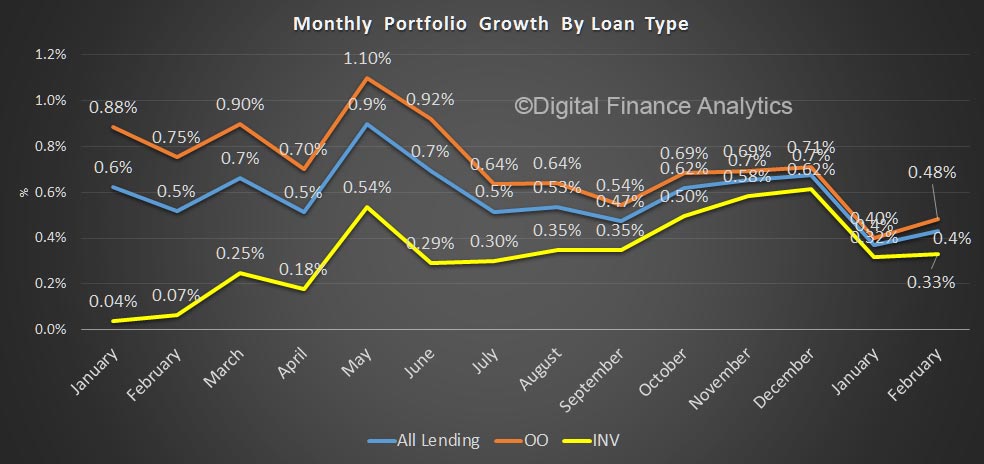

APRA released their monthly statistics for February 2017 today. Overall lending for housing rose 0.4% (which is lower than the market rate of 0.6%, implying the non-bank sector is growing faster, and may account for APRA today saying they wanted to limit the bank’s ability to warehouse mortgages for other lenders prior to their securitisation).

This means the banks total book is now worth $1.54 trillion. Within that owner occupied loans rose 0.48% to $993 billion, whilst investment loans rose 0.33% to $543 billion, or 35.4%. This tells us that more investors are going to the non-banks – which are not regulated by APRA, but by ASIC as commercial companies – and they do not have the same capital requirements as the banks – this is a major regulatory blind-spot.

This means the banks total book is now worth $1.54 trillion. Within that owner occupied loans rose 0.48% to $993 billion, whilst investment loans rose 0.33% to $543 billion, or 35.4%. This tells us that more investors are going to the non-banks – which are not regulated by APRA, but by ASIC as commercial companies – and they do not have the same capital requirements as the banks – this is a major regulatory blind-spot.

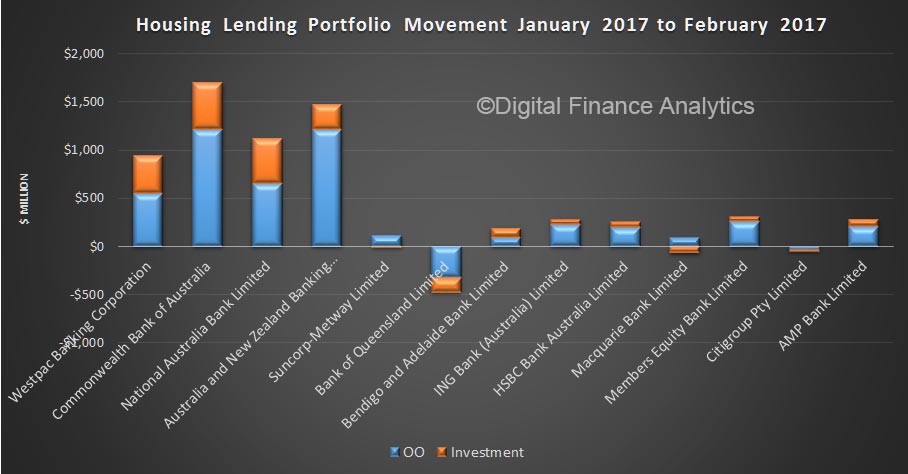

Looking at the ADI’s portfolio movements, CBA wrote the net largest loan volumes, followed by ANZ, then NAB. Westpac had the weakest growth among the big four. Among the smaller players, Bank of Queensland went backwards, whilst ME Bank and and AMP Bank grew relatively strongly.

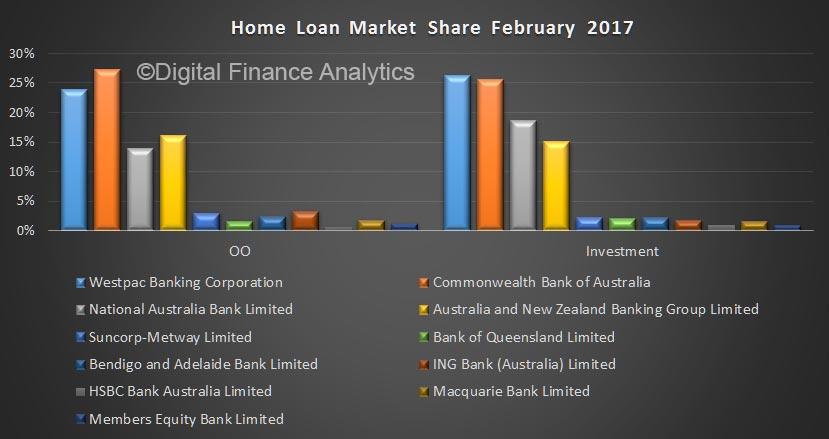

The overall market share of the majors show CBA with the largest share of the OO market, and Westpac still in pole position (just) on investment loans. ANZ has a larger share than NAB of owner occupied loans, whilst in the investment loan sector, the position is reversed.

The overall market share of the majors show CBA with the largest share of the OO market, and Westpac still in pole position (just) on investment loans. ANZ has a larger share than NAB of owner occupied loans, whilst in the investment loan sector, the position is reversed.

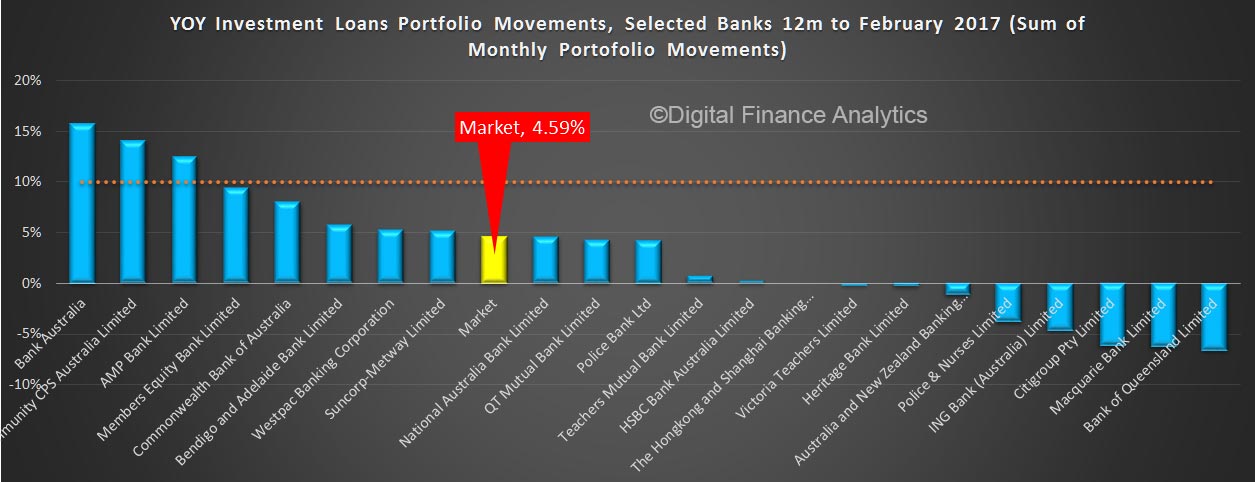

The APRA speed limit of 10% is higher than the annualised growth rate (which we calculate by summing the monthly movements from APRA), and we see that all the major players are “comfortably below” the 10%.

The APRA speed limit of 10% is higher than the annualised growth rate (which we calculate by summing the monthly movements from APRA), and we see that all the major players are “comfortably below” the 10%.

All in all then, we think the banks will still be writing more investment loans, and as a result, we expect the investor lending party will continue until such time as the tax breaks are reduced (which just might happen in the budget?). Therefore home prices are set to continue to push higher, as household debt rises higher. In addition, the out of cycle rises on investor loans will bolster bank profits, whilst the additional interest costs will be born by tax payers, as investors who are negatively geared offset the higher borrowing costs. There is nothing here that will fundamentally change the trajectory of the market.

All in all then, we think the banks will still be writing more investment loans, and as a result, we expect the investor lending party will continue until such time as the tax breaks are reduced (which just might happen in the budget?). Therefore home prices are set to continue to push higher, as household debt rises higher. In addition, the out of cycle rises on investor loans will bolster bank profits, whilst the additional interest costs will be born by tax payers, as investors who are negatively geared offset the higher borrowing costs. There is nothing here that will fundamentally change the trajectory of the market.

One final point, APRA in their earlier release mentioned the Council of Financial Regulators, the body where the Treasury, RBA APRA and ASIC all sit to discuss strategy, so we have to assume there was agreement to adopt the current stance across these bodies.