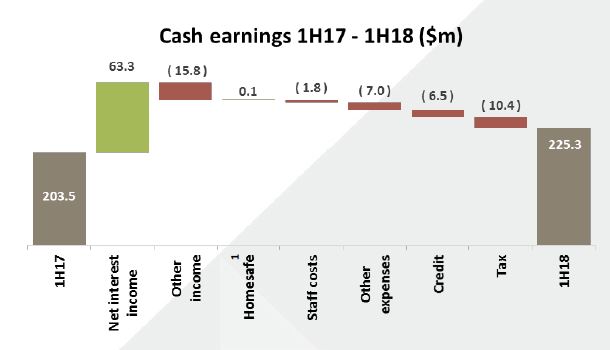

Bendigo and Adelaide Bank announced their 1H18 results, with an after tax statutory profit of $213.7 million, up $22.7m. Underlying earnings were $225.3 million, which is a 10.7% increase on pcp. It is a story of tight management, a boost to NIM from asset repricing, which may not be repeated, and an uplift in commercial property lending provisions plus a rise in bad and doubtful debts. Capital benefited from weighted risk asset adjustments and so was stronger than expected. But being a regional bank remains a tough gig.

The results were supported by strong margin growth, but were impacted by reduced trading income and lower ATM and transaction fees.

The results were supported by strong margin growth, but were impacted by reduced trading income and lower ATM and transaction fees.

Cash earnings per share were 46.8 cents a 3.3% increase on the pcp. A dividend of 35 cents per share, up 1 cent on the pcp.

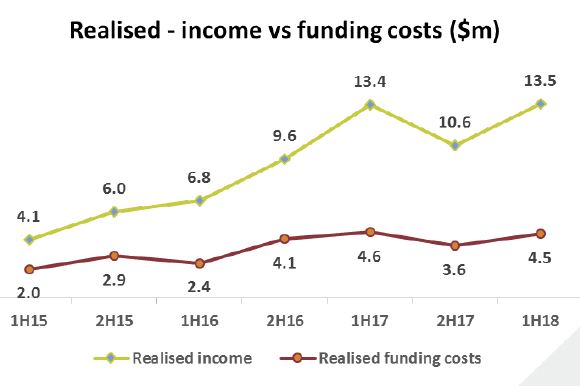

They reported an exit net interest margin of 2.38% a margin expansion of 18 basis points, driven by mortgage and deposit repricing. They also warn that front book discounts will challenge their margin in 2H18.

Growth in Owner Occupied home loans was up 13% pcp, whilst total loans were up 0.7% (implying a fall in investor loan, flows down 59%). Interest only loans flows were down 41%.

Growth in Owner Occupied home loans was up 13% pcp, whilst total loans were up 0.7% (implying a fall in investor loan, flows down 59%). Interest only loans flows were down 41%.

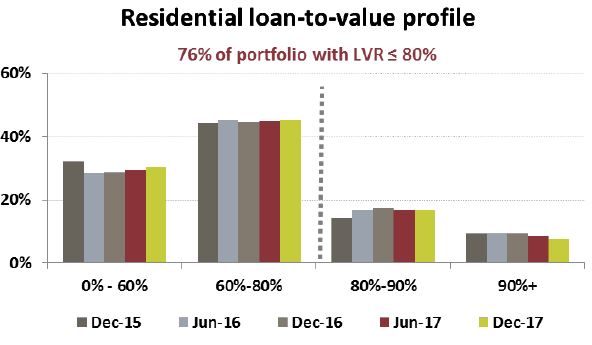

76% of their home lending portfolio was at or below 80% (or around a quarter of the book is above 80%).

Home safe proceed to completed contracts continue to exceed pre-overlay values. The overlay assumes a 3% rise in property prices for the next 18 months, then rising back to 6%. This may be optimistic!

Home safe proceed to completed contracts continue to exceed pre-overlay values. The overlay assumes a 3% rise in property prices for the next 18 months, then rising back to 6%. This may be optimistic!

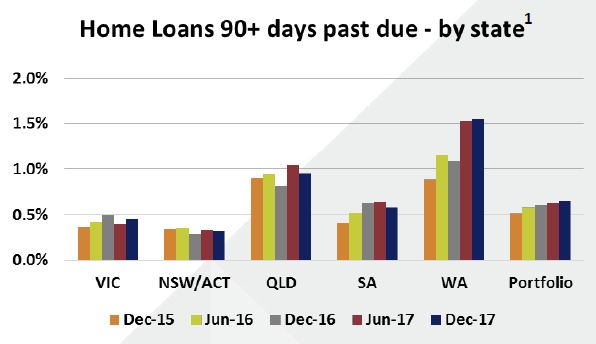

Arrears appear benign, though with a small rise on past 90-day due home loans. WA remains the most trouble state. But in value terms, past due 90 day loans were down $57.2m (10.7%).

Arrears appear benign, though with a small rise on past 90-day due home loans. WA remains the most trouble state. But in value terms, past due 90 day loans were down $57.2m (10.7%).

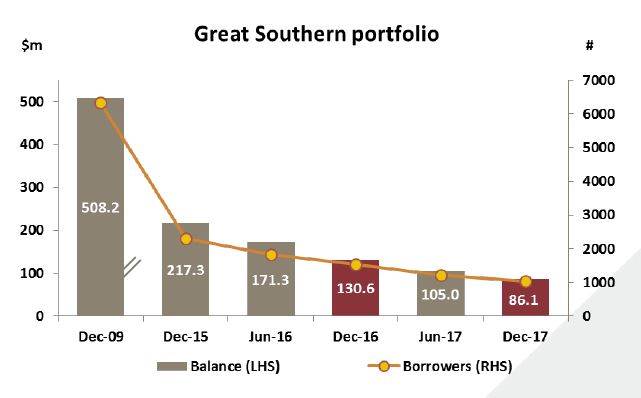

Total impaired assets were down $11.9m to $288.8m. Great Southern past due 90 days fell down $40.5m to $62.7m.

Total impaired assets were down $11.9m to $288.8m. Great Southern past due 90 days fell down $40.5m to $62.7m.

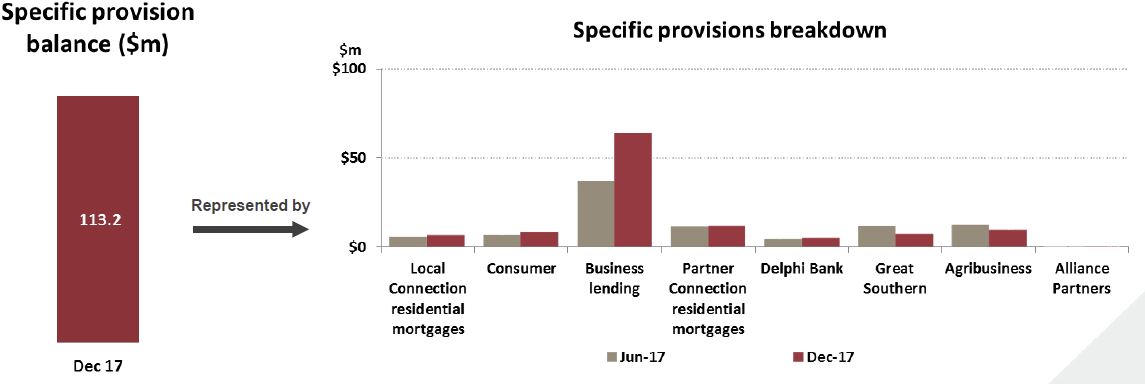

Specific provisions were $113.2 million, with business lending showing the largest move, mainly relating to commercial property lending. B&DD stood at $46 million, which is higher than expected.

Specific provisions were $113.2 million, with business lending showing the largest move, mainly relating to commercial property lending. B&DD stood at $46 million, which is higher than expected.

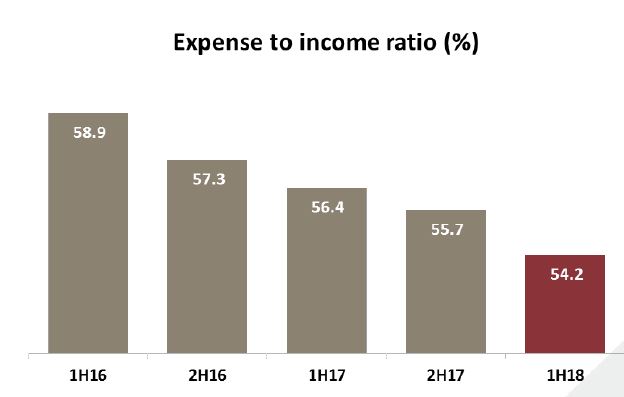

Cost to income ratio moved down 220 basis points to 54.2%. Software amortisation was up $4.5% (50%) on 1H17 and staff costs up 0.7% pcp.

Cost to income ratio moved down 220 basis points to 54.2%. Software amortisation was up $4.5% (50%) on 1H17 and staff costs up 0.7% pcp.

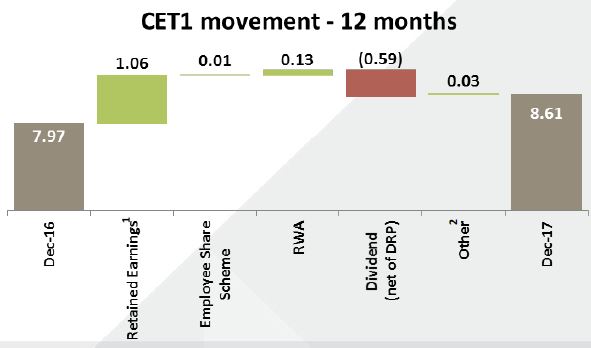

Their CET1 ratio was 8.61%, up 64 basis points and they expect to be able to meet the “unquestionably strong” benchmark.

Their CET1 ratio was 8.61%, up 64 basis points and they expect to be able to meet the “unquestionably strong” benchmark.

Progress toward Advanced Accreditation awaits APRA’s release of new guidelines. 79.6% of funding comes from retail customers

Progress toward Advanced Accreditation awaits APRA’s release of new guidelines. 79.6% of funding comes from retail customers

The liquidity ratio was 128.8% and NSFR around 111%.