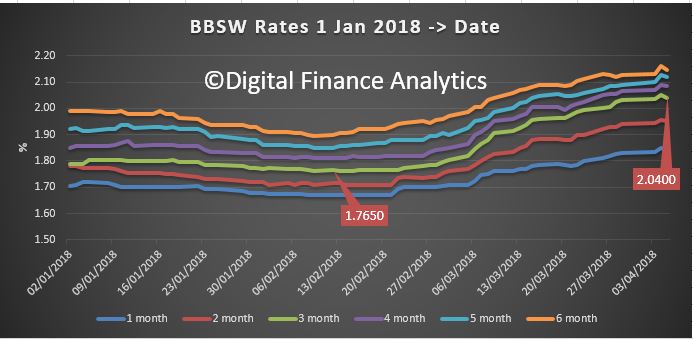

The latest BBSW data shows the trajectory in recent weeks. This will add more pressure to bank funding costs.

The question to consider is whether these moves are reflective of changes in global rates – LIBOR for example is higher (see below) – or whether this reflects the perceived risks in the local bank market in the light of the first rounds from the Royal Commission, which has generally underscored potential risks in their lending books. Or both.

The question to consider is whether these moves are reflective of changes in global rates – LIBOR for example is higher (see below) – or whether this reflects the perceived risks in the local bank market in the light of the first rounds from the Royal Commission, which has generally underscored potential risks in their lending books. Or both.

The international rates are probably more the cause of the move of 25 basis points or more, which is significant because it suggests more upward pressure ahead, irrespective of what the RBA may choose to do.

The international rates are probably more the cause of the move of 25 basis points or more, which is significant because it suggests more upward pressure ahead, irrespective of what the RBA may choose to do.

We think mortgage rates will likely (and quietly) go higher in the months ahead.