BOQ has delivered record statutory and cash profit results for the financial year to 31 August 2015, despite strong competition, and funding pressure. Growth in broker originated home loans helped. Statutory profit after tax was up 22% on the prior year to $318 million and was helped by a reduction in impaired assets. As a standard capital bank, it may benefit from the higher IRB capital being required of the majors. In summary, BOQ bears the hallmarks of a well run business, so is well positioned to leverage digital transformation and growth beyond Queensland next year. Unless of course the housing market goes pear-shaped!

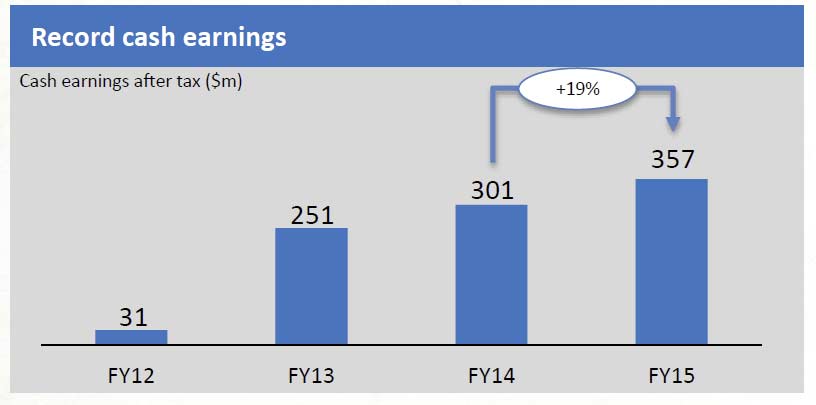

After tax cash earnings increased 19% on FY14 driven by higher net interest margin, a strong full year contribution from BOQ Specialist and further improvement in impairment expense. Basic cash earnings per share grew 9% to 97 cents per share.

After tax cash earnings increased 19% on FY14 driven by higher net interest margin, a strong full year contribution from BOQ Specialist and further improvement in impairment expense. Basic cash earnings per share grew 9% to 97 cents per share.

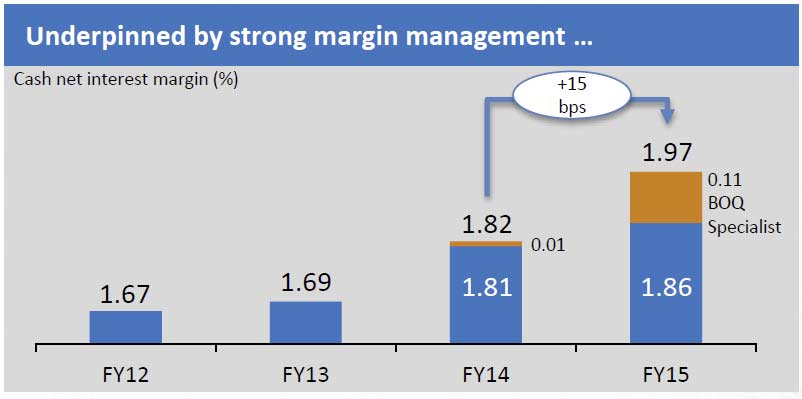

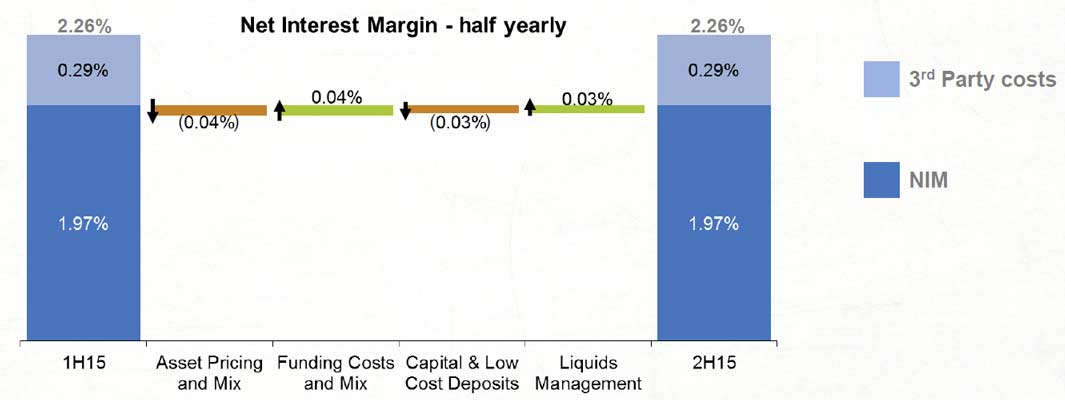

Net interest margin for the full year was 1.97%, up 15 basis points on the prior year due largely to the higher margin BOQ Specialist business.

Net interest margin for the full year was 1.97%, up 15 basis points on the prior year due largely to the higher margin BOQ Specialist business.

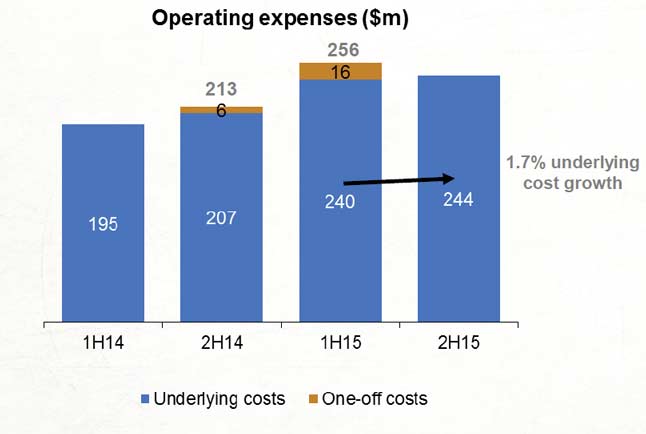

The Group’s cost to income ratio increased to 46%, up from 43.9% in the prior year, due to some one off items.

The Group’s cost to income ratio increased to 46%, up from 43.9% in the prior year, due to some one off items.

The FY15 impairment expense of $74 million was a $12 million (14%) improvement on the prior year. Impaired assets declined by $56 million (19%) to $237 million following a reduction in new impaired assets and continued momentum in realisations.

The FY15 impairment expense of $74 million was a $12 million (14%) improvement on the prior year. Impaired assets declined by $56 million (19%) to $237 million following a reduction in new impaired assets and continued momentum in realisations.

BOQ Finance’s loan impairment expense increased $10 million which was primarily attributable to the impact of the mining industry downturn on associated sectors.

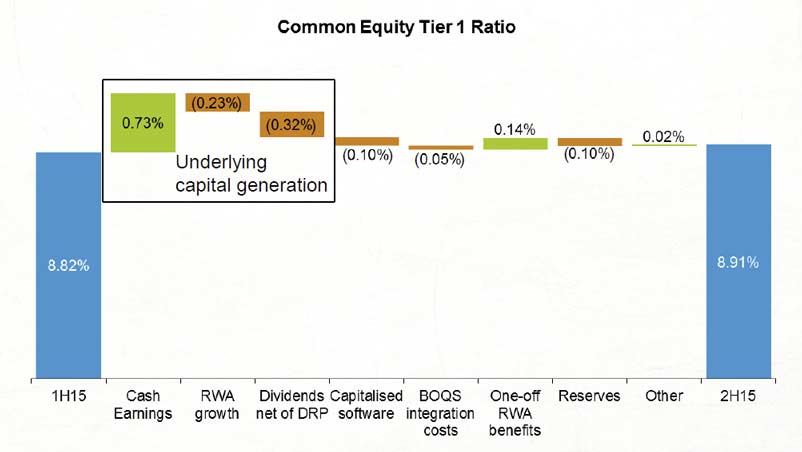

The Group further strengthened its capital ratios during the year with the CET1 ratio increasing 28 basis points to 8.91%. CET1 increased in the second half as underlying cash earnings supported 7% annualised loan growth and a two cent increase in the final dividend.

The Bank will pay a final dividend of 38 cents per share, up two cents on the previous corresponding period, taking full year dividends to 74 cents per share fully franked.

The Bank will pay a final dividend of 38 cents per share, up two cents on the previous corresponding period, taking full year dividends to 74 cents per share fully franked.

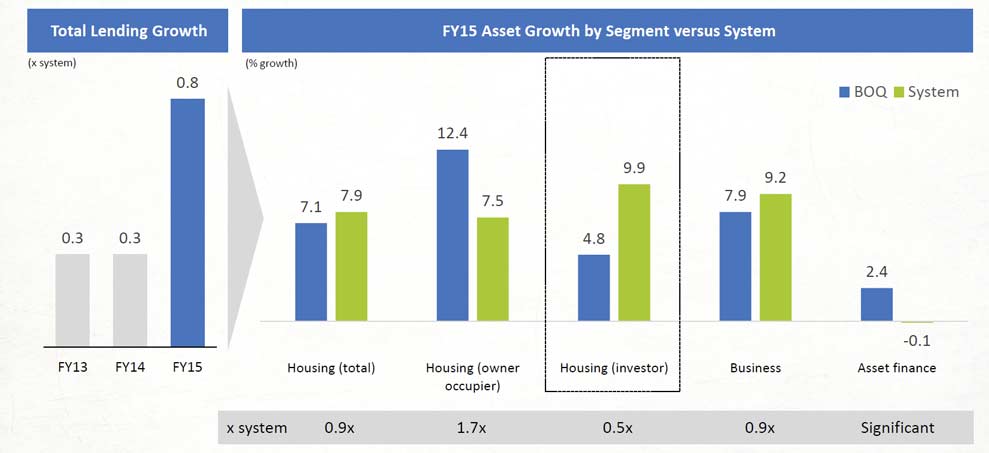

New distribution channels, including brokers, also helped diversify BOQ’s asset base, with the proportion of total lending in Queensland falling below 50% for the first time.

The housing portfolio grew $1.9 billion or 7% (0.9x System) supported by the contribution of BOQ Specialist, which generated growth of $1.3 billion. The mortgage broker channel, which accounted for 15% of the Retail Bank’s housing settlements, was up from 5% in the prior year.

Commercial lending balances grew 8% to $8.3 billion while BOQ Specialist’s commercial book increased 14% to $2.3 billion.

Commercial lending balances grew 8% to $8.3 billion while BOQ Specialist’s commercial book increased 14% to $2.3 billion.

The BOQ Finance portfolio grew by 2% to $4 billion, a solid result in an operating environment that has seen sluggish investment in plant and equipment. BOQ Finance’s strategy of expanding its third party origination sources while continuing to support the Business and Retail Bank network has positioned the business for future growth.

BOQ Specialist contributed $43 million to the Group’s FY15 result in its first full year since acquisition, exceeding the maintainable earnings guidance of $38 million announced at the time of acquisition by 13%.

The business delivered loan growth of $1.6 billion while maintaining margins and credit quality. BOQ Specialist serves health, medical and accounting customers and continues to benefit from the higher growth rates of these segments compared to the broader economy.

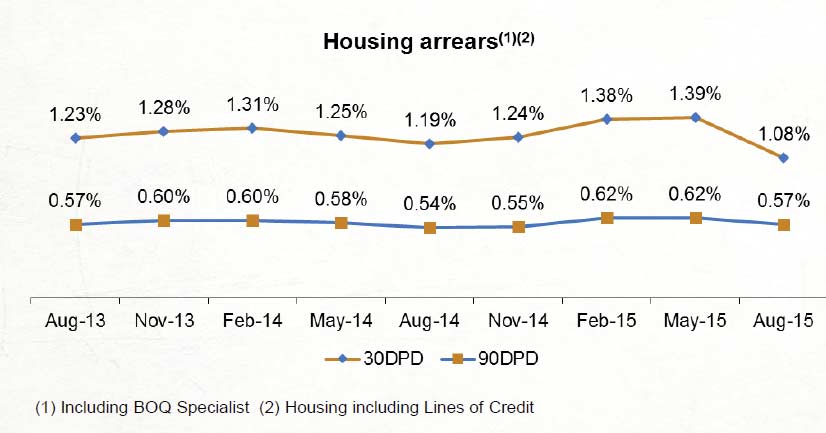

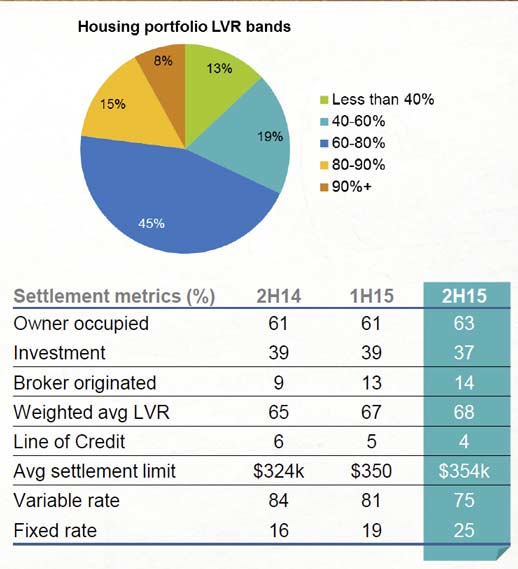

Looking at the housing data in more detail, the LVR and loan mix remains stable.

Housing loan arrears are under control, and fell a little in August.

Housing loan arrears are under control, and fell a little in August.