BOQ today announced record interim cash earnings after tax of $167 million for the six months to 28 February 2015, a solid result driven by growing momentum in lending growth, strong Net Interest Margin performance and further asset quality improvements. Statutory profit after tax rose 14% to $154 million on the prior comparative half. Home lending including investment loans was a significant element in the results.

In its first full half since acquisition in July 2014, BOQ Specialist performed well with highlights including lending growth of $352 million in on-balance sheet mortgages, on track to exceed its target for the full financial year. BOQ’s financial performance enabled the Board to set an interim dividend of 36 cents per share fully franked, an increase of 4 cents or 13% on1H14.

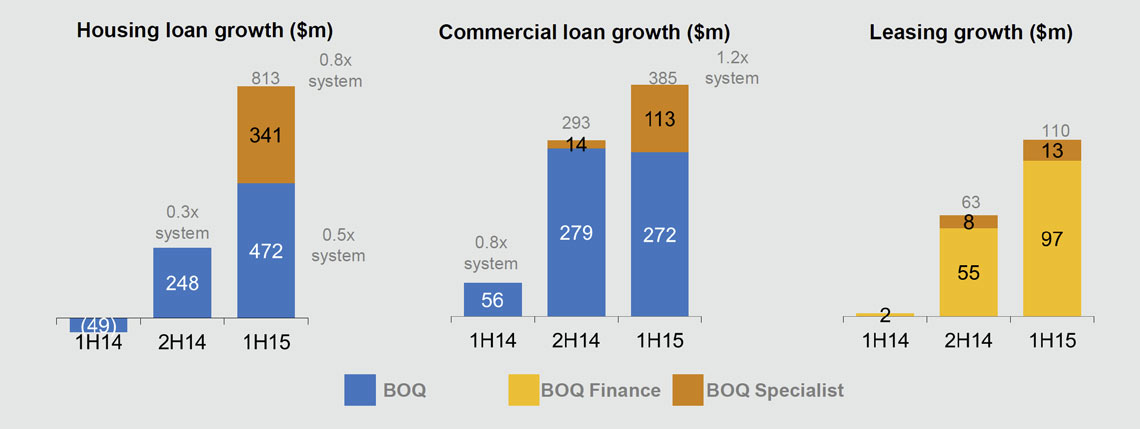

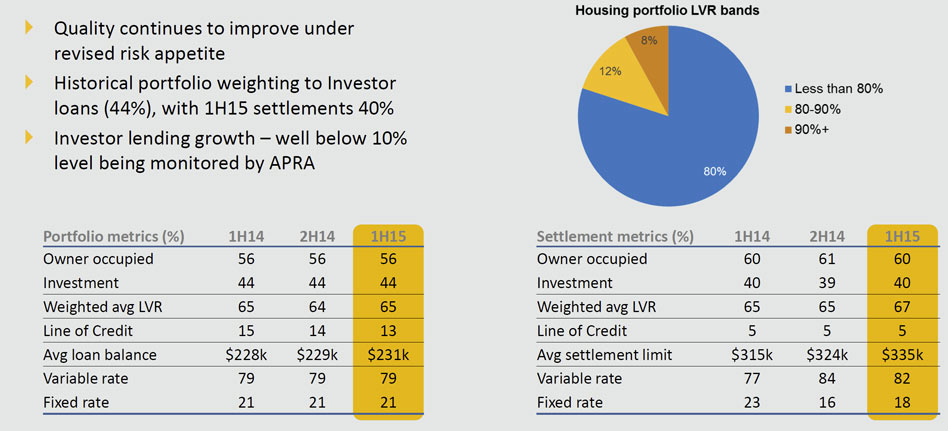

Lending growth headed back towards system levels as a result of the strategic initiatives BOQ has implemented in recent years, including expansion of the mortgage broker channel and investment in the Business Bank’s presence and capabilities.Retail lending grew at an annualised 6% to $27.3 billion over the February half with $813 million underlying growth. The housing book saw increased diversification with 57% of applications originating from outside of Queensland, largely driven by the broker channel which contributed$420 million of loan growth and accounted for 14% of settlements.

Investment lending is below the 10% monitoring threshold which APRA has imposed.

Investment lending is below the 10% monitoring threshold which APRA has imposed.

Commercial lending balances continued to exceed system levels, growing by an annualised 10% over the six months to $8.0 billion. A greater presence in New South Wales, Victoria and Western Australia saw the geographic concentration of the portfolio in Queensland reduce further. In its first full half of contribution, BOQ Specialist’s contribution to lending growth exceeded expectations delivering $352 million in on-balance sheet mortgages while maintaining margins and credit quality across the portfolio. BOQ Finance grew by an annualised 6% over the half to $4.0 billion. This was a healthy result against an industry backdrop of lower volumes due to a slowdown in plant and equipment investment in the broader economy.

Commercial lending balances continued to exceed system levels, growing by an annualised 10% over the six months to $8.0 billion. A greater presence in New South Wales, Victoria and Western Australia saw the geographic concentration of the portfolio in Queensland reduce further. In its first full half of contribution, BOQ Specialist’s contribution to lending growth exceeded expectations delivering $352 million in on-balance sheet mortgages while maintaining margins and credit quality across the portfolio. BOQ Finance grew by an annualised 6% over the half to $4.0 billion. This was a healthy result against an industry backdrop of lower volumes due to a slowdown in plant and equipment investment in the broader economy.

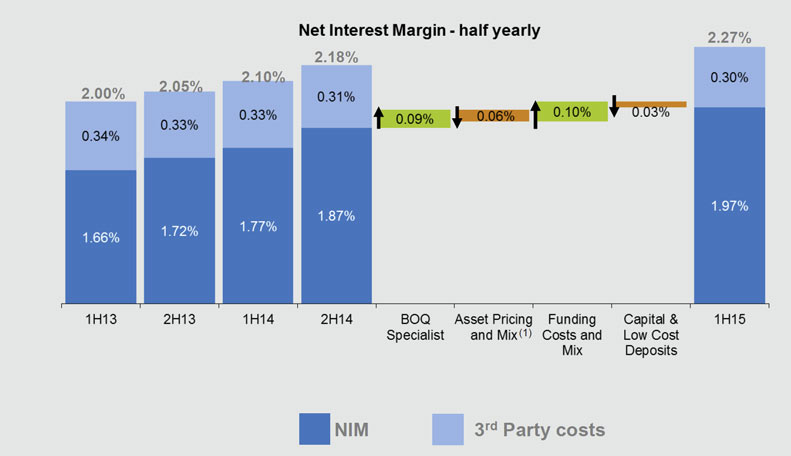

Despite a highly competitive market, the Bank’s Net Interest Margin rose 20 basis points from February 2014 to 1.97% due to an 11 basis point increase from BOQ Specialist as well as ongoing pricing discipline. Deposit interest rates were managed down.

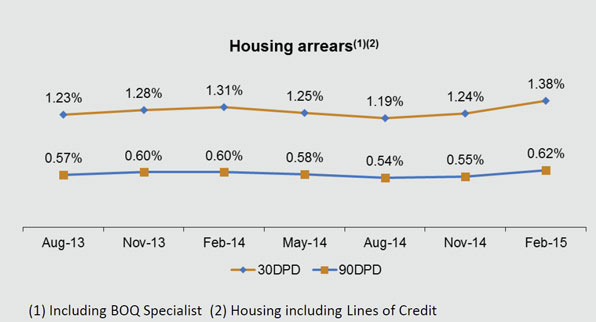

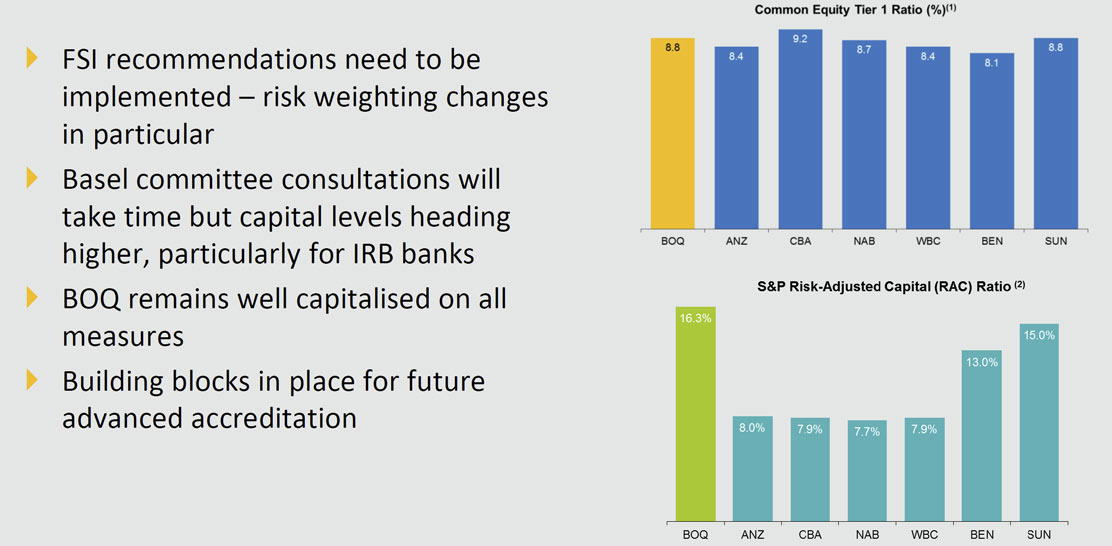

BOQ’s Common Equity Tier 1 ratio increased 19 basis points to 8.82% during the half. The Bank’s capital position remains the highest of Australia’s regional and major banks based on Standard and Poor’s risk-adjusted capital approach, positioning it well given the evolving domestic and global regulatory environment. Cost to Income (CTI) ratio for the half increased to 48.1% due to the inclusion of BOQ Specialist for the entire period as well as one-off costs(property costs and CRM impairment expenses) already flagged to the market. Excluding BOQ Specialist, underlying expense growth was 3% annualised from 2H14. Total loan impairment expense was down 22% on prior comparative period to $36 million (1H14: $46 million). Total impaired assets across retail,commercial and BOQ Finance fell 13% to $259 million (1H14: $298 million). Housing impairments rose.

BOQ’s Common Equity Tier 1 ratio increased 19 basis points to 8.82% during the half. The Bank’s capital position remains the highest of Australia’s regional and major banks based on Standard and Poor’s risk-adjusted capital approach, positioning it well given the evolving domestic and global regulatory environment. Cost to Income (CTI) ratio for the half increased to 48.1% due to the inclusion of BOQ Specialist for the entire period as well as one-off costs(property costs and CRM impairment expenses) already flagged to the market. Excluding BOQ Specialist, underlying expense growth was 3% annualised from 2H14. Total loan impairment expense was down 22% on prior comparative period to $36 million (1H14: $46 million). Total impaired assets across retail,commercial and BOQ Finance fell 13% to $259 million (1H14: $298 million). Housing impairments rose.

During the half, BOQ continued to strengthen its balance sheet, creating a sustainable funding profile that is able to support growth and deliver internal capital generation. Fitch Ratings’ decision in November 2014 to lift its long-term credit rating from BBB+ to A- followed similar upgrades from other ratings agencies. These changes have improved access to long-term wholesale funding markets and allowed the Bank to actively manage its funding profile by diversifying composition and increasing duration, while reducing cost.

During the half, BOQ continued to strengthen its balance sheet, creating a sustainable funding profile that is able to support growth and deliver internal capital generation. Fitch Ratings’ decision in November 2014 to lift its long-term credit rating from BBB+ to A- followed similar upgrades from other ratings agencies. These changes have improved access to long-term wholesale funding markets and allowed the Bank to actively manage its funding profile by diversifying composition and increasing duration, while reducing cost.

BOQ advocates the implementation of stronger capital measures as recommended by the FSI inquiry.

We think BOQ’s future will be determined by the trajectory of the housing market, and the extent to which they are able to grow their commercial business in an increasingly competitive market. They are certainly at a capital disadvantage compared with the majors and will need to target customer segments carefully to compete successfully.

We think BOQ’s future will be determined by the trajectory of the housing market, and the extent to which they are able to grow their commercial business in an increasingly competitive market. They are certainly at a capital disadvantage compared with the majors and will need to target customer segments carefully to compete successfully.