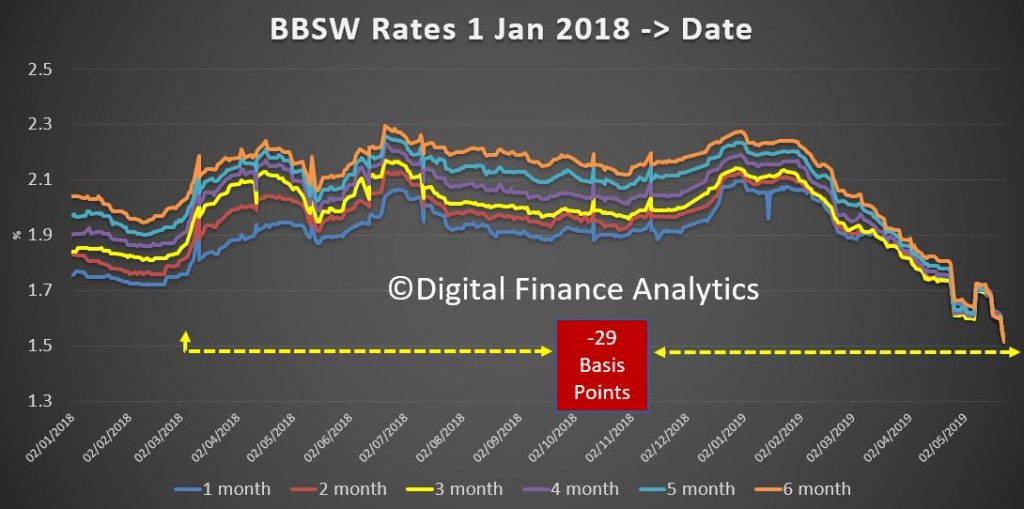

The Bank Bill Swap Rate continues to track down, which means that Banks are sitting on considerable funding advantage, which is being used to discount attractor mortgage rates.

However, there is a strong case now for banks to reverse their out of cycle rate hikes imposed on borrowers over recent months, irrespective of whether the RBA moves the cash rate down next month.

This would help household with their budgets, and help support the weakening economy. They could also stop the rot in terms of falling bank deposit rates.

The question is, will they?