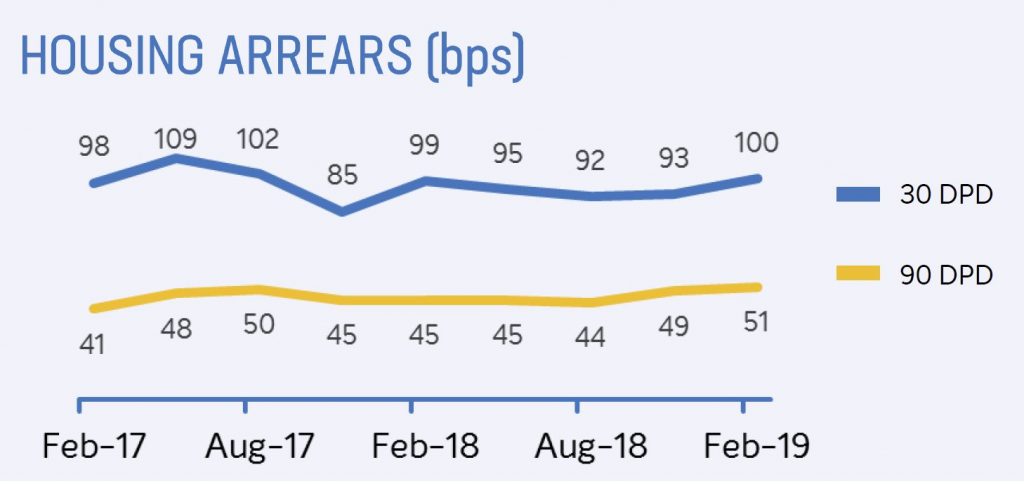

They reported a loan impairment expense of $30 million or 13 basis points of gross loans. There was an uptick in housing arrears.

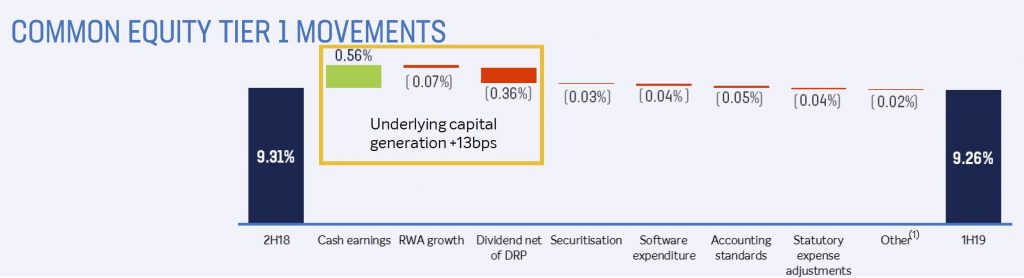

Common Equity Tier 1 (CET1) capital ratio of 9.26%, down from 9.31% 2H18.

The basic earnings per share down 10% to 41.8 cents on 1H18, but 13% down on 2H18.

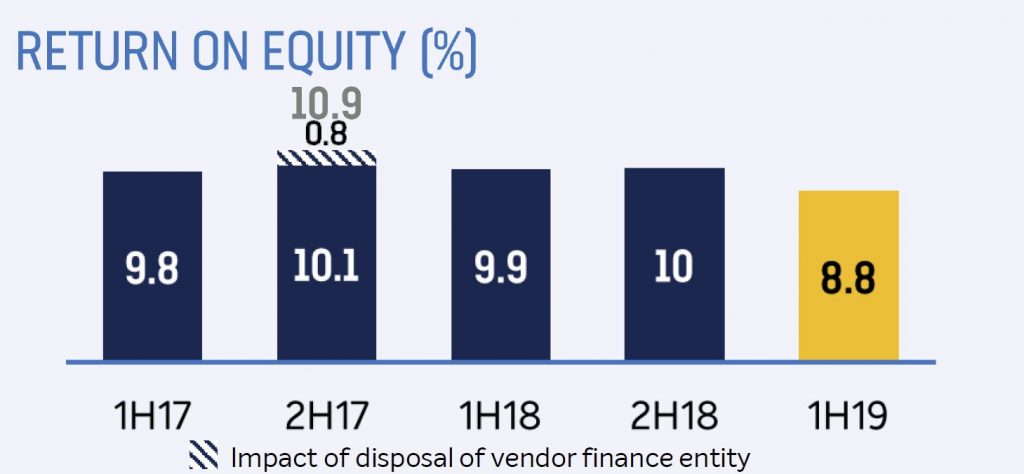

Their return on average ordinary equity was down 110 bps to 8.8%

The fully franked interim dividend was 34 cents per ordinary share, down from 38 cents.