Bendigo and Adelaide Bank released their FY17 results today. It was perhaps stronger than expected and they have a good retail franchise. But they benefited from on-off mortgage loans repricing which helped margin and are now seeing lower mortgage volumes following the APRA guidance, so there remains much to do.

They reported an after tax statutory profit of $429.6m for the 12 months to 30 June 2017. The full year dividend was maintained at 68 cents fully franked.

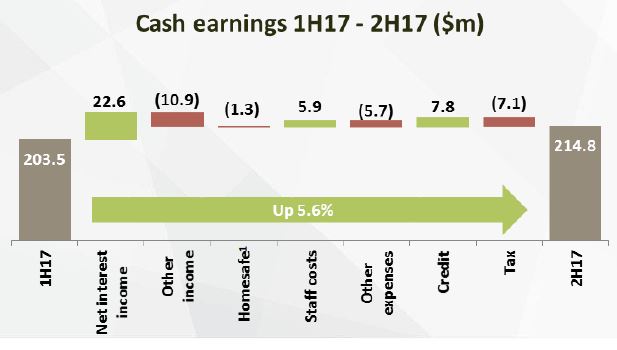

Underlying cash earnings was $418.3 million, up 4.2% on the prior year.

Underlying cash earnings was $418.3 million, up 4.2% on the prior year.

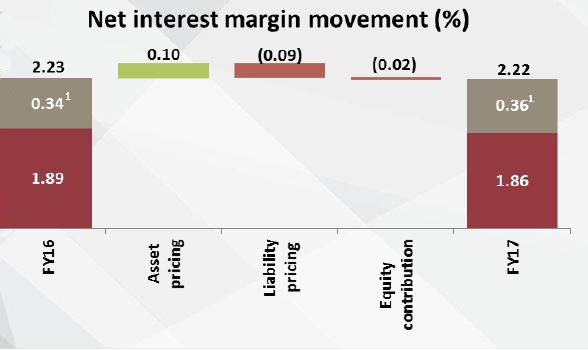

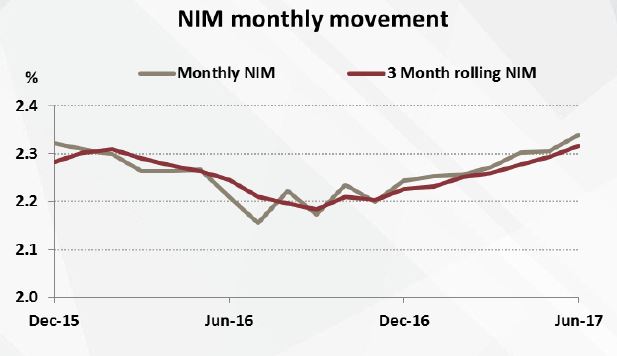

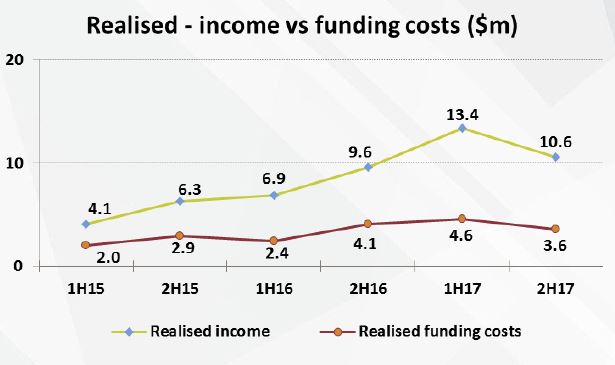

They reported mortgage growth of 7.7%, with a strong NIM improvement of 8 basis points in the second half despite a 1 basis point fall across the year, achieving 2.26% half on half. They gave away deposit margin to grow their funding base.

Their exit margin was 2.34%. Keystart’s NII contribution was $11.3m.

Their exit margin was 2.34%. Keystart’s NII contribution was $11.3m.

Funding includes 80. 2 percent from deposits, with retail deposits up 4.7 per cent. The mix of call to term deposits swung a little to call (term down 1.1% and call up 2%).

Funding includes 80. 2 percent from deposits, with retail deposits up 4.7 per cent. The mix of call to term deposits swung a little to call (term down 1.1% and call up 2%).

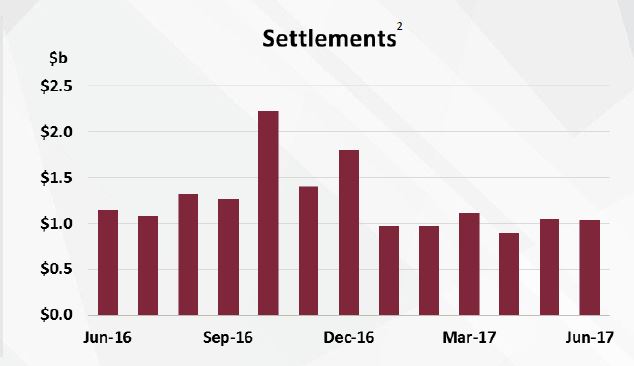

Home lending showed a fall in approvals IH17 $8,711m approved compared with $5,419m in the 2H17.

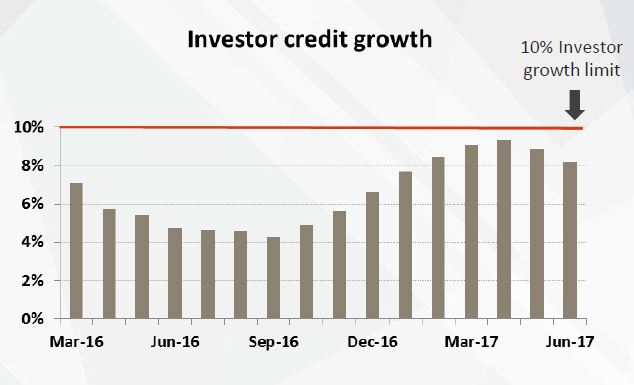

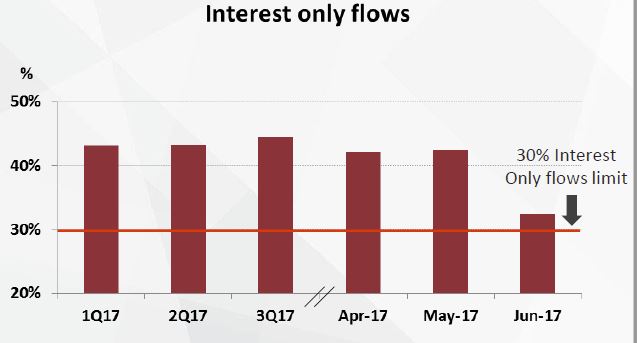

They were impacted by APRA’s lending caps as shown by interest only flows

They were impacted by APRA’s lending caps as shown by interest only flows

Settlements are sitting at ~$1bn per month. They say 45% of customers are ahead of minimum repayments, and 29% three or more repayments ahead.

Settlements are sitting at ~$1bn per month. They say 45% of customers are ahead of minimum repayments, and 29% three or more repayments ahead.

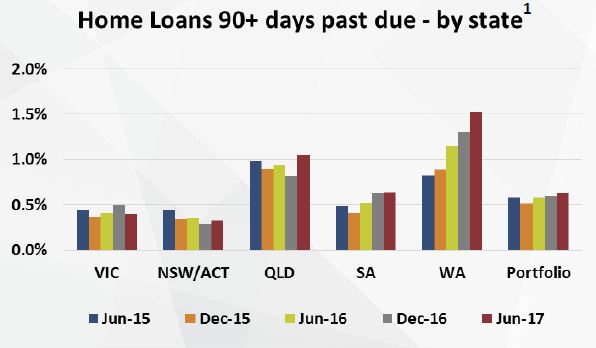

Home loan 90+ days past due shows a persistent rise in WA (Keystart included from Jun-17 and is below the WA average). QLD was also higher.

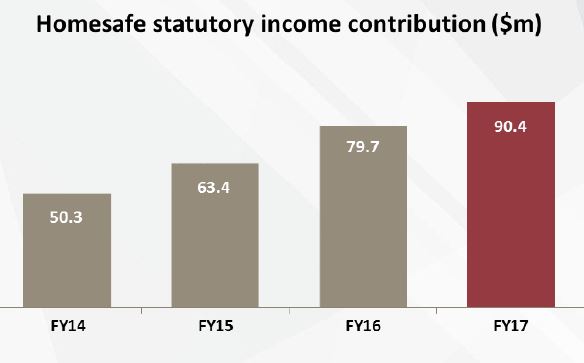

Homesafe overlay reflects an assumed 3% increase in property prices for the next 18 months, before returning to a long term growth rate of 6%

Homesafe overlay reflects an assumed 3% increase in property prices for the next 18 months, before returning to a long term growth rate of 6%

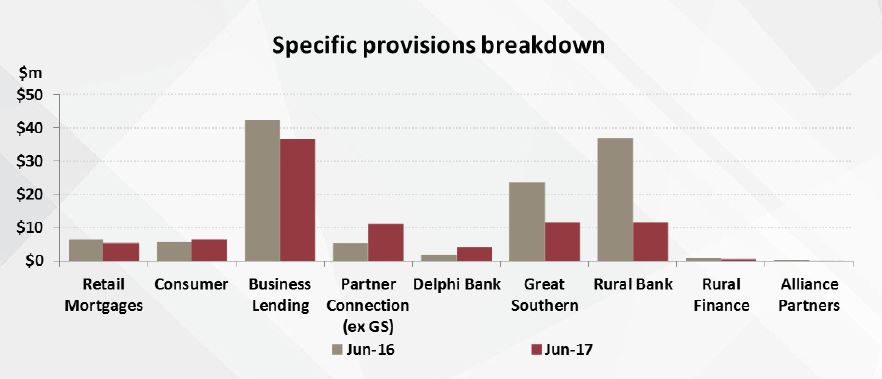

Retail mortgage provisions are 0.02% in FY17, down from 0.03% at Jun-16. Business arrears were lower, and there was a small rise in credit card arrears, to above 1.5% in Jun-17. The specific provisions balance was $89.5m, reflecting 0.15% of gross loans compared with 0.22% a year ago.

Retail mortgage provisions are 0.02% in FY17, down from 0.03% at Jun-16. Business arrears were lower, and there was a small rise in credit card arrears, to above 1.5% in Jun-17. The specific provisions balance was $89.5m, reflecting 0.15% of gross loans compared with 0.22% a year ago.

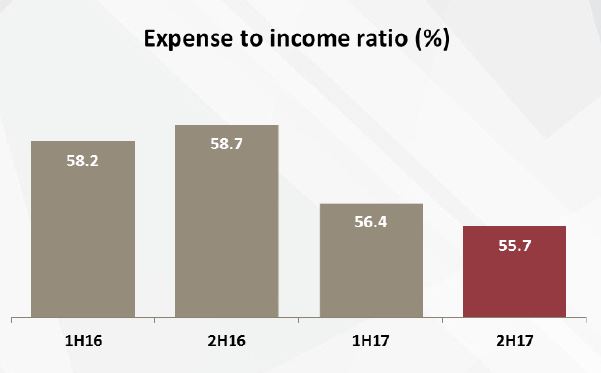

The cost income ratio fell 2% to 56.1 per cent, on nearly flat expenses. They had 118 less FTE in FY17 and included redundancies of $4.2m.

The cost income ratio fell 2% to 56.1 per cent, on nearly flat expenses. They had 118 less FTE in FY17 and included redundancies of $4.2m.

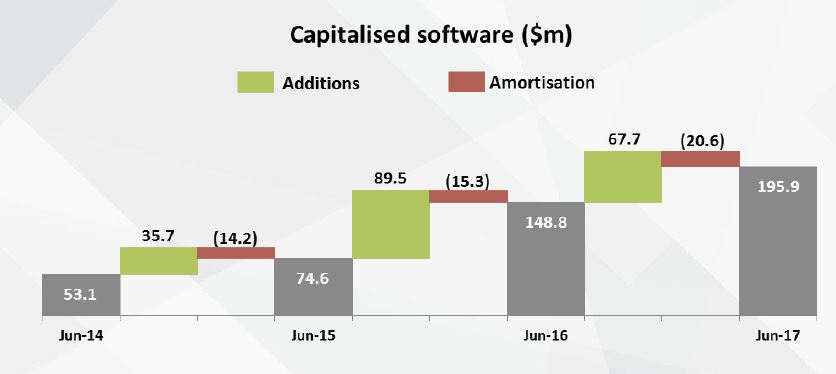

They continued to invest in, and capitalise software.

They continued to invest in, and capitalise software.

The CET1 ratio is 8.27%, up 30 basis points from December 2016, and they say the “unquestionably strong” target will be achieved – but no details.

They continue progress towards advanced accreditation, and the investment has improved their risk management capability, whether or not they decide to switch (given APRA’s moving target!). Again, no details. Our own view is that the benefit of advanced has been significantly eroded by APRA.

They continue progress towards advanced accreditation, and the investment has improved their risk management capability, whether or not they decide to switch (given APRA’s moving target!). Again, no details. Our own view is that the benefit of advanced has been significantly eroded by APRA.

One thought on “Bendigo and Adelaide Bank FY17 Results”