The Bank for International Settlements has released the now agreed Basel III framework. Many of the measures will have a 2022 target implementation data. They will tend to lift capital requirements higher, and reduce the potential advantage of adopting advanced IRB models. Investment mortgage lending will attract higher weights.

APRA will, we assume take account of this framework when their paper on capital is issued, now expected in the new year (presumably to take account of the BIS announcement).

Here is a quick summary, of some of the main take outs. However, the new revisions makes the Basel framework ever more complex.

The Basel III framework is a central element of the Basel Committee’s response to the global financial crisis. It addresses a number of shortcomings in the pre-crisis regulatory framework and provides a foundation for a resilient banking system that will help avoid the build-up of systemic vulnerabilities. The framework will allow the banking system to support the real economy through the economic cycle.

The initial phase of Basel III reforms focused on strengthening the following components of the regulatory framework:

- improving the quality of bank regulatory capital by placing a greater focus on going-concern loss-absorbing capital in the form of Common Equity Tier 1 (CET1) capital;

- increasing the level of capital requirements to ensure that banks are sufficiently resilient to withstand losses in times of stress;

- enhancing risk capture by revising areas of the risk-weighted capital framework that proved to be acutely miscalibrated, including the global standards for market risk, counterparty credit risk and securitisation;

- adding macroprudential elements to the regulatory framework, by: (i) introducing capital buffers that are built up in good times and can be drawn down in times of stress to limit procyclicality; (ii) establishing a large exposures regime that mitigates systemic risks arising from interlinkages across financial institutions and concentrated exposures; and (iii) putting in place a capital buffer to address the externalities created by systemically important banks;

- specifying a minimum leverage ratio requirement to constrain excess leverage in the banking system and complement the risk-weighted capital requirements; and

- introducing an international framework for mitigating excessive liquidity risk and maturity transformation, through the Liquidity Coverage Ratio and Net Stable Funding Ratio.

The Committee’s now finalised Basel III reforms complement these improvements to the global regulatory framework. The revisions seek to restore credibility in the calculation of risk-weighted assets (RWAs) and improve the comparability of banks’ capital ratios by:

- enhancing the robustness and risk sensitivity of the standardised approaches for credit risk, credit valuation adjustment (CVA) risk and operational risk;

- constraining the use of the internal model approaches, by placing limits on certain inputs used to calculate capital requirements under the internal ratings-based (IRB) approach for credit risk and by removing the use of the internal model approaches for CVA risk and for operational risk;

- introducing a leverage ratio buffer to further limit the leverage of global systemically important banks (G-SIBs); and

- replacing the existing Basel II output floor with a more robust risk-sensitive floor based on the Committee’s revised Basel III standardised approaches.

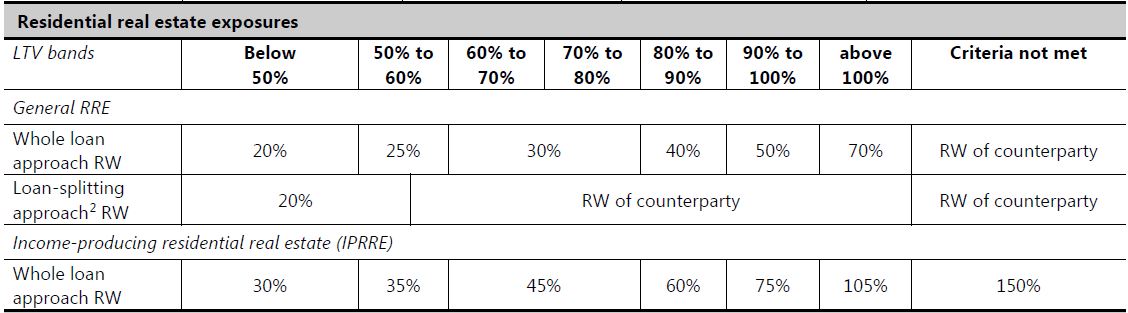

Banks on the standard approach will need to incorporate mortgage risk weights depend on the loan-to-value (LTV) ratio of the mortgage and different risks for investment property.

They also changed the risk weights on commercial real estate and will reducing mechanistic reliance on credit ratings.

They also changed the risk weights on commercial real estate and will reducing mechanistic reliance on credit ratings.

The financial crisis highlighted a number of shortcomings related to the use of internally modelled approaches for regulatory capital, including the IRB approaches to credit risk. These shortcomings include the excessive complexity of the IRB approaches, the lack of comparability in banks’ internally modelled IRB capital requirements and the lack of robustness in modelling certain asset classes.

To address these shortcomings, the Committee has made the following revisions to the IRB approaches: (i) removed the option to use the advanced IRB (A-IRB) approach for certain asset classes; (ii) adopted “input” floors (for metrics such as probabilities of default (PD) and loss-given-default (LGD)) to ensure a minimum level of conservativism in model parameters for asset classes where the IRB approaches remain available; and (iii) provided greater specification of parameter estimation practices to reduce RWA variability.

The Financial Stability Board welcomed the announcement.

The Financial Stability Board (FSB) welcomes the announcement by the Group of Central Bank Governors and Heads of Supervision (GHOS), the oversight body of the Basel Committee on Banking Supervision, that agreement has been reached on the finalisation of Basel III. The agreement improves the comparability of banks’ risk-weighted assets and reinforces the credibility of the bank capital framework. Agreement on these final elements means that one of the key reforms pursued to address the causes of the global financial crisis has been completed and can be fully implemented.