Bengido and Adelaide Bank’s CEO provided a brief trading update as part of the FY17 AGM. There are some interesting comments on the FY18 outlook.

First they have been forced to “slam on the breaks” on mortgage lending to ensure they comply with APRA’s limits on interest only loans and investor loans. As a result their balance sheet will not grow as fast as previously expected.

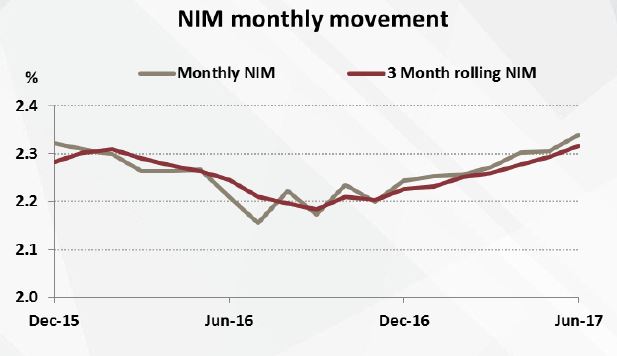

On the other hand, this should help them maintain their net interest margins, their previous results had shown a steady improvement and strong exit margin. They are forecasting 2.34%.

The recent ATM fee changes will have a negative impact, with costs rising ~2% although the amount is not stated from their ~1,700 ATM’s.

Finally, the slower loan book growth means they will be in a better capital position, and will be able to meet APRA’s “unquestionable strong” metric, on a standard basis, and perhaps 50 basis points above. The journey towards advanced accreditation appears still uncertain, but they believe there will be a more “level playing field”.